Kia 2004 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

KIA Motors_2004 Annual Report

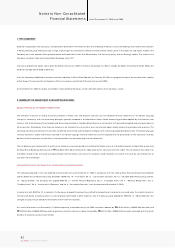

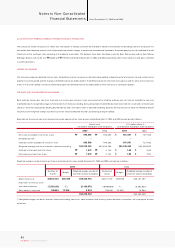

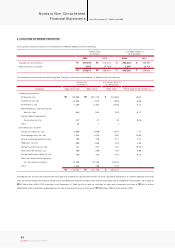

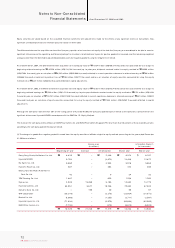

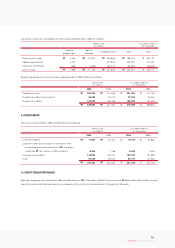

Available-for-sale securities included in long-term investment securities as of December 31, 2003 consist of the following:

The difference between the book value and the acquisition cost of available-for-sale securities, am ounting to ₩88,579 million (US$84,862 thousand) as of

December 31, 2003, consist of gain on valuation of long-term investment securities of ₩91,129 million (US$87,305 million) reflected in capital adjustm ents and an

impairment loss of investment of ₩2,550 million (US$2,443 thousand) in 2002.

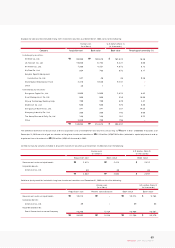

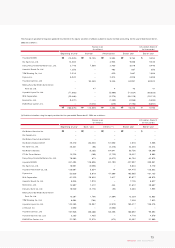

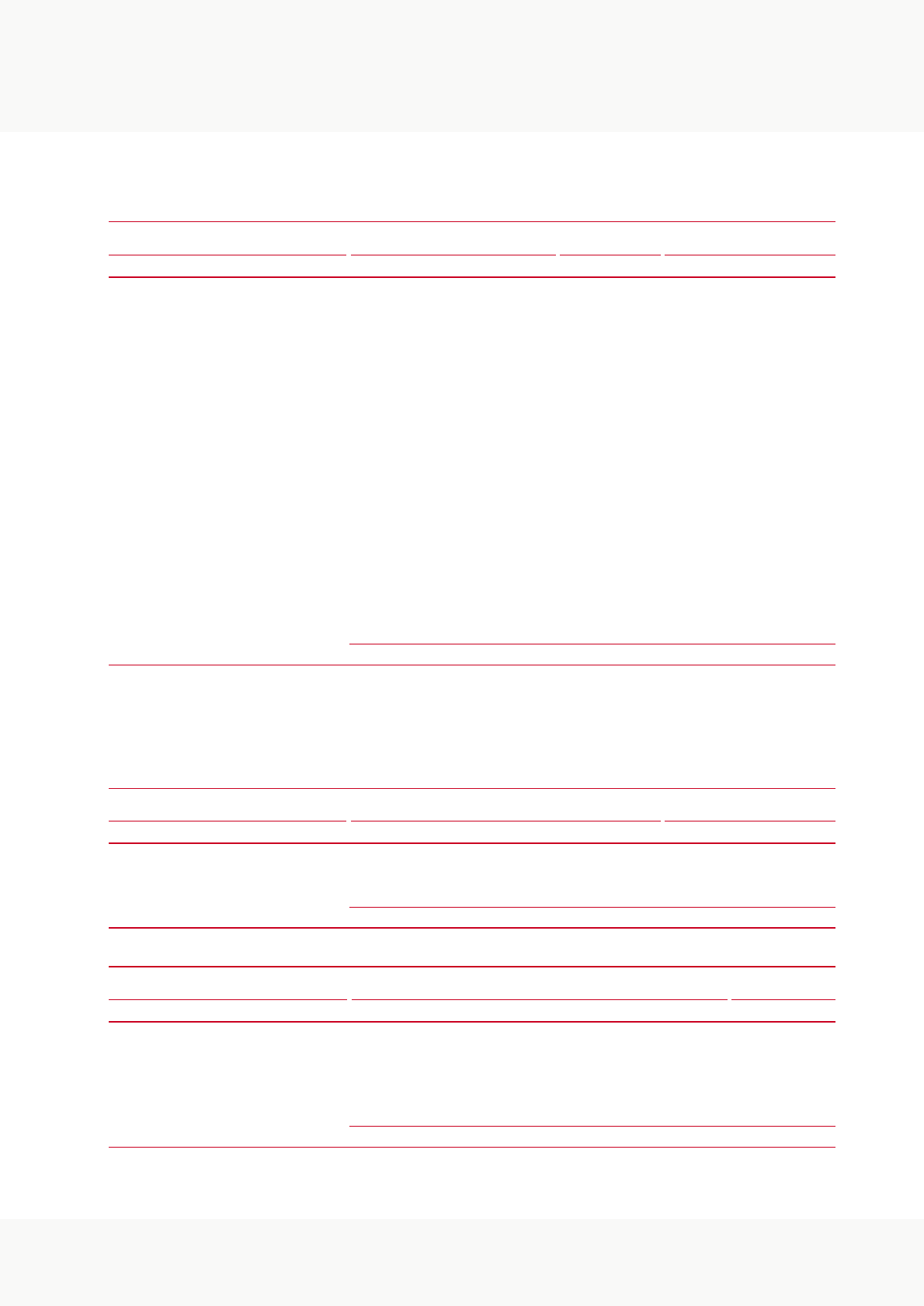

(3) Held-to-maturity securities included in long-term investm ent securities as of December 31, 2004 consist of the following:

Held-to-maturity securities included in long-term investment securities as of December 31, 2003 consist of the following:

99,999

10,056

7,200

854

347

2,410

30

3,000

950

700

600

241

200

168

3,339

130,094

₩

₩

Acquisition costCompany Book value Book value Percentage of ownership (%)

190,675

6,702

4,251

703

48

9,646

1

3,000

950

700

600

241

200

168

789

218,673

₩

₩

182,674

6,421

4,072

673

46

9,241

1

2,874

910

670

575

231

192

161

756

209,497

$

$

18.36

0.66

0.12

0.17

0.38

–

–

4.62

19.99

2.41

5.80

19.35

8.00

0.22

–

Listed equity securities:

INI Steel Co., Ltd.

LG Telecom Co., Ltd.

KT Freetel Co., Ltd.

Kia Steel Co., Ltd.

Kanglim Specific Equipment

Automotive Co., Ltd.

Stock Market Stabilization Fund

Other

Unlisted equity securities:

Dongwon Capital Co., Ltd.

Asset Management Co., Ltd.

Kihyup Technology Banking Corp.

Mobil.com Co., Ltd.

Dongyung Industries Co., Ltd.

Namyang Industrial Co., Ltd.

The Korea Economic Daily Co., Ltd.

Other

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)

2,413

89

2,502

₩

₩

Acquisition cost Book value Book value

2,413

89

2,502

₩

₩

2,312

85

2,397

$

$

Government and municipal bonds

Corporate bonds:

Acrowave Co., Ltd.

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)

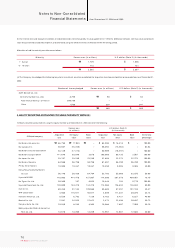

10,213

89

16,200

26,502

₩

₩

Acquisition cost Present value discount Book value Book value

–

–

5,234

5,234

₩

₩

10,213

89

10,966

21,268

₩

₩

9,784

85

10,507

20,376

$

$

Government and municipal bonds

Corporate bonds:

Acrowave Co., Ltd.

Subordinated bonds:

Seoul Guarantee Insurance Company

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)