Konica Minolta 2010 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2010 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

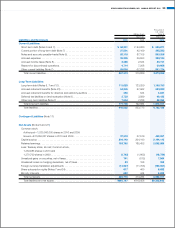

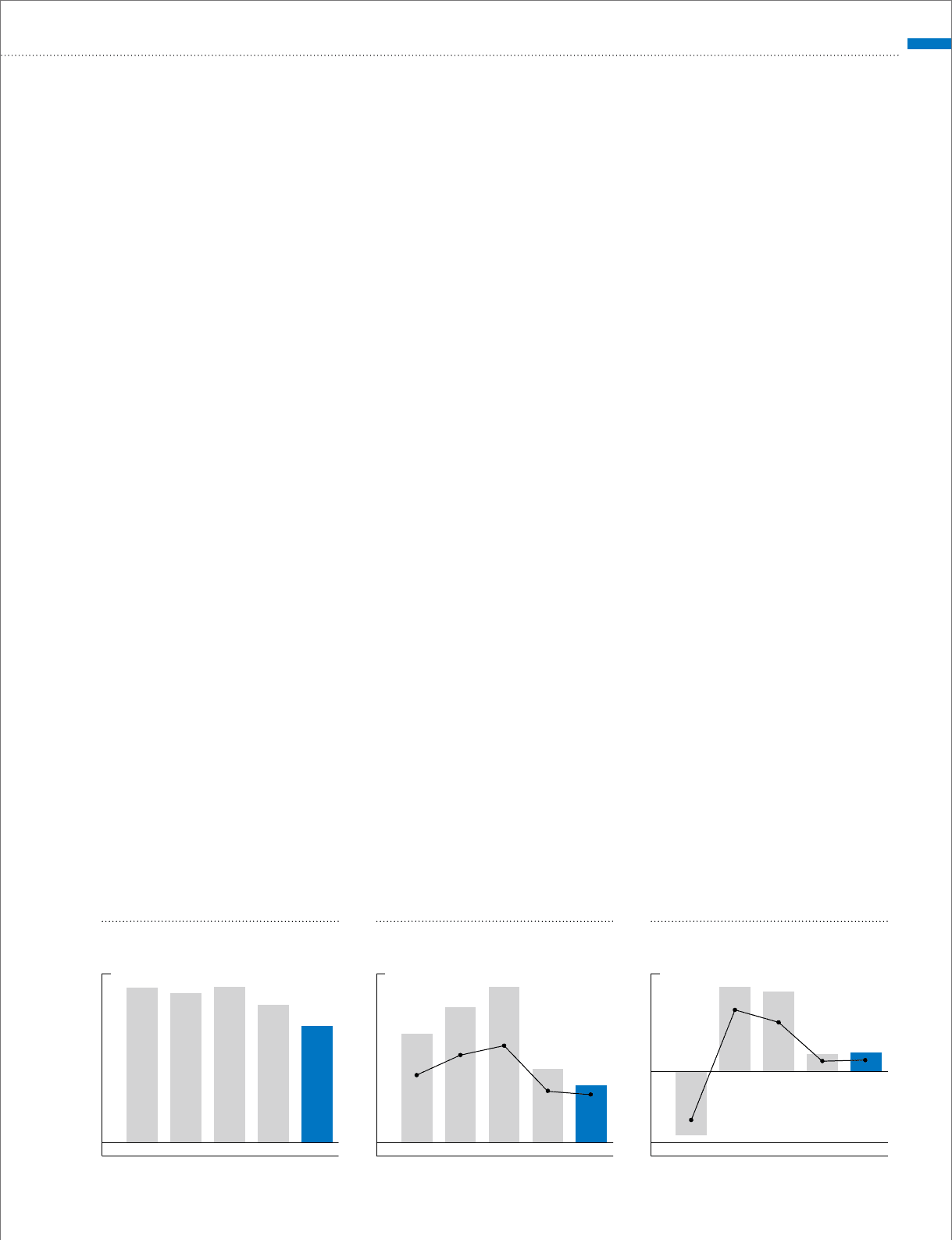

NET INCOME

Net income for the year rose ¥1.7 billion, or 11.5%, to ¥16.9 billion,

mainly as the result of a smaller write-down of investment securities

and lower business structure improvement expenses. Return on

equity increased 0.4 of a percentage point to 4.1%.

SEGMENT INFORMATION

Sales in the Business Technologies business fell ¥82.8 billion, or

13.3%, to ¥540.8 billion, while operating income declined ¥13.5

billion, or 25.9%, to ¥38.9 billion. Sales of the Group’s mainstay

products, MFPs for the office, were lower year on year, primarily

due to corporate cutbacks in capital spending and operating

expenses, coupled with more stringent lease contract terms due to

the credit crunch. Performance in the second half of the year, how-

ever, surpassed that of the previous fiscal year due to steady

growth in sales volume for color MFPs each quarter, as the Group

generated demand by aggressively unveiling new color models.

In the Optics business, sales declined ¥36.6 billion, or 21.1%,

to ¥136.7 billion, while operating income climbed ¥1.8 billion, or

14.8%, to ¥14.3 billion. Sales of TAC films and glass hard disk

substrates were brisk, benefitting from a recovery in market prices

for LCD televisions and PCs. Business performance was notably

impacted, however, by lower sales volumes in image input/output

components and optical pickup lenses for Blu-ray Discs.

In the Medical and Graphic Imaging business, sales declined

¥21.5 billion, or 17.1%, to ¥104.3 billion, with operating income down

¥1.6 billion, or 52.3%, to ¥1.4 billion. While sales for digital equipment

remained largely on a par with the previous fiscal year, these levels

were insufficient to cover the decline in sales of film products.

CAPITAL EXPENDITURE AND DEPRECIATION

Total capital expenditure for the fiscal year under review declined

¥24.2 billion year on year, to ¥36.9 billion. Of this expenditure, the

Business Technologies business accounted for ¥18.1 billion, the

Optics business for ¥13.5 billion, the Medical and Graphic Imaging

business for ¥1.7 billion, and other businesses for ¥3.3 billion.

Capital expenditure during the year was used mainly for invest-

ment in casting molds for new products in the Business Technolo-

gies business, and to boost production capacity for TAC films in the

Optics business.

Depreciation was ¥61.1 billion, down ¥9.0 billion from the previ-

ous fiscal year.

RESEARCH AND DEVELOPMENT COSTS

R&D costs declined ¥13.4 billion year on year, to ¥68.4 billion.

While reducing expenses overall, the Group concentrated expendi-

tures on investments in future growth fields. R&D costs by business

segment were as follows.

R&D costs declined 21.3% year on year in the Business Tech-

nologies business to ¥38.4 billion, 13.6% in the Optics business to

¥11.0 billion, and 16.0% in the Medical and Graphic Imaging busi-

ness to ¥7.7 billion. In contrast, R&D costs in other businesses rose

2.1% to ¥11.1 billion.

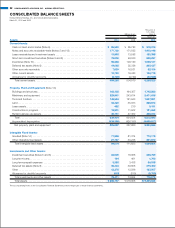

FINANCIAL POSITION AND LIQUIDITY

“Execute structural reforms” is one of the core policies that the

Konica Minolta Group is pursuing under the MANAGEMENT

POLICY <09-10> management plan. Accordingly, the Group is

focused on strengthening its financial position as a key component

of this policy. During the fiscal year under review, the Group worked

to streamline its balance sheet by reducing inventories, scaling

back capital expenditure, and negotiating more favorable terms

with respect to credit and debt.

2006

1,068.3

2007

1,027.6

2008

1,071.5

2009

947.8

2010

804.4

2006

83.4

2007

104.0

2008

119.6

2009

56.2

2010

43.9

7.8

10.1 11.2

5.9 5.5

2006

(54.3)

2007

72.5

2008

68.8

2009

15.1

2010

16.9

(17.1)

21.9

17.5

3.7 4.1

NET SALES OPERATING INCOME AND

OPERATING INCOME RATIO

NET INCOME (LOSS) AND ROE

(Billions of yen) (Billions of yen, %) (Billions of yen, %)

nn Operating Income

n

Operating Income Ratio

nn Net Income (Loss)

n

ROE

KONICA MINOLTA HOLDINGS, INC. ANNUAL REPORT 2010 29