Kia 2004 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

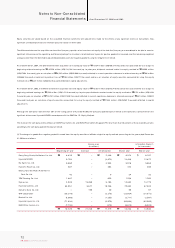

Notes to Non-Consolidated

Financial Statements As of December 31, 2004 and 2003

68

KIA Motors_2004 Annual Report

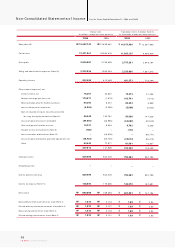

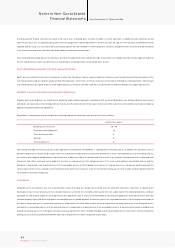

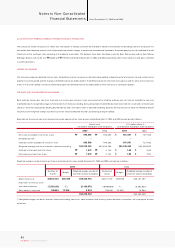

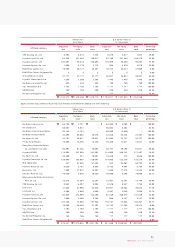

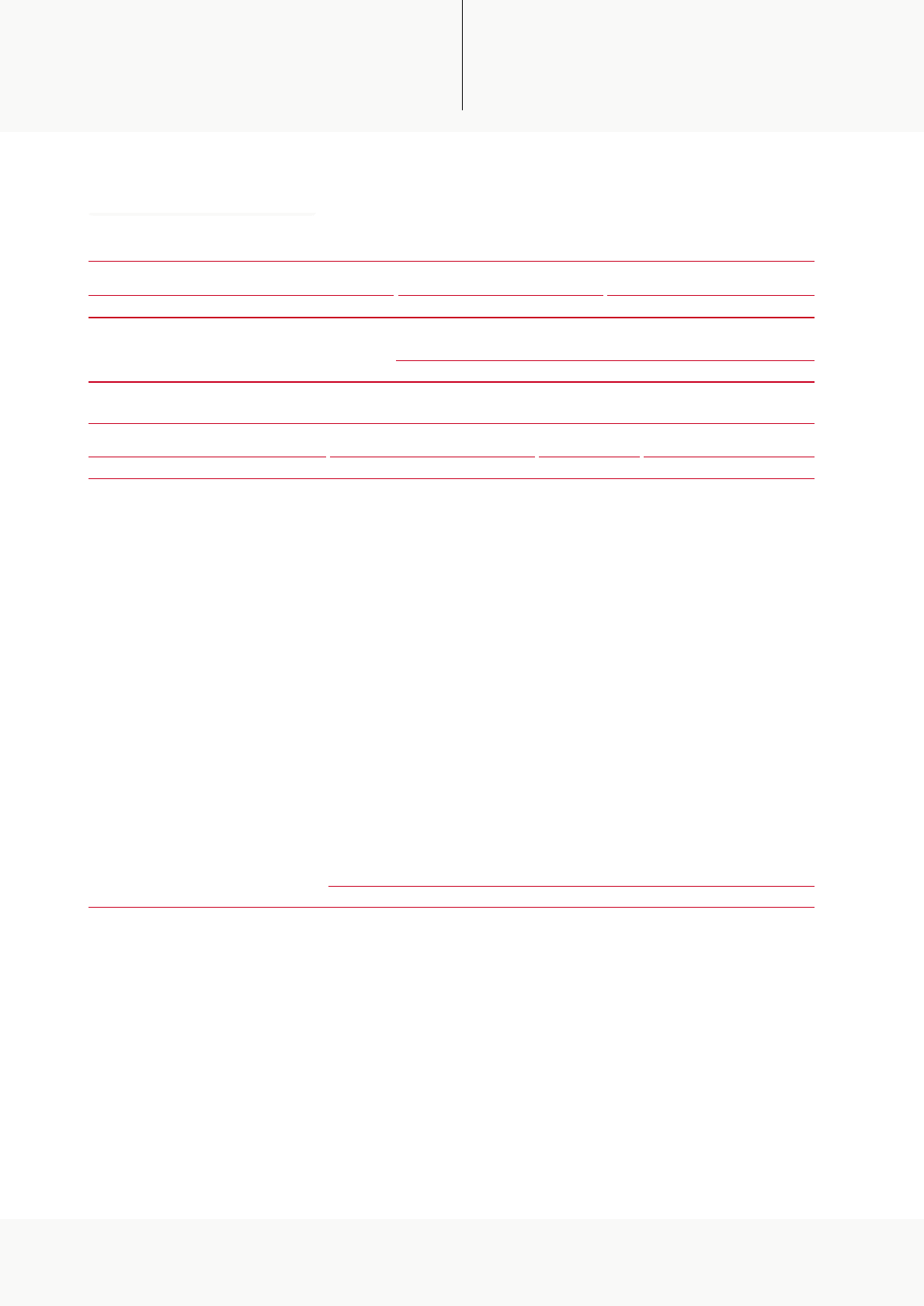

4. LONG-TERM INVESTMENT SECURITIES

(1) Long-term investm ent securities as of December 31, 2004 and 2003 consist of the follow ing:

(2) Available-for-sale securities included in long-term investment securities as of December 31, 2004 consist of the following:

Available-for-sale securities are valued at fair value. How ever, available-for-sale securities that do not have a quoted market price in an active market and whose fair

value cannot be reliably measured are valued at cost. The difference between the book value and the acquisition cost of available-for-sale securities, am ounting to

₩137,565 million (US$131,792 thousand) as of December 31, 2004, consist of gain on valuation of long-term investm ent securities of ₩140,115 million

(US$134,235 million) reflected in capital adjustments and an impairm ent loss of investment of ₩2,550 million (US$2,443 thousand) in 2002.

276,109

2,502

278,611

₩

₩

2004 2003 2004 2003

218,673

21,268

239,941

₩

₩

264,523

2,397

266,920

$

$

209,497

20,376

229,873

$

$

Available-for-sale securities

Held-to-maturity securities

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)

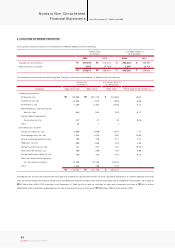

99,999

10,056

7,200

854

347

30

3,000

1,024

700

600

241

200

168

10,786

3,339

138,544

₩

₩

Acquisition costCompany Book value Book value Percentage of ownership (% )

245,153

7,375

5,497

543

31

1

3,000

1,024

700

600

241

200

168

10,786

790

276,109

₩

₩

234,865

7,066

5,266

520

30

1

2,874

981

671

575

231

192

161

10,333

757

264,523

$

$

19.87

0.66

0.12

0.17

0.38

1.77

19.99

2.41

5.80

19.23

8.00

0.22

–

–

Listed equity securities:

INI Steel Co., Ltd.

LG Telecom Co., Ltd.

KT Freetel Co., Ltd.

SeAH Besteel Co., Ltd (formerly Kia

Steel Co., Ltd.)

Kanglim Specific Equipment

Automotive Co., Ltd.

Other

Unlisted equity securities:

Dongwon Capital Co., Ltd.

Asset Management Co., Ltd.

Kihyup Technology Banking Corp.

Mobil.com Co., Ltd.

Dongyung Industries Co., Ltd.

Namyang Industrial Co., Ltd.

The Korea Economic Daily Co., Ltd.

Pilot Asset Securitization Specialty

Co. - beneficiary certificate

Other

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)