Kia 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

KIA Motors_2004 Annual Report

To the Shareholders and Board of Directors of

Kia Motors Corporation:

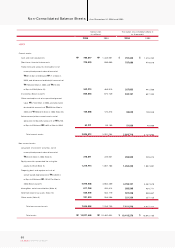

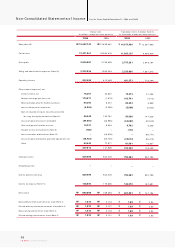

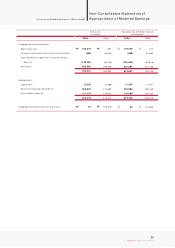

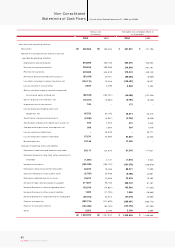

We have audited the accom panying non-consolidated balance sheets of Kia Motors Corporation as of December 31, 2004 and

2003, and the related non-consolidated statements of income, appropriations of retained earnings and cash flow s for the years

then ended, all expressed in Korean won. These financial statements are the responsibility of the Company's managem ent. Our

responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the Republic of Korea. Those standards

require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of

material misstatement. An audit includes exam ining, on a test basis, evidence supporting the am ounts and disclosures in the

financial statements. An audit also includes assessing the accounting principles used and significant estimates made by

managem ent, as well as evaluating the overall financial statem ents presentation. We believe that our audits provide a

reasonable basis for our opinion.

In our opinion, the financial statem ents referred to above present fairly, in all material respects, the financial position of Kia

Motors Corporation as of December 31, 2004 and 2003, and the results of its operations, changes in its retained earnings and its

cash flows for the years then ended in conformity with financial accounting standards in the Republic of Korea (see Note 2).

The translated amounts in the accom panying financial statements have been translated into U.S. dollars, solely for the

convenience of the reader, on the basis set forth in Note 2.

As explained in Notes 2 and 5, the Com pany early applied the Statements of Korea Accounting Standards - "SKAS” No. 15 -

"Equity Method", and changed its accounting methods for the treatment of investment securities. As a result, total assets as of

December 31, 2004 and opening shareholders" equity for 2004 have been reduced by ₩679,462 million (US$650,950 thousand)

and ₩729,099 million (US$698,505 thousand), respectively, and net income have been increased by ₩84,072 million

(US$80,544 thousand), compared with the results based on the previous accounting methods. In addition, this change in

accounting methods has been accounted for retrospectively and the com parative statements for 2003 have been restated.

As discussed in Note 14, the Com pany completed stock retirement of 12.5 million shares of treasury stock on May 28, 2004,

which were acquired for ₩136,700 million (US$130,964 thousand) for such retirem ent purposes based on the decision of the

Board of Directors on March 19, 2004. The remaining shares of comm on stock are reduced from 359,730,455 shares to

347,230,455 shares.

Independent Auditors’ Report