Konica Minolta 2010 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

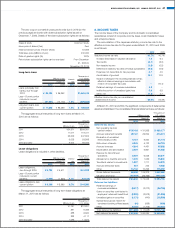

Fair Values of Financial Instruments

The book value on consolidated balance sheets, fair value, and differ-

ence as of March 31, 2010 are as follows:

Millions of yen

March 31

Book Value Fair value Differences

Assets

(1) Cash on hand and in banks ¥ 85,533 ¥ 85,533 ¥ –

(2) Notes and accounts

receivable–trade 177,720 177,720 –

(3) Short-term investment securities

and Investment securities

(i) Held-to-maturity securities 10 10 –

(ii) Other investment securities 95,848 95,848 –

Total ¥359,112 ¥359,112 ¥ –

Liabilities

(1) Notes and accounts

payable–trade 83,118 83,118 –

(2) Short-term loans 58,231 58,231 –

(3) Long-term loans 71,625 71,715 90

Total ¥212,974 ¥213,064 ¥90

Derivatives* ¥ (1,375) ¥ (1,375) ¥ –

Thousands of U.S. dollars

March 31

Book Value Fair value Differences

Assets

(1) Cash on hand and in banks $ 919,314 $ 919,314 $ –

(2) Notes and accounts

receivable–trade 1,910,146 1,910,146 –

(3) Short-term investment securities

and Investment securities

(i) Held-to-maturity securities 107 107 –

(ii) Other securities 1,030,181 1,030,181 –

Total $3,859,759 $3,859,759 $ –

Liabilities

(1) Notes and accounts

payable–trade 893,358 893,358 –

(2) Short-term loans 625,871 625,871 –

(3) Long-term loans 769,830 770,798 967

Total $2,289,058 $2,290,026 $967

Derivatives * $ (14,779) $ (14,779) $ –

* Derivatives assets and liabilities are on a net basis, and the net liability position is

enclosed in parentheses.

(i) Methods of calculating the fair value of financial

instruments and securities & derivatives transactions

Assets

(1) Cash on hand and in banks and (2) Notes and accounts

receivable–trade

The fair value equates to the book value due to the short-term

nature of these instruments.

(3) Short-term investment securities and Investment securities

(i) Held-to-maturity securities

The fair value equates to the book value due to the securities

being entirely school bonds and as the credit risk of the issuers

has not changed significantly since the time of acquisition.

(ii) Other investment securities

The fair value of equity securities is determined based on the

prevailing market price. The fair value of bonds is based on the

prevailing market price or provided price by financial institutions.

These other securities are described further in ‘Note 6. INVEST-

MENT SECURITIES’.

Liabilities

(1) Notes and accounts payable–trade and (2) Short-term loans

The fair value equates to the book value due to the short-term

nature of these instruments.

(3) Long-term loans

Fair value of long-term loans with fixed interest rates is based on the

present value of future cash flows discounted using the current

borrowing rate for similar debt of a comparable maturity.

Fair value of long-term loans with variable interest rates is based

on the book value as the Company’s credit risk has not significantly

changed since entering the borrowing.

For those that are subject to the special treatment of interest rate

swaps (Please see below ‘Derivatives’), the total amount of the

principal and interest that were accounted for as a single item with

the relevant interest rate swap is discounted with a rate that is

assumed to be applied when a new, similar loan is taken out.

Derivatives

Derivatives are described further in ‘Note 23. DERIVATIVES’.

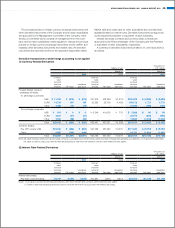

(ii) Financial instruments for which the fair value is extremely

difficult to measure

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

Book Value Book Value

Unlisted equity securities ¥2,354 $25,301

Investments in unconsolidated subsidiaries

and affiliated companies 2,816 30,267

Above are not included in ‘(3)(ii) Other securities’ because there is no market value and it

is difficult to measure the fair value.

(iii) Redemption schedule for money claim and

securities with maturity date subsequent to the

consolidated balance sheet date

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

Within one

year

More than

one year,

within five

years

Within one

year

More than

one year,

within five

years

Cash on hand

and in banks ¥ 85,533 ¥ – $ 919,314 $ –

Notes and accounts

receivable–trade 177,720 – 1,910,146 –

Short-term investment

securities and

investment securities

Held-to-maturity

securities – 10 – 107

Other securities 79,000 – 849,097 –

Total ¥342,254 ¥10 $3,678,568 $107

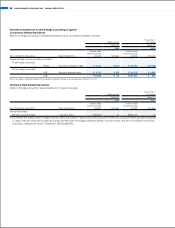

(iv) Redemption schedule for long-term loans

subsequent to the consolidated balance sheet date

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

More than

one year,

within five

years

More than

five years,

within ten

years

More than

one year,

within five

years

More than

five years,

within ten

years

Long-term loans ¥63,622 ¥8,002 $683,813 $86,006

KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010 39