Kia 2004 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Non-Consolidated

Financial Statements As of December 31, 2004 and 2003

72

KIA Motors_2004 Annual Report

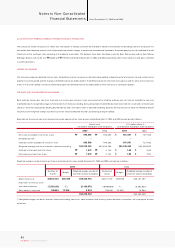

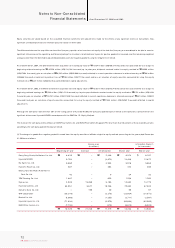

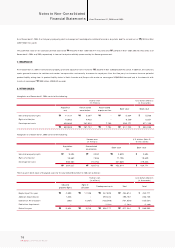

Equity securities are valued based on the unaudited financial statements with adjustments made for the effects of any significant events or transactions. Also,

significant unrealized profit (loss) on intercompany transactions is elim inated.

The difference between the acquisition cost and the Com pany s portion of an investee s net equity at the date the Company was considered to be able to exercise

significant influence over the operating and financial policy of an investee is amortized over 5 years for positive goodwill or reversed over the remaining weighted

average useful life of the identifiable acquired depreciable assets for negative goodwill, using the straight-line method.

As of December 31, 2004, the difference between acquisition cost and equity value of ₩167,341million (US$160,319 thousand) was accounted for as a charge to

beginning retained earnings for ₩145,228 million (US$139,134 thousand) up to prior year, dividends received under the equity method of ₩28,500 million

(US$27,304 thousand), gain on valuation of ₩58,545 million (US$56,088 thousand) reflected in current operations, decrease in retained earnings of ₩906 million

(US$868 thousand), investment impairment loss of ₩185 million (US$177 thousand) and loss on valuation of equity securities accounted for using the equity

method, net of ₩6,841 million (US$6,554 thousand) reflected in capital adjustments.

As of December 31, 2003, the difference between acquisition cost and equity value of ₩172,661 million (US$165,416 thousand) was accounted for as a charge to

beginning retained earnings for ₩1,539 million (US$1,474 thousand) up to prior year, dividends received under the equity method of ₩9,701 million (US$9,294

thousand), gain on valuation of ₩153,781 million (US$147,328 thousand) reflected in current operations, decrease in retained earnings of ₩391 million (US$374

thousand) and gain on valuation of equity securities accounted for using the equity method of ₩27,433 million (US$26,282 thousand) reflected in capital

adjustments.

Although the Com pany holds less than 20% of the voting power of Hyundai MOBIS, the Company applied equity method as the Company is presum ed to have

significant influence on Hyundai MOBIS in accordance with the SKAS No. 15 - Equity Method .

The shares of the Com pany and its affiliates on EUKOR Car carriers, Inc. and EUKOR Car Carriers Singapore Pte. total more than 20 percent of the outstanding shares;

accordingly, the Company applied the equity method.

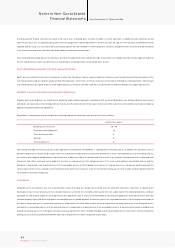

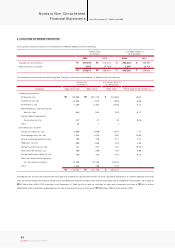

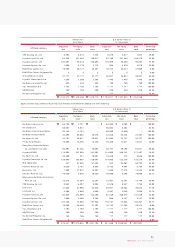

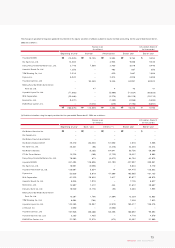

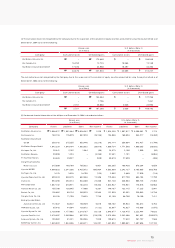

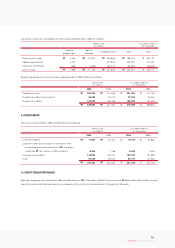

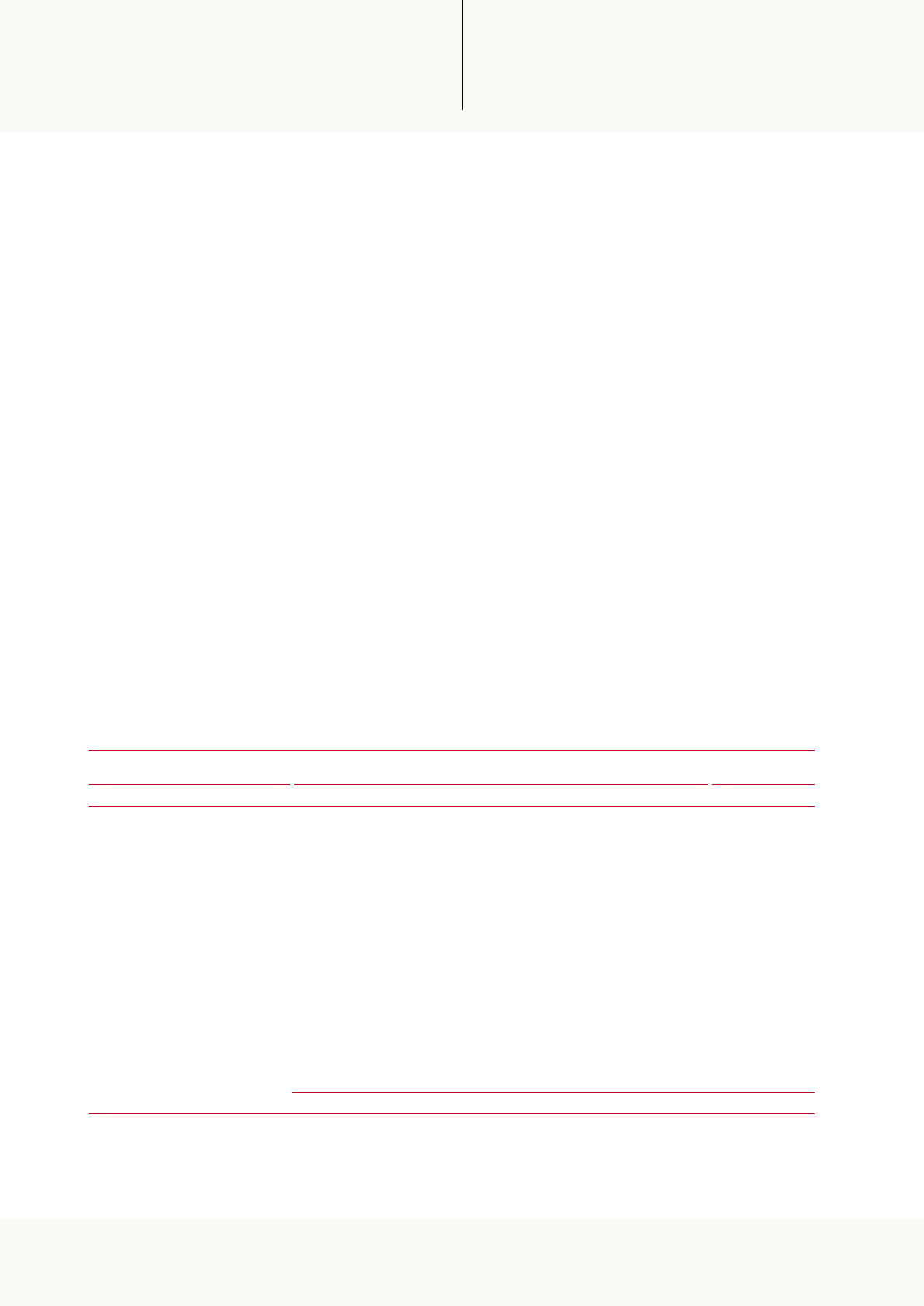

(2) The changes in goodwill or negative goodwill incurred from the equity securities of affiliates subject to equity method accounting for the year ended December

31, 2004 are as follows:

–

–

–

–

–

–

15,459

5,677

100

–

–

–

–

21,236

₩

₩

Increase Amortization End of year End of year

2,436

(3,673)

3,944

463

9

629

5,105

19,246

40

(3,276)

(1,355)

(5,970)

(379)

17,219

₩

₩

6,374

13,436

5,916

424

34

1,258

14,382

70,482

60

(22,934)

(2,711)

(65,664)

(6,814)

14,243

₩

₩

6,107

12,872

5,668

406

33

1,205

13,779

67,524

57

(21,972)

(2,597)

(62,909)

(6,528)

13,645

$

$

Dong Feng Yueda-Kia Motors Co., Ltd.

Hyundai MOBIS

Kia Tigers Co., Ltd.

Haevichi Resort Co., Ltd.

Beijing Hyundai Mobis Automotive

Parts Co. Ltd.

TRW Steering Co., Ltd.

Dymos Inc.

Hyundai Card Co., Ltd

Donghui Auto Co., Ltd.

WIA Corporation

Bontek Co., Ltd.

Hyundai Hysco Co., Ltd.

EUKOR Car Carriers, Inc.

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)

8,810

9,763

9,860

887

43

1,887

4,028

84,051

–

(26,210)

(4,066)

(71,634)

(7,193)

10,226

Beginning of year

₩

₩