Kia 2004 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

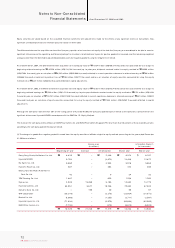

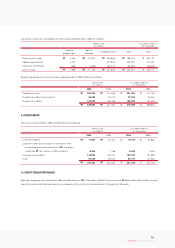

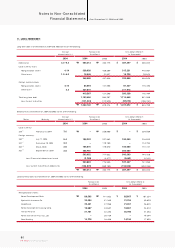

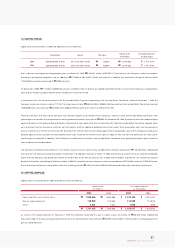

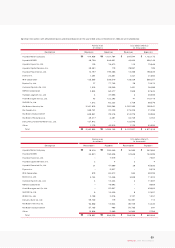

The maturities of long-term debt as of December 31, 2004 are as follows:

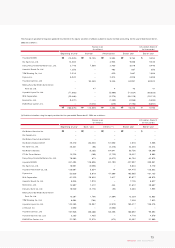

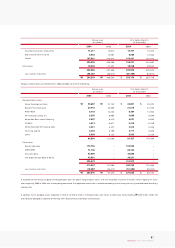

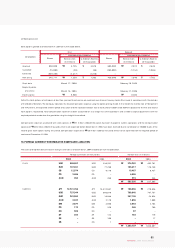

12. COMMITMENTS AND CONTINGENCIES:

(1) As of December 31, 2004, the outstanding balance of installment accounts receivable and notes receivable discounted with recourse amounts to ₩79,555

million (US$76,216 thousand) and the outstanding balance of accounts receivable from export sales discounted with recourse amounts to ₩2,336,666 million

(US$2,238,614 thousand).

(2) The Company uses a customer financing system related to a long-term installment sales system and has provided guarantees of ₩32,531 million (US$31,165

thousand) to the banks concerned as of December 31, 2004. These guarantees are all covered by insurance contracts, which regulate a customer and the Company

as a contractor and a beneficiary, respectively. In addition, the Company provides payment guarantee to Chohung Bank London Branch amounting to GBP

6,670,000 from July 1, 2004 through June 30, 2005 on behalf of Kia Motors (UK) Ltd., a related party.

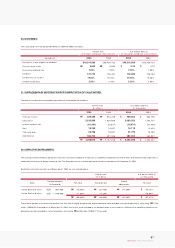

(3) The Company is a defendant to seven lawsuits for com pensation of losses or damages amounting to ₩6,513 million (US$6,239 thousand) as of December 31,

2004. Although the outcome of these matters is not currently determinable, the managem ent believes that the resolution of these matters will not have a material

adverse effect on the operations or financial position of the Com pany.

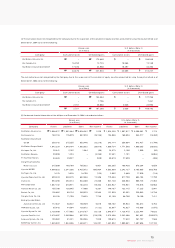

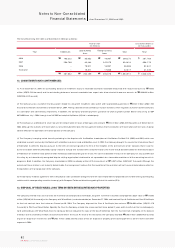

(4) The Company is carrying certain lawsuits pertaining to the disputes with the Brazilian shareholders of Asia Motors Do Brasil S.A. (AMB) and AMB, which was

established as a joint venture by Asia Motors with a Brazilian investor, in local and Brazilian court. In 2002, the Company brought the case to the International Court

of Arbitration to settle the disputes pursuant to the terms of contract signed at the time of the inception of the joint venture, which stipulates that in case the

business has been adversely affected by a party s failure to comply with contract term s and other reasons, the matter should be taken before the International Court

of Arbitration for settlem ent and parties shall be held accountable according to the results. The case was decided in favour of the Com pany on July 22, 2004, and

this ruling by an internationally-recognized dispute-settling organization is believed to set a precedent for a favourable resolution of all the remaining lawsuits in

progress in Brazil. In addition, the Com pany, shareholder of AMB, has already written off this investment of ₩14,057 million (US$13,467 thousand). Although the

outcome of these matters is not currently determinable, the management believes that the resolution of these matters will not have a material adverse effect on

the operations or financial position of the Company.

(5) The Company made an agreem ent with its 9 European sales subsidiaries and agents for them to be responsible for projected costs for dismantling and recycling

vehicles sold in corresponding countries to com ply with European Parliament directive regarding End-of-Life vehicles (ELV).

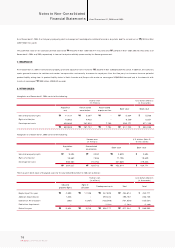

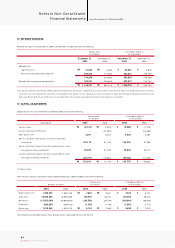

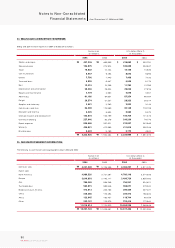

13. DISPOSAL OF RECEIVABLES, LONG TERM INVESTMENT SECURITIES AND PROPERTIES

The Company entered into a trust contract for maintenance and disposal of receivables, long-term investment securities and properties (book value of ₩154,892

million (US$148,392 thousand)) of the Com pany with Woori Bank ( trustee hereinafter) on December 27, 2004, and received Class A Certificate and Class B Certificate

for the trust contract from the trustee on December 30, 2004. The Company disposed the Class A Certificate (face value of ₩158,000 million (US$151,370

thousand)) to Pilot Asset Securitization Specialty Co. Also, the Com pany entered into a lease contract (lease period: 2 years and 6 months) on the trusted property

(land and buildings) with Woori Bank. Also, the Company did not recognize the value of the Class B Certificate from the trust contract of property on the balance

sheet due to the uncertainty of inflow of economic benefits in the future. As result of this transaction, the Company recorded ₩6,308 million (US$6,043 thousand)

of gain on disposal of investments and ₩3,482 million (US$3,336 thousand) of loss on disposal of property, plant and equipment as other income and other

expenses in 2004.

Notes to Non-Consolidated

Financial Statements As of December 31, 2004 and 2003

82

KIA Motors_2004 Annual Report

198,322

208,760

–

–

407,082

₩

₩

85,053

83,484

79,911

15,811

264,259

₩

₩

16,997

342,570

16,997

17,006

393,570

₩

₩

300,372

634,814

96,908

32,817

1,064,911

₩

₩

287,768

608,176

92,841

31,440

1,020,225

$

$

Year Debentures Local currency

loans

Foreign currency

loans Total Total

2006

2007

2008

Thereafter

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)