Kia 2004 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

KIA Motors_2004 Annual Report

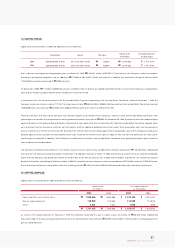

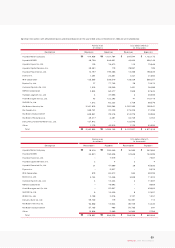

STOCK INDICATOR

347,230

10,900

113.2%

15.6%

2.6%

1.65x

8.47x

5.53x

1,972

14.22%

3.68x

36.52%

7%

17.5%

2004 2003 2002

359,730

10,900

127.2%

20.4%

4.4%

1.67x

11.90x

5.13x

2,123

17.98%

3.22x

33.10%

7%

16.3%

369,730

8,800

127.3%

16.8%

Net Cash

1.35x

7.39x

4.76x

1,849

18.92%

2.88x

17.26%

5%

13.5%

No. of Shares (in thousands)

Stock Price (Based on the Closing price, KRW)

Liability / Equity

Total Debt / Total Asset

Net Debt / Equity

Total Debt / EBITDA

EBITDA / Interest Expense

PER (Price Earnings Ratio)

EPS (Earnings per Share, KRW)

ROE (Return on Equity)

EV / EBITDA

Equity held by Foreigners

Dividend Rate

Dividend Payout Ratio

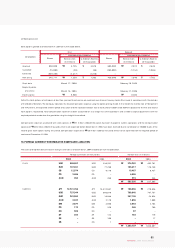

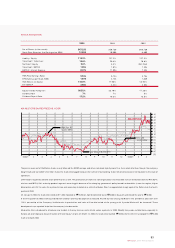

The price movement of Kia Motors shares mainly followed the KOSPI average, and return remained slightly lower than the market rate. Even though the com pany

bought back and cancelled 12.5 million shares, the share price lagged because the num ber of outstanding shares remained excessive in com parison to the scale of

operations.

Other factors negatively affected share performance as well. The productivity of dom estic sales organization was evaluated to have weakened. Sales for RVs (SUVs,

minivans and MPVs), Kia's mainstay product segment, were sluggish because of the changing government policy towards automobiles (a new tax regime, higher

diesel prices, etc.). At the same tim e, prices for raw and secondary materials rose, while the Korean Won has appreciated sharply against the Dollar since the fourth

quarter of 2004.

On January 2, 2004, the share price stood at W11,400. It peaked at ₩12,350 on April 8, bottom ed out at ₩8,600 on August 6 and closed the year at ₩10,900.

In the first quarter of 2005, overhang related with creditors and Hyundai Capital was reduced. And Mr. Eui-Sun Chung, Kia Motors' new president & CEO, took over

1.01% ownership of the Company. Inefficiencies in production and sales will be eliminated, while synergy with Hyundai Motor will be increased. These

developments are expected to bolster the com pany's fundamentals.

Meanwhile, Kia is scheduled to introduce new models in the key minivan and mid-size sedan segments in 2005. Steadily rising sales outside Korea, especially in

Europe, are also helping to elevate the price of the company's shares. On March 14, 2005, the share price reached ₩15,650, the first time it has topped the ₩15,000

mark since April 2002.

KIA MOTORS SHARE PRICE VS. KOSPI