Hasbro 2010 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

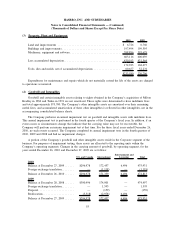

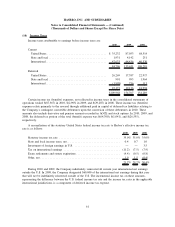

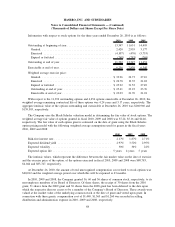

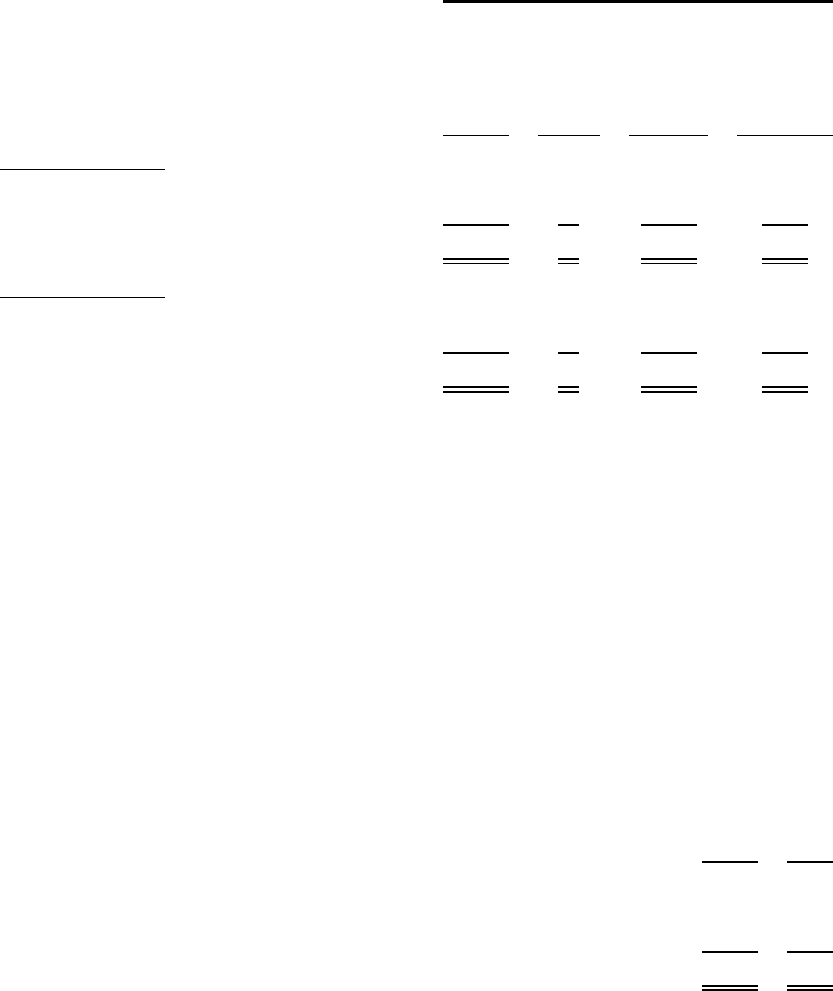

At December 26, 2010 and December 27, 2009, the Company had the following assets measured at fair

value in its consolidated balance sheets:

Fair

Value

Quoted

Prices in

Active

Markets

for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Fair Value Measurements Using

December 26, 2010

Available-for-sale securities .................. $21,791 24 21,767 —

Derivatives .............................. 38,092 — 28,937 9,155

Total ................................... $59,883 24 50,704 9,155

December 27, 2009

Available-for-sale securities .................. $21,151 43 21,108 —

Derivatives .............................. 26,631 — 19,823 6,808

Total ................................... $47,782 43 40,931 6,808

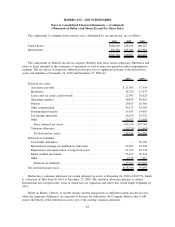

For a portion of the Company’s available-for-sale securities, the Company is able to obtain quoted prices

from stock exchanges to measure the fair value of these securities. Certain other available-for-sale securities

held by the Company are valued at the net asset value which is quoted on a private market that is not active;

however, the unit price is predominantly based on underlying investments which are traded on an active

market. The Company’s derivatives consist primarily of foreign currency forward contracts. The Company uses

current forward rates of the respective foreign currencies to measure the fair value of these contracts. The

Company’s derivatives also include interest rate swaps used to adjust the amount of long-term debt subject to

fixed interest rates. The fair values of the interest rate swaps are measured based on the present value of future

cash flows using the swap curve as of the valuation date. The remaining derivative securities consist of

warrants to purchase common stock. The Company uses the Black-Scholes model to value these warrants. One

of the inputs used in the Black-Scholes model, historical volatility, is considered an unobservable input in that

it reflects the Company’s own assumptions about the inputs that market participants would use in pricing the

asset or liability. The Company believes that this is the best information available for use in the fair value

measurement. There were no changes in these valuation techniques during 2010.

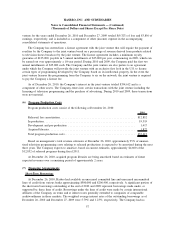

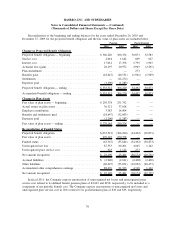

The following is a reconciliation of the beginning and ending balances of the fair value measurements of

the Company’s warrants to purchase common stock that use significant unobservable inputs (Level 3):

2010 2009

Balance at beginning of year ........................................ $6,808 4,591

Gain (loss) from change in fair value .................................. 2,347 (776)

Warrant modification .............................................. — 2,993

Balance at end of year ............................................. $9,155 6,808

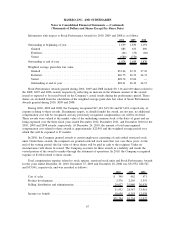

In the second quarter of 2009, certain warrants held by the Company were modified in connection with

the amendment of an existing license agreement. The fair value of the modification was recorded as deferred

revenue and is being amortized to revenue over the term of the amended license agreement.

65

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)