Kia 2004 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

remaining period. Trading securities are valued at fair value, with unrealized gains or losses included in current operations. Available-for-sales securities are also

valued at fair value, with unrealized holding gains or losses recognized in capital adjustments, until the securities are sold or if the securities are determined to be

impaired and the lump-sum cumulative amount of capital adjustm ents are reflected in current operations. How ever, available-for-sales securities that are not traded

in an active market and w hose fair value cannot be reliably measured are valued at cost.

If the estimated recoverable am ount of securities is less than the acquisition cost of equity securities or amortized cost of debt securities and any objective evidence

for such impairment loss exists, impairment loss is recognized in current operations in the period when it arises.

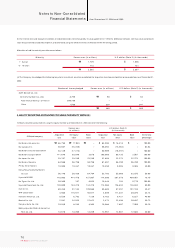

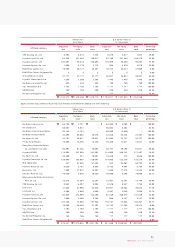

EQUITY SECURITIES ACCOUNTED FOR USING THE EQUITY METHOD

Equity securities held for investment in companies in which the Company is able to exercise significant influence over the operating and financial policies of the

investees are accounted for using the equity method. The Company s share in the net income or net loss of investees is reflected in current operations. The changes

in the retained earnings, capital surplus or other capital accounts of investees are accounted for as an adjustment to retained earnings or to capital adjustm ents.

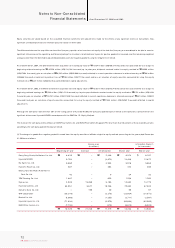

PROPERTY, PLANT AND EQUIPMENT AND RELATED DEPRECIATION

Property, plant and equipm ent are stated at cost, except for assets revalued upward in accordance with the Asset Revaluation Law of Korea. Routine maintenance

and repairs are expensed as incurred. Expenditures that result in the enhancement of the value or extension of the useful lives of the facilities involved are treated as

additions to property, plant and equipm ent.

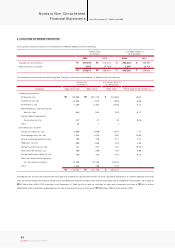

Depreciation is computed using the straight-line method based on the estimated useful lives of the assets as follows:

The Company charges all financing cost to current operations in accordance with SKAS No. 7 - Capitalization of Financing Costs . In addition, the Com pany assesses

possible recognition of impairment loss when there is an indication that expected future economic benefits of an asset is considerably less than its carrying amount,

as a result of technological obsolescence or rapid declines in market value. When it is determined that an asset m ay have been impaired and that its estimated total

future cash flows from continued use or disposal is less than its carrying amount, the carrying amount of the asset is reduced to its recoverable am ount and the

difference is recognized as an impairment loss. If the recoverable amount of the im paired asset exceeds its carrying amount in subsequent reporting period, the

amount equal to the excess is treated as the reversal of the impairment loss; how ever, it cannot exceed the carrying amount that would have been determined had

no impairment loss been recognized.

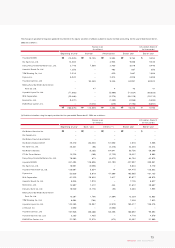

INTANGIBLES

Intangible assets are stated at cost, net of amortization computed using the straight-line method over the estimated econom ic useful lives of related assets.

Developm ent costs are amortized over the estimated economic useful life (not exceeding three years) from the usable date of the related productions. Ordinary

development and research expenses are charged to current operations. Cost in excess of net identifiable assets acquired (goodwill) is am ortized over five years and

industrial property rights and other intangibles are amortized over the period between five and ten years. If the recoverable amount of an intangible asset becomes

less than its carrying am ount as a result of obsolescence, sharp decline in market value or other causes of impairment, the carrying amount of the intangible asset is

reduced to its recoverable amount and the reduced amount is recognized as impairm ent loss. If the recoverable amount of a previously impaired intangible asset

exceeds its carrying am ount in subsequent periods, an am ount equal to the excess shall be recorded as reversal of im pairment loss; how ever, it shall not exceed the

carrying amount that would have been determined had no impairm ent loss been recognized in prior years.

Notes to Non-Consolidated

Financial Statements As of December 31, 2004 and 2003

64

KIA Motors_2004 Annual Report

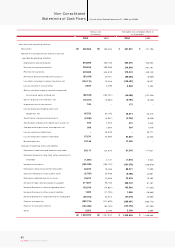

Buildings and structures

Machinery and equipm ent

Tools, dies and molds

Vehicles

Office equipment

20~40

15

5

5

5

Useful lives (years)