Kia 2004 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

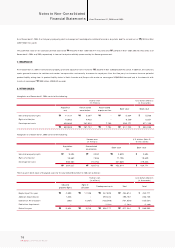

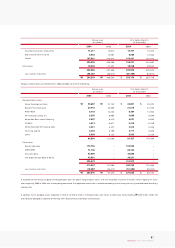

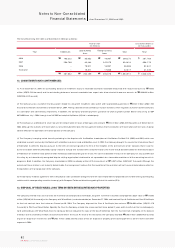

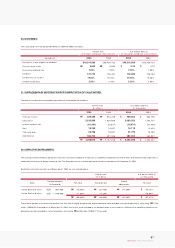

19. INCOME TAX EXPENSE AND DEFERRED INCOME TAX ASSETS:

Income tax expense in 2004 and 2003 is computed as follows:

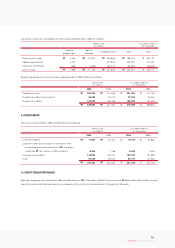

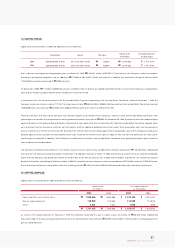

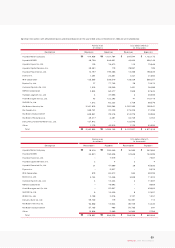

The difference between income before tax in financial accounting and taxable income pursuant to Corporate Income Tax Law of Korea is as follows:

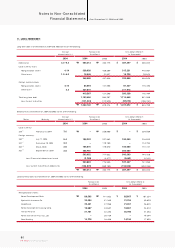

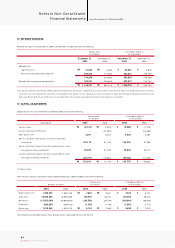

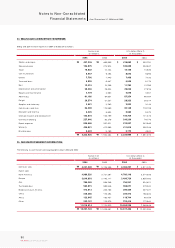

The changes in accumulated temporary difference in 2004 and 2003 and deferred incom e tax assets as of December 31, 2004 and 2003 are computed as follow s:

The accum ulated temporary differences as of December 31, 2004 and 2003 do not include the tem porary differences of ₩261,001 million (US$250,049 thousand)

and ₩272,036 million (US$260,621 thousand) for the gain on revaluation of land, which may not be disposed of in the near future.

When each tem porary difference reverses in the future, it will result in a decrease (increase) of taxable income and income tax payable. Deferred incom e tax assets

are recognized only when it is probable that the differences will be realized in the future.

Effective tax rate of 27.5% including resident tax surcharges is applied to temporary differences expected to be realized after December 31, 2004 in accordance with

the change in corporate tax rate announced on December 30, 2003.

Notes to Non-Consolidated

Financial Statements As of December 31, 2004 and 2003

86

KIA Motors_2004 Annual Report

114,226

70,456

(45,782)

138,900

₩

₩

2004Description 2003 2004 2003

159,178

28,538

(12,680)

175,036

₩

₩

109,433

67,500

(43,861)

133,072

$

$

152,499

27,340

(12,148)

167,691

$

$

Income tax currently payable

Changes in deferred incom e taxes due to:

Temporary differences

Tax credit carry forward

Income tax expense

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)

829,469

3,820

(202,579)

19,157

649,867

₩

₩

2004Description 2003 2004 2003

944,429

5,385

(44,067)

594

906,341

₩

₩

794,663

3,660

(194,078)

18,353

622,598

$

$

904,799

5,159

(42,218)

569

868,309

$

$

Income before tax

Permanent differences

Temporary differences

Other adjustm ents

Taxable income

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)

1,390,113

(202,579)

1,187,534

27.50%

326,572

202,873

529,445

₩

₩

₩

2004Description 2003 2004 2003

1,434,180

(44,067)

1,390,113

29.7/27.5

397,028

157,091

554,119

₩

₩

₩

1,331,781

(194,078)

1,137,703

27.50%

312,868

194,360

507,228

$

$

$

1,373,999

(42,218)

1,331,781

29.7/27.5

380,368

150,499

530,867

$

$

$

Accumulated temporary difference

Beginning of period, net

Changes in the current year, net

End of period, net

Statutory tax rate (%)

Tax credit carry forward

Deferred income tax assets

Korean won

(In millions) U.S. dollars (Note 2)

(In thousands)