Kia 2004 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

KIA Motors_2004 Annual Report

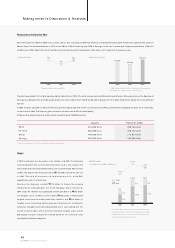

Management’s Discussion & Analysis

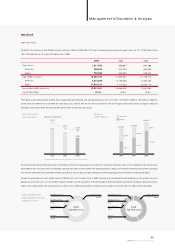

Non-operating Income & Expenses

Non-operating incom e reached ₩899.5 billion in 2004, which was ₩310.8 billion higher than that for the previous year. There were several factors behind this rise.

The gain on foreign exchange transactions, which is linked to exchange rate fluctuation, was up ₩192.2 billion. The Company won lawsuits against financial

institutions, returning ₩84.2 billion of provision for bad debt. After performance results were announced on February 18, the evaluation method for Hyundai Mobis

shares held by the Company was changed from the market value method to the equity method. Subsequently, the gain on equity evaluation method rose from

₩92.6 billion to ₩221.2 billion.

Non-operating expenses increased ₩115.8 billion year on year to ₩572.5 billion. This expense was prompted by ₩13.7 billion increase in interest expenses for

short-term borrowings, ₩121 billion loss on equity evaluation method for the Company affiliates (Hyundai Card, etc.), and ₩23.3 billion loss on the sale of export

trade receivables resulting from the higher export volume.

Net Income / EPS / Income Taxes

The strong Won, increased discounts in dom estic market, higher raw material prices and other factors caused operating income to fall 38.1% year on year.

However, net incom e still amounted to ₩690.6 billion, a 10.2% drop from the previous year. The smaller rate in net profit decrease was due to non-operating

income from gains on foreign exchange transactions and equity evaluation, and return of provision for bad debt. Earnings per share shrank 7.1% to ₩1,972.

Income taxes fell 20.6% year on year, as net income was lower and tax incentives were increased for R&D and other facility investment.

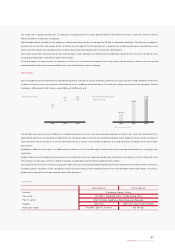

Assets

Current Assets

Cash and cash equivalents declined 45.1% from the previous year to ₩790.5 billion. The drop stemmed from payments of matured borrowings, investment in

affiliates, buyback and cancellation of Company stock and increased cash payments for materials used in exported vehicles.

Short-term financial instruments reached ₩770 billion, ₩270 billion increase from the previous year, thanks to efficient managem ent of liquid assets. The share of

"ultra-short-term" financial instruments with a maturity within 90 days shrank, but the share of relatively high-yield short-term financial instruments with various

maturities increased in the Company's portfolio.

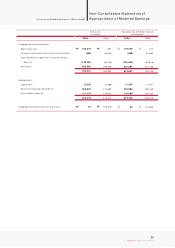

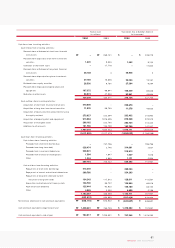

• Net Income

(KRW in Billions)

• Change in Number of Shares

(Shares in Millions)

• Earnings per Share

(Korean won)

2002

1,849

2003

2,123

2004

1,972

2002 2003 20042002

680.4

2003

769.4

2004

690.6

369

359

347

10,871,468

5,772,379

5,099,089

113.2%

46.9%

2004 2003 2002

10,482,033

5,868,953

4,613,080

127.2%

44.0%

8,962,680

5,018,963

3,943,717

127.3%

44.0%

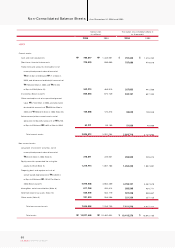

Assets

Liabilities

Shareholders' Equity

Debt-to-Equity Ratio

Equity-to-Asset Ratio

(Korean won in millions)