Kia 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

KIA Motors_2004 Annual Report

▶3rd phase (2009~2010: Accelerate brand m anagem ent): Upgrade global brand managem ent system.

As part of the efforts to improve brand pow er, Hyundai and Kia will instill differentiated brand images in customers' minds. This approach will expand the core

customer base and increase profitability with brand power with the strength to match product quality. Over the long term , the two companies aim to join the ranks

of the world's top five automakers and top 30 brands.

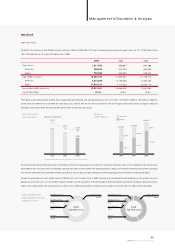

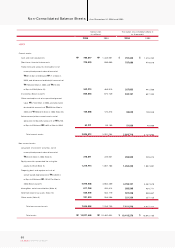

Changes to Accounting in 2004

In 2004, the evaluation method for the Com pany's 18.2% stake in Hyundai Mobis was changed from the market value method to the equity method. The 2003 financial

statements were revised to conform with the new accounting policy retroactively. As a result, assets and shareholders' equity for fiscal years 2003 and 2004 were each

reduced by ₩679.5 billion and ₩729.1 billion. On the other hand, net income increased ₩84.1 billion for fiscal year 2004 and ₩64 billion for fiscal year 2003.

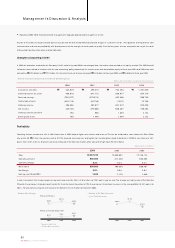

Profitability

Operating incom e to sales was 3.3% in 2004, lower than in 2003 despite higher sales volume and revenue. This can be attributed to som e factors: the Won/ Dollar

rate, which fell ₩57 from the previous year to W1,135, lowered sales revenues, and higher raw material prices raised material cost. COGS to sales ratio rose 2.9%

points, from 78.5% to 81.4%. Discounts were also increased in the domestic market, while sales of the high-value RVs fell in Korea.

In terms of product mix, the passenger car segment accounted for 48.4% of total sales, up 10.6% points year on year. The change was led by sales of the Morning

(Picanto), the com pany's strategic export model. On the other hand, the portion of RVs, the com pany's mainstream business, in the sales portfolio fell 4.3% points to

40.2%. RV sales continue to grow overseas, but the Korean mini-van market contracted in 2004.

Management’s Discussion & Analysis

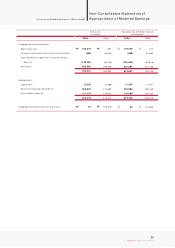

499,272

641,772

(279,674)

(20,739)

462,677

579,605

986

1,495

2001 2002 2003

764,453

569,977

402,498

(7,357)

857,572

680,407

1,849

1,849

1,291,049

554,119

990,726

72,746

944,429

769,393

2,123

2,123

Investment securities

Deferred income tax assets

Retained earnings

Capital adjustments

Ordinary income

Net incom e

Ordinary income per share

Earnings per share

333,029

458,978

(765,977)

(329,715)

396,366

349,146

785

785

2000

• Effect of change in accounting methods for preceding years Korean won (in millions, except per share amount)

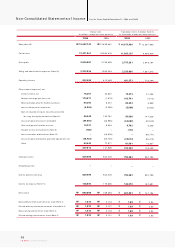

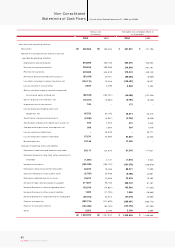

₩₩₩₩

15,257,742

502,455

3.3%

690,569

4.5%

1,972

2004 2003 2002

12,839,881

812,440

6.3%

769,393

6.0%

2,123

12,158,113

658,493

5.4%

680,407

5.6%

1,849

Sales

Operating Income

Operating Margin

Net Income

Net Margin

Earnings per Share(KRW)

(Korean won in millions)

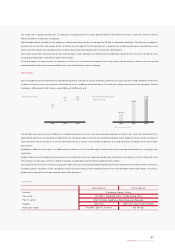

• Product Mix Change • Portion of RV Sales Revenue

(% of Total Revenue)

2002

40.7%

2003

44.5%

2004

40.2%

0.3% 2.6% 4.4%

Portion of RV Sales

Portion of Full-Size Sedan Sales

49.8%

51.8%

47.8%

2002 2003 2004

* Based on Sales Unit

* RV (SUV, Mini-Van, MPV)