Hasbro 2010 Annual Report Download - page 82

Download and view the complete annual report

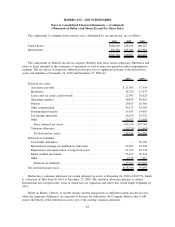

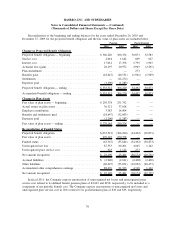

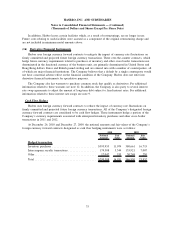

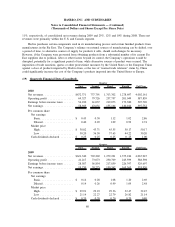

Please find page 82 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.well as other private investment funds that are valued using the net asset values provided by the trust or fund.

Although these trusts and funds are not traded in an active market with quoted prices, the investments

underlying the net asset value are based on quoted prices. The Company believes that these investments could

be sold at amounts approximating the net asset values provided by the trust or fund. The Plans’ Level 3 assets

consist of an investment in a hedge fund which is valued using the net asset value provided by the investment

manager as well as an investment in a public-private investment fund which is also valued using the net asset

value provided by the investment manager. The hedge fund contains investments in financial instruments that

are valued using certain estimates which are considered unobservable in that they reflect the investment

manager’s own assumptions about the inputs that market participants would use in pricing the asset or liability.

The public-private investment fund, which is included in fixed income investments above, invests in

commercial mortgage-backed securities and non-agency residential mortgage-backed securities. These securi-

ties are valued using certain estimates which are considered unobservable in that they reflect the investment

manager’s own assumptions about the inputs that market participants would use in pricing the asset. The

Company believes that the net asset value is the best information available for use in the fair value

measurement of this fund. Of the activity in Level 3 assets for 2010 $7,126 relates to purchases of investments,

$2,102 relates to capital distributions and $8,276 relates to the return on plan assets still held at December 26,

2010.

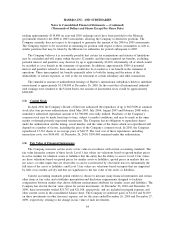

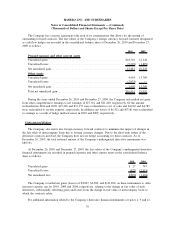

Hasbro’s two major funded plans (the “Plans”) are defined benefit pension plans intended to provide

retirement benefits to participants in accordance with the benefit structure established by Hasbro, Inc. The

Plans’ investment managers, who exercise full investment discretion within guidelines outlined in the Plans’

Investment Policy, are charged with managing the assets with the care, skill, prudence and diligence that a

prudent investment professional in similar circumstance would exercise. Investment practices, at a minimum,

must comply with the Employee Retirement Income Security Act (ERISA) and any other applicable laws and

regulations.

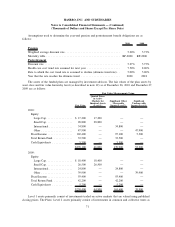

The Plans’ asset allocations are structured to meet a long-term targeted total return consistent with the

ongoing nature of the Plans’ liabilities. The shared long-term total return goal, presently 8.00%, includes

income plus realized and unrealized gains and/or losses on the Plans’ assets. Utilizing generally accepted

diversification techniques, the Plans’ assets, in aggregate and at the individual portfolio level, are invested so

that the total portfolio risk exposure and risk-adjusted returns best meet the Plans’ long-term obligations to

employees. The Company’s asset allocation includes alternative investment strategies designed to achieve a

modest absolute return in addition to the return on an underlying asset class such as bond or equity indices.

These alternative investment strategies may use derivatives to gain market returns in an efficient and timely

manner; however, derivatives are not used to leverage the portfolio beyond the market value of the underlying

assets. These alternative investment strategies are included in other equity and fixed income asset categories at

December 26, 2010 and December 27, 2009. Plan asset allocations are reviewed at least quarterly and

rebalanced to achieve target allocation among the asset categories when necessary.

The Plans’ investment managers are provided specific guidelines under which they are to invest the assets

assigned to them. In general, investment managers are expected to remain fully invested in their asset class

with further limitations of risk as related to investments in a single security, portfolio turnover and credit

quality.

With the exception of the alternative investment strategies mentioned above, the Plans’ Investment Policy

restricts the use of derivatives associated with leverage or speculation. In addition, the Investment Policy also

restricts investments in securities issued by Hasbro, Inc. except through index-related strategies (e.g. an S&P

500 Index Fund) and/or commingled funds. In addition, unless specifically approved by the Investment

Committee (which is comprised of members of management, established by the Board to manage and control

pension plan assets), certain securities, strategies, and investments are ineligible for inclusion within the Plans.

72

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)