Kia 2004 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

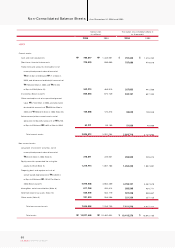

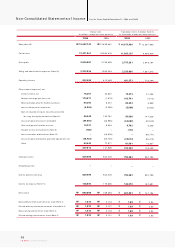

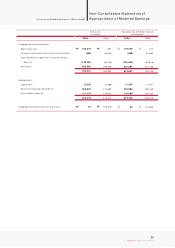

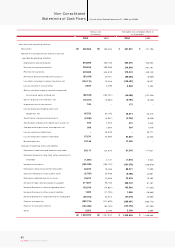

Notes to Non-Consolidated

Financial Statements As of December 31, 2004 and 2003

62

KIA Motors_2004 Annual Report

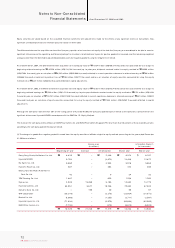

1. THE COMPANY:

Kia Motors Corporation (the Company ), incorporated in December 1944 under the laws of the Republic of Korea, is one of the leading motor vehicle manufacturers

in Korea, producing and offering for sale a range of passenger cars, recreational vehicles and commercial vehicles, both in the dom estic and export markets. The

Com pany owns and operates three principal automobile production bases: the Sohari factory, the Hwasung factory and the Kwangju factory. The shares of the

Com pany have been listed on the Korea Stock Exchange since 1973.

Overseas subsidiaries for export sales include Kia Motors America, Inc. (KMA) in America, Kia Canada, Inc. (KCI) in Canada, Kia Motors Deutschland GmbH (KMD) and

Kia Motors Europe Gm bH (KME) in Germany.

Also, the Com pany established an overseas assem bly subsidiary in Zilina, Slovak Republic on February 26, 2004, as a progressive step to secure production capacity

within Europe. The construction of the plant in Zilina is in progress and w ill roll off the line by the end of 2006.

As of December 31, 2004, the largest shareholder is Hyundai Motor Company, which holds 38.7 percent of the Company s stock.

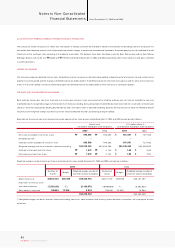

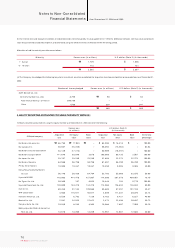

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

BASIS OF FINANCIAL STATEMENT PRESENTATION

The Company maintains its official accounting records in Korean won and prepares statutory non-consolidated financial statem ents in the Korean language

(Hangul) in conformity with the accounting principles generally accepted in the Republic of Korea. Certain accounting principles applied by the Com pany that

conform with financial accounting standards and accounting principles in the Republic of Korea may not conform with generally accepted accounting principles in

other countries. Accordingly, these financial statements are intended for use by those who are informed about Korean accounting principles and practices. The

accompanying financial statements have been condensed, restructured and translated into English (with certain expanded descriptions) from the Korean language

financial statements. Certain information included in the Korean language financial statements, but not required for a fair presentation of the Company’s financial

position, results of operations or cash flows, is not presented in the accompanying financial statem ents.

The U.S. dollar amounts presented in these financial statements were computed by translating the Korean won into U.S. dollars based on the Basic Rate announced

by Seoul Money Brokerage Services, Ltd. of ₩1043.80 to US $1.00 at December 31, 2004, solely for the convenience of the reader. This convenience translation into

U.S. dollars should not be construed as a representation that the Korean won amounts have been, could have been, or could in the future be, converted at this or

any other rate of exchange.

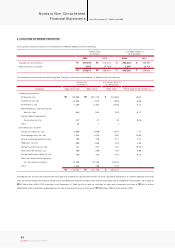

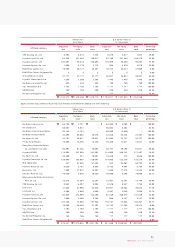

IMPLEMENTATION OF STATEMENTS OF KOREA ACCOUNTING STANDARDS

The Company prepared its non-consolidated financial statem ents as of December 31, 2004 in accordance with the existing Korea Financial Accounting Standards

and the Statements of Korea Accounting Standards (“SKAS”) No. 10 - “Inventories”, No. 12 - “Construction Contracts”, No. 13 - “Troubled Debt Restructurings and No.

15 - “Equity Method”. The Company has applied SKAS No. 2 - “Interim Financial Reporting”, No. 3 - “Intangible Assets”, No. 4 - “Revenue Recognition”, No. 5 -

“Tangible Assets”, No. 8 - “Investments in Securities” and No. 9 - “Convertible Securities” since the year ended December 31, 2003.

In conformity with SKAS No. 10 - Inventories , the Company changed the accounting method for recognition of valuation loss incurred when the market value of an

inventory falls below its carrying amount as cost of goods sold instead of other expenses. Also, the Com pany early applied the SKAS No. 15 - “Equity Method”, and

changed its accounting methods for the treatm ent of investment securities.

As a result, total assets as of December 31, 2004 and opening shareholders equity for 2004 have been reduced by ₩679,462 million (US$650,950 thousand) and

₩729,099 million (US$698,505 thousand), respectively, and net income have been increased by ₩84,072 million (US$80,544 thousand), compared with the results

based on the previous accounting methods.