Konica Minolta 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

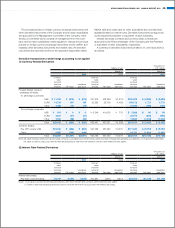

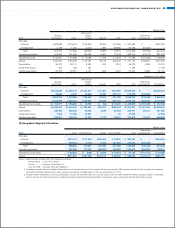

Derivative transactions to which hedge accounting is applied

(1) Currency-Related Derivatives

Method of hedge accounting: Forecasted transactions such as forward exchange contracts

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2010

Type of derivatives transactions Major hedged items

Contract value

(notional principal

amount) Fair value

Contract value

(notional principal

amount) Fair value

Forward foreign currency exchange contracts:

To sell foreign currencies:

EURO Accounts receivable–trade ¥ 6,141 ¥(101) $ 66,004 $(1,086)

To buy foreign currencies:

US$ Accounts payable–trade ¥ 5,701 ¥ 158 $ 61,275 $ 1,698

Total ¥11,842 ¥ 56 $127,279 $ 602

Note: Fair value is calculated based on the currency forward exchange rates prevailing as of March 31, 2010.

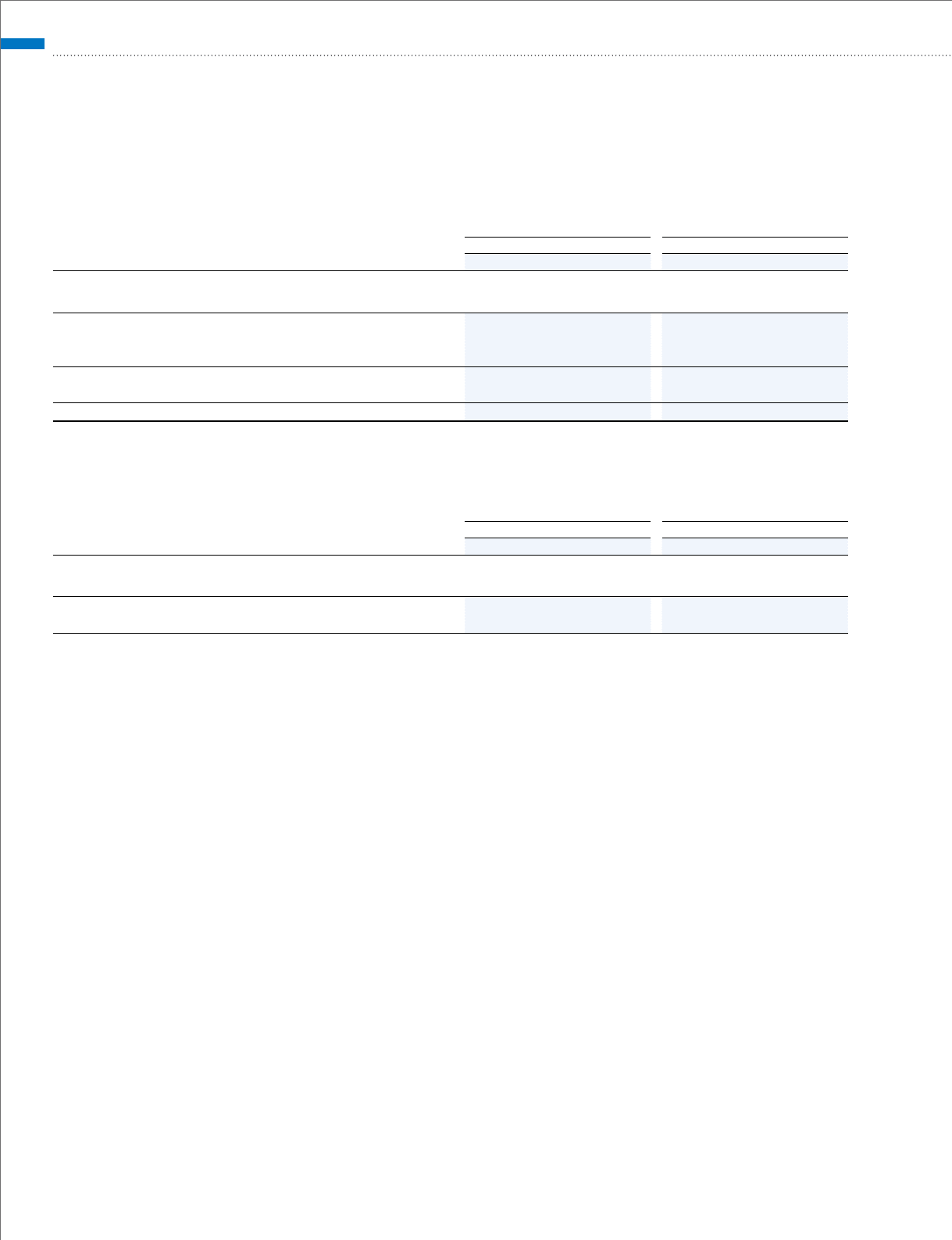

(2) Interest Rate-Related Derivatives

Method of hedge accounting: Special treatment of interest rate swap

Millions of yen

Thousands of

U.S. dollars

March 31 March 31

2010 2010

Type of derivatives transactions Major hedged items

Contract value

(notional principal

amount) Fair value

Contract value

(notional principal

amount) Fair value

Interest rate swaps:

Pay fixed, receive floating Long-term loans ¥50,500 (*) $542,777 (*)

(*) As interest rate swaps used to hedge long-term loans are subject to special accounting treatment under accounting principles generally accepted

in Japan, their fair values are included as a single line item with the hedged underlying liability, long-term loans, and are not included in the above

information. (Please see ‘Note 5. FINANCIAL INSTRUMENTS’).

46 KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010