Kia 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

KIA Motors_2004 Annual Report

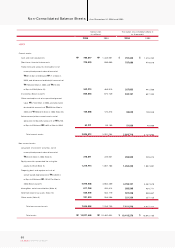

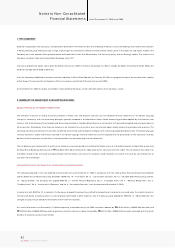

Trade receivables were down ₩155.7 billion year on year. The protracted slump in domestic market led to fewer issuances of domestic trade receivables and the

com pany liquidated more of its export trade receivables as soon as possible. Inventories increased ₩193.9 billion from the previous year as a result of a rise in

dom estic inventory of built-up cars.

Fixed Assets

The investment assets in fixed assets increased ₩245.2 billion year on year. During the sam e period, long-term investm ent securities and securities under equity

method grew ₩307.3 billion. The gain was due to the following factors:

The Company acquired stocks of its affiliates and overseas subsidiaries to ensure smooth parts supply and boost exports. There were equity-method gains on stocks

of Hyundai Mobis, Wia and Hyundai Hysco. Share prices for marketable securities such as INI Steel also rose on the stock market.

Tangible assets climbed ₩311.6 billion year on year, mainly driven by increased new investm ent in new model development and engine and transmission

production facilities. At the same time, intangible assets also increased ₩157.4 billion because R&D expenses related to new versions of the Rio, Carnival (Sedona),

Optima (Magentis) and Carens were capitalized.

Current Liabilities

Trade accounts payable in 2004 grew ₩311.6 billion from the previous year, boosted by increases in material and component purchases due to expanded

production of built-up cars. At the sam e time, short-term borrowings shrank ₩418.6 billion because increased exports provided more cash, and subsequently

com pany issued ₩300 billion less commercial paper than in 2003 and repaid matured foreign currency borrowings, ₩79.6 billion. In addition, the current portion

of debentures and current portion of long-term debt decreased ₩224.4 billion as they were repaid as matured borrowings.

Long-term Liabilities

A total amount of debentures declined ₩200 million from the previous year. Although the com pany issued additional US$200 million (₩229.4 billion) in corporate

bonds, the dollar-denominated bonds produced ₩73 billion in gains on foreign exchange evaluation and were reclassified on the books as current debentures

and current long-term debts within one year of maturity. The surge in overseas sales volum e was expected to boost overall warranty provision (including both short

and long term) significantly with the growing number of vehicles under warranty and expansion in recall provision. However, strong sales of vehicles with improved

quality and the sharp fall in foreign exchange rate nudged the provision up to ₩815.2 billion.

Shareholders' Equity

The stock option rights granted in 2000 were exercised to generate a ₩1 billion gain on the disposition of treasury stock, causing capital surplus to rise from the

previous year. Net income of ₩690.6 billion was generated in 2004, but 2003 dividend payout of ₩125.4 billion was followed by ₩136.7 billion share buyback and

cancellation in 2004 and other expenses. As a result, retained earnings increased ₩427.5 billion year on year. Meanwhile, total capital adjustm ent was increased by

₩57.5 billion from the previous year. The adjustments are as follow s: Profit on paper (valuation incom e) increased ₩49 billion from the previous year as a result of

higher prices for listed stocks held by the Company. On the other hand, the net loss on equity evaluation method rose ₩34.3 billion from the previous year, while

the (-)₩41.6 billion that was held for capital adjustm ent of short-term derivative investment incurred in 2003 was invalidated in 2004.

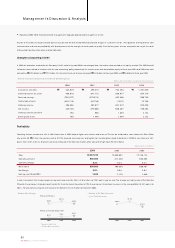

• Debt-to-Equity Ratio • Equity-to-Asset Ratio

2002

127.3%

2003

127.2%

2004

113.2%

2002

44.0%

2003

44.0%

2004

46.9%