Kia 2004 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

KIA Motors_2004 Annual Report

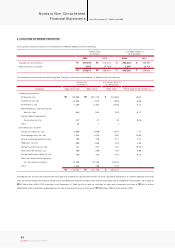

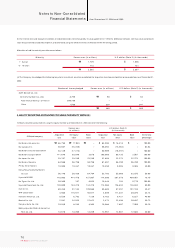

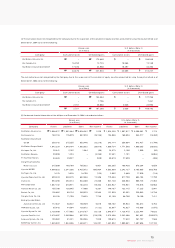

VALUATION OF RECEIVABLES AND PAYABLES AT PRESENT VALUE

Receivables and payables arising from long-term installment transactions, long-term cash loans (borrowings) and other similar loan (borrow ing) transactions are

stated at present value, if the difference between nominal value and present value is material. The present value discount is am ortized using the effective interest

rate method, and the amortization is included in interest expense or interest income. As of December 31, 2004 and 2003, an interest rate of 8.25 percent and 10.0

percent is used, respectively, in valuing the receivables and payables at present value. Also, the Company recognizes impairm ent loss and records the loss as

allowance for doubtful accounts and bad debt expense when collection of receivables in accordance with the original schedule has become impossible due to

restructuring of the receivables.

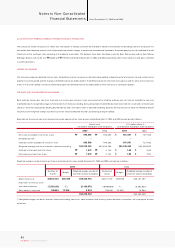

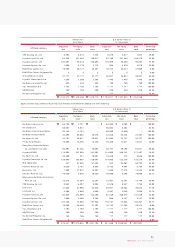

ACCRUED SEVERANCE BENEFITS

Employees and directors with m ore than one year of service are entitled to receive a lum p-sum payment upon termination of their service with the Com pany,

based on their length of service and rate of pay at the time of termination. The accrued severance benefits that would be payable assuming all eligible employees

were to resign amount to ₩1,437,077 million (US$1,376,774 thousand) and ₩1,340,068 million (US$1,283,836 thousand) as of December 31, 2004 and 2003,

respectively.

Accrued severance benefits are approximately 61 percent and 58 percent funded at December 31, 2004 and 2003, respectively, through an individual severance

insurance plan. Individual severance insurance deposits, in which the beneficiary is a respective employee, are presented as deduction from accrued severance

benefits.

Before April 1999, the Company and its employees paid 3 percent and 6 percent, respectively, of monthly pay (as defined) to the National Pension Fund in

accordance with the National Pension Law of Korea. The Company paid half of the employees 6 percent portion and is paid back at the termination of service by

offsetting the receivable against the severance payment. Such receivables, totalling ₩39,691million (US$38,025 thousand) and ₩44,892 million (US$43,008

thousand) as of December 31, 2004 and 2003, respectively, are presented as a deduction from accrued severance benefits. Since April 1999, according to a revision

in the National Pension Law, the Company and its employees each pay 4.5 percent of monthly pay to the Fund.

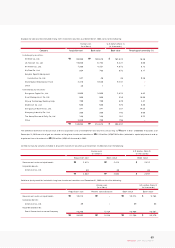

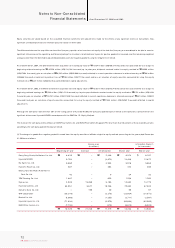

STOCK OPTIONS

The Company computes total compensation expense to stock options, w hich are granted to employees and directors, by fair value method using the option-

pricing model. The com pensation expense has been accounted for as a charge to current operations and a credit to capital adjustments from the grant date using

the straight-line method.

DERIVATIVE INSTRUMENTS

All derivative instruments are accounted for at fair value with the valuation gain or loss recorded as an asset or liability. If the derivative instrument is not part of a

transaction qualifying as a hedge, the adjustment to fair value is reflected in current operations. The accounting for derivative transactions that are part of a qualified

hedge based both on the purpose of the transaction and on meeting the specified criteria for hedge accounting differs depending on whether the transaction is a

fair value hedge or a cash flow hedge. Fair value hedge accounting is applied to a derivative instrument designated as hedging the exposure to changes in the fair

value of an asset or a liability or a firm commitment (hedged item) that is attributable to a particular risk. The gain or loss both on the hedging derivative instruments

and on the hedged item attributable to the hedged risk is reflected in current operations. Cash flow hedge accounting is applied to a derivative instrument

designated as hedging the exposure to variability in expected future cash flows of an asset or a liability or a forecasted transaction that is attributable to a particular

risk. The effective portion of gain or loss on a derivative instrument designated as a cash flow hedge is recorded as a capital adjustment and the ineffective portion is

recorded in current operations.

The effective portion of gain or loss recorded as a capital adjustm ent is reclassified to current earnings in the same period during which the hedged forecasted

transaction affects earnings. If the hedged transaction results in the acquisition of an asset or the incurrence of a liability, the gain or loss in capital adjustm ent is

added to or deducted from the asset or the liability.