Kia 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Non-Consolidated

Financial Statements As of December 31, 2004 and 2003

76

KIA Motors_2004 Annual Report

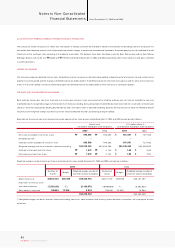

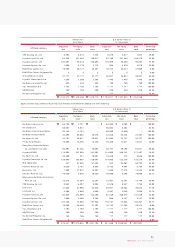

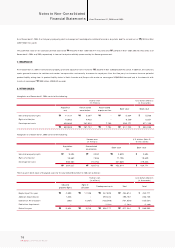

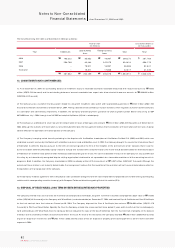

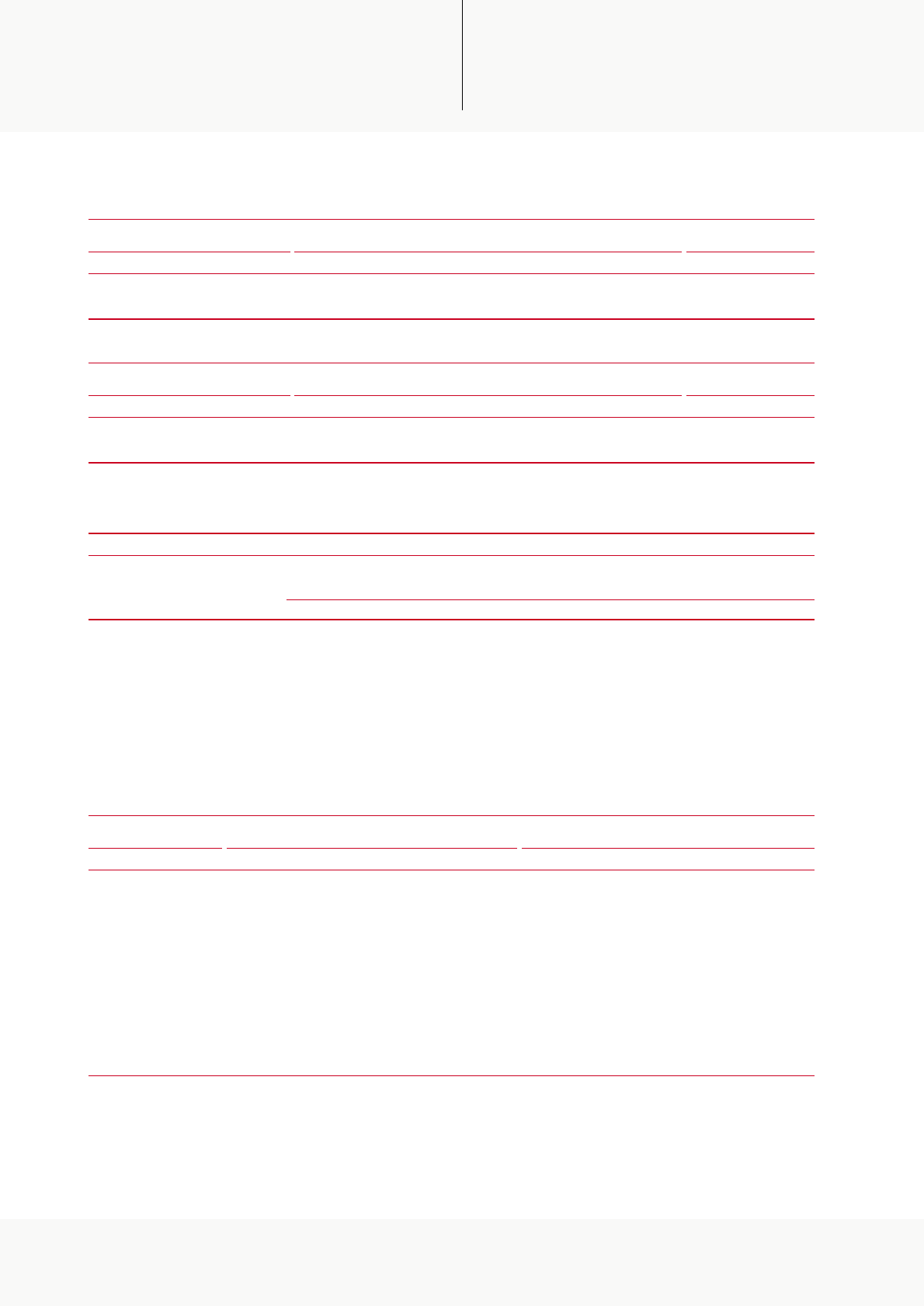

(6) The market price of listed equity securities as of December 31, 2004 is as follows:

The market price of listed equity securities as of December 31, 2003 is as follows:

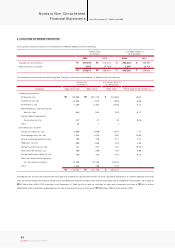

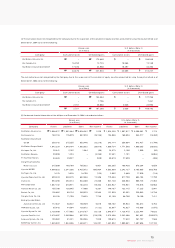

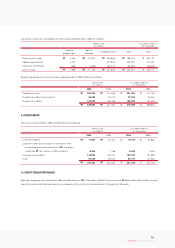

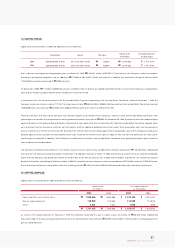

(7) The Company has pledged the follow ing equity securities accounted for using the equity method as collateral for borrowings of EUKOR Car Carriers, Inc. as of

December 31, 2004:

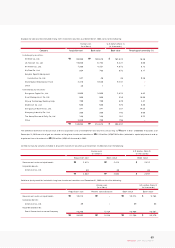

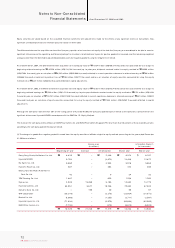

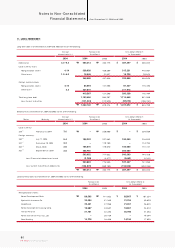

(8) In 2004, the Company early applied the SKAS No. 15 - Equity Method , and changed its accounting methods for the treatment of investm ent securities. As a

result, investment securities accounted for using the equity methods and retained earnings for 2003 have been increased by ₩331,403 million (US$317,497

thousand) and ₩149,649 million(US$143,369 thousand), respectively. Also, long-term investment securities, capital adjustm ents, and deferred income tax assets for

2003 have been reduced by ₩997,276 million (US$955,428 thousand), ₩878,747 million (US$841,873 thousand) and ₩63,226 million (US$60,573 thousand),

respectively. In addition, net income for 2003 has been increased by ₩63,970 million (US$61,286 thousand).

This change in accounting m ethods has been accounted for retrospectively, and the comparative statements for 2003 have been restated. The effect on financial

statements due to early application of the SKAS No.15 for preceding years is as follows:

15,558,120

19,294,680

Number of shares Market value Market value

1,019,057

146,254

₩

976,295

140,117

$

Hyundai MOBIS

Hyundai Hysco Co., Ltd.

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)

65,500

7,580

Price per shareCompany

₩

15,558,120

19,294,680

Number of shares Market value Market value

1,019,057

146,254

₩

955,427

118,674

$

Hyundai MOBIS

Hyundai Hysco Co., Ltd.

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)

64,100

6,420

Price per shareCompany

₩

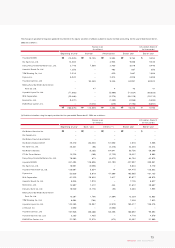

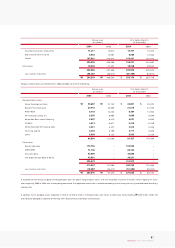

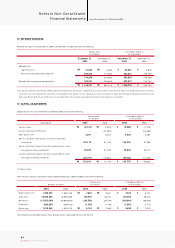

Investment securities

Deferred income

tax assets

Retained earnings

Capital adjustments

Ordinary income

Net incom e

Ordinary income

per share

Earnings per share

Korean won

(in millions, except per share amount) U.S. dollars (Note 2)

(in thousands, except per share amount)

2001 2002 2003 2000 2001 2002 20032000Company

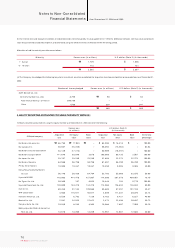

333,029

458,978

(765,977)

(329,715)

396,366

349,146

785

785

₩

499,272

641,772

(279,674)

(20,739)

462,677

579,605

986

1,495

₩

764,453

569,977

402,498

(7,357)

857,572

680,407

1,849

1,849

₩

1,291,049

554,119

990,726

72,746

944,429

769,393

2,123

2,123

₩

319,054

439,718

(733,835)

(315,879)

379,734

334,495

0.75

0.75

$

478,322

614,842

(267,938)

(19,869)

443,262

555,284

0.94

1.43

$

732,375

546,060

385,608

(7,048)

821,587

651,856

1.77

1.77

$

1,236,874

530,867

949,153

69,693

904,799

737,108

2.03

2.03

$

1,760,000

8,000

Number of shares pledged Korean won (in millions) U.S. dollars (Note 2) (in thousands)

33,307

5

33,312

₩

₩

31,909

5

31,914

$

$

EUKOR Car Carriers, Inc.

EUKOR Car Carriers Singapore, Pte.