Kia 2004 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Non-Consolidated

Financial Statements As of December 31, 2004 and 2003

66

KIA Motors_2004 Annual Report

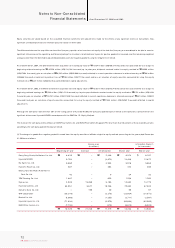

ACCOUNTING FOR FOREIGN CURRENCY TRANSACTIONS AND TRANSLATION

The Company maintains its accounts in Korea won. Transactions in foreign currencies are recorded in Korean won based on the prevailing rates of exchange on the

transaction date. Monetary accounts with balances denominated in foreign currencies are recorded and reported in the accompanying non-consolidated financial

statements at the exchange rates prevailing at the balance sheet dates. The balances have been translated using the Basic Rate announced by Seoul Money

Brokerage Services, Ltd., which was ₩1043.80 and ₩1,197.80 to US $1.00 at December 31, 2004 and 2003, respectively, and the translation loss and gain is reflected

in current operations.

INCOME TAX EXPENSE

The Company recognizes deferred income taxes. Accordingly, income tax expense is determ ined by adding or deducting the total incom e tax and surtaxes to be

paid for the current period and the changes in deferred incom e tax debits (credits). The difference between the income tax expense and the amount of incom e tax

show n in the current period s tax return will be offset against the deferred income tax credits (debits), which will occur in subsequent periods.

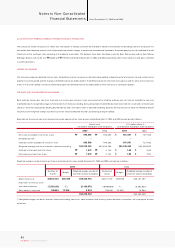

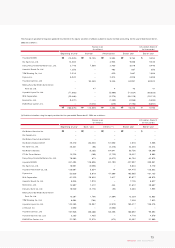

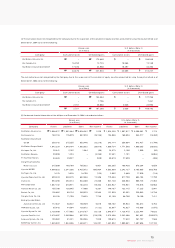

ORDINARY (NET) INCOME PER COMMON SHARE

Basic ordinary income per com m on share and net income per common share are computed by dividing ordinary and net income available to common

shareholders by the weighted average number of common shares outstanding during the period. Diluted ordinary income per com m on share and net income per

com m on share are com puted by dividing diluted ordinary and net income, which is adjusted by adding back the after-tax am ount of expenses related to diluted

securities, by the weighted average number of common shares and diluted securities, outstanding during the period.

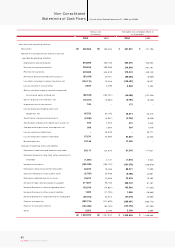

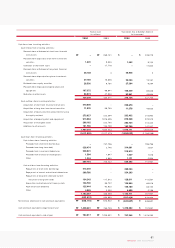

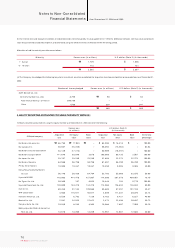

Basic ordinary income per com m on share and net income per common share for years ended December 31, 2004 and 2003 are com puted as follows:

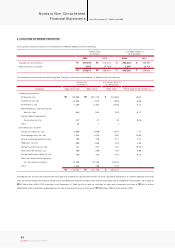

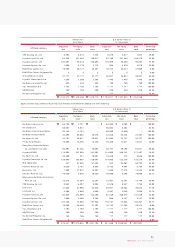

Weighted average number of comm on shares outstanding for the years ended December 31, 2004 and 2003 is computed as follows:

(*) Weighted average number of comm on shares outstanding consists of stock retirem ent and treasury shares acquisition transactions for the purpose of stock

retirement.

690,569

–

690,569

350,245,262

1,972

1,972

₩

₩

₩

2004 2003 2004 2003

769,393

–

769,393

362,335,493

2,123

2,123

₩

₩

₩

661,591

–

661,591

350,245,262

1.89

1.89

$

$

$

737,108

–

737,108

362,335,493

2.03

2.03

$

$

$

Net incom e available to comm on share

Extraordinary item

Ordinary income available to common share

Weighted average number of comm on shares outstanding

Ordinary income per com mon share

Net incom e per com m on share

Korean won

(In millions except per share amounts) U.S. dollars (Note 2)

(In thousands except per share amounts)

358,420,732

(12,500,000)

289,854

366/366

(* )

12/366

2004 2003

Weighted average number of

common shares outstanding

Weight

Number of

shares

Weighted average number of

common shares outstanding

Weight

Number of

shares

368,121,297

(10,000,000)

299,435

358,420,732

(8,184,973)

9,503

350,245,262

365/365

(* )

22/365

368,121,297

(5,803,852)

18,048

362,335,493

Beginning of year

Acquisition of treasury stock

and stock retirement

Stock options, exercised