Kia 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The strong sales in Europe resulted from the Com pany's stronger product mix. Diesel-powered Sorento and Carnival turned out solid sales numbers, and the

Picanto entered the market with a vengeance.

Well received by British and German auto experts at its April market debut, the Kia m ini-car beat the VW Polo in comparative evaluations. The Picanto was judged to

be better than its rival from Volkswagen, which has led the mini-car segment for the past 30 years, in performance, durability, quality, price com petitiveness and

almost every other aspect. The favorable assessment led to soaring sales and helped elevate the Company's brand power.

The Cerato has also done well, with features that satisfy European needs. Moreover, the recently launched Sportage is bolstering the Company's RV sales mix and

should play a leading role in expanding market share in Europe.

To meet European custom er needs, the Company will focus on new product development with high quality, elegant design, a diverse sales line-up and

com petitive prices. These efforts are expected to further raise the Com pany's exports to Europe.

China Market

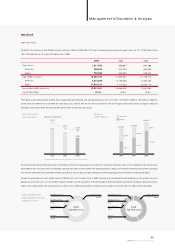

From June 2004, the Chinese governm ent imposed belt-tightening measures to cool an overheating economy. As a result, consumers had a harder time obtaining

installment financing for new car purchases, and overall consum er confidence waned somew hat. As a result, the surging sales growth at the Company's Chinese

subsidiary in 2003 slowed to 22.5% year on year in 2004, with 62,506 units sold.

The TianLiMa, launched at the end of 2002, was an excellent choice for a new car in China and elevated recognition of the Kia name. With the introduction of the

higher-priced Carnival in July and Optima in September, the Com pany hoped to make up for weakened profitability and to establish itself as a world-class player in

China. However, rivals cut their prices as the new Kia models came out and consum er confidence declined, so the sales promotion campaigns for the new models

got nowhere.

Profitability in 2004 was not as high as in 2003 because of discounts for the TianLiMa, higher marketing costs and increased overhead because of sluggish new

model sales.

Despite the government belt-tightening measures, the automobile sales volume is expanding rapidly and competition is intensifying in China. To cope with these

circumstances, the Company's Chinese subsidiary is building a second plant and will introduce additional new models.

The Company will also focus on marketing to expand market share and maximizing profitability. Marketing w ill not be limited to the TianLiMa, the No.1 small car on

the 2004 customer satisfaction survey. The positive survey results will also be used to effectively promote the more profitable Carnival and Optima. This effort is

aimed at increasing both overall sales and profits from China operations.

47

KIA Motors_2004 Annual Report

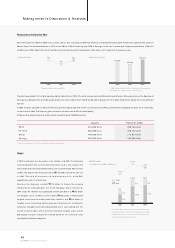

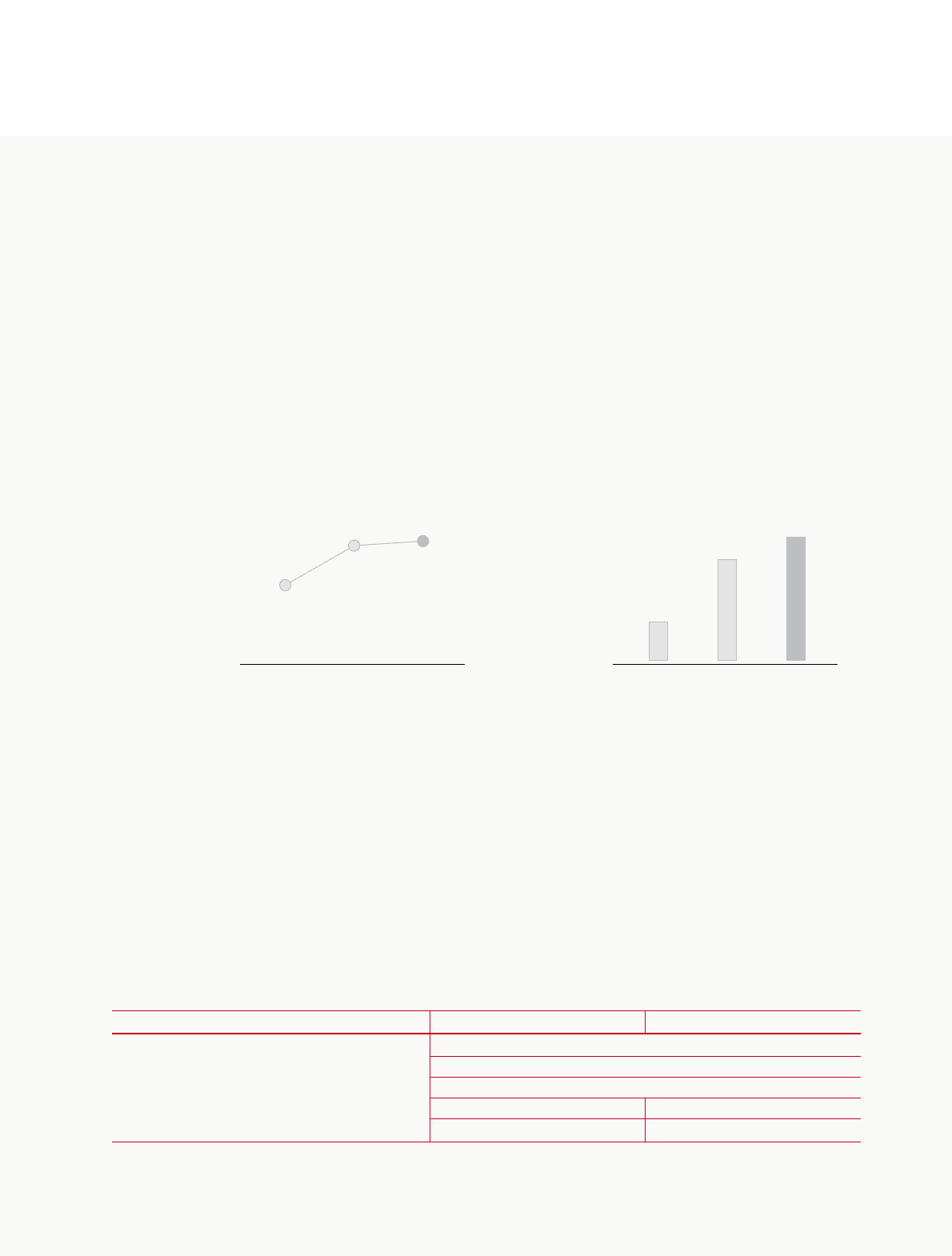

• China Market M/S • China Market Retail Sales

Volume (Units)

* Source: Company data

2002

1.6%

2003

2.4%

2004

2.5%

2002

20,370

2003

51,008

2004

62,506

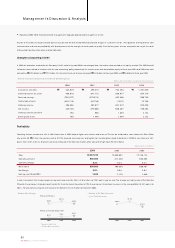

130K Units

TianLiM a, Optima, Carnival

Yancheng, Jiangsu, China

Kia (50% ), Dongfeng (25% ), Yueda Group (25% )

US$ 70 million (Additional Eqity Financing (Planned))

China Plant #1 China Plant #2

300K Units (by the end of 2006)

Full line-up

Location

Ownership

Paid-in-Capital

Capacity

Production Model

• China Plant