Hasbro 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

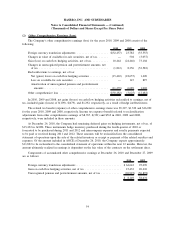

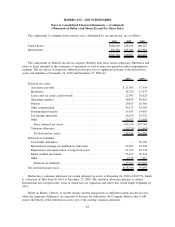

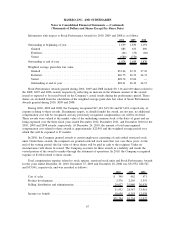

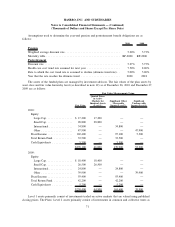

The components of earnings before income taxes, determined by tax jurisdiction, are as follows:

2010 2009 2008

United States ........................................ $168,436 248,654 208,125

International ........................................ 339,284 281,043 232,930

$507,720 529,697 441,055

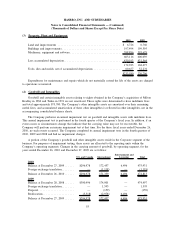

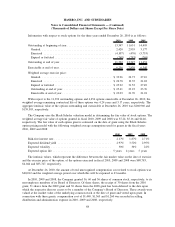

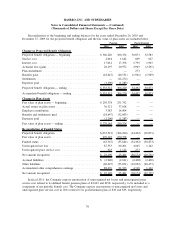

The components of deferred income tax expense (benefit) arise from various temporary differences and

relate to items included in the statements of operations as well as items recognized in other comprehensive

earnings. The tax effects of temporary differences that give rise to significant portions of the deferred tax

assets and liabilities at December 26, 2010 and December 27, 2009 are:

2010 2009

Deferred tax assets:

Accounts receivable.......................................... $ 21,095 17,314

Inventories ................................................ 18,723 15,937

Losses and tax credit carryforwards .............................. 22,395 29,623

Operating expenses .......................................... 40,835 40,419

Pension ................................................... 29,823 26,566

Other compensation .......................................... 45,175 45,383

Postretirement benefits........................................ 15,435 14,463

Tax sharing agreement ........................................ 26,276 26,352

Other .................................................... 25,477 31,683

Gross deferred tax assets .................................... 245,234 247,740

Valuation allowance.......................................... (10,776) (11,641)

Net deferred tax assets ...................................... 234,458 236,099

Deferred tax liabilities:

Convertible debentures ....................................... — 56,787

International earnings not indefinitely reinvested .................... 25,903 25,903

Depreciation and amortization of long-lived assets ................... 61,274 40,144

Equity method investment ..................................... 23,617 26,941

Other .................................................... 4,715 7,227

Deferred tax liabilities ...................................... 115,509 157,002

Net deferred income taxes ....................................... $118,949 79,097

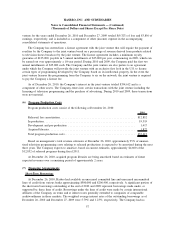

Hasbro has a valuation allowance for certain deferred tax assets at December 26, 2010 of $10,776, which

is a decrease of $865 from $11,641 at December 27, 2009. The valuation allowance pertains to certain

International loss carryforwards, some of which have no expiration and others that would expire beginning in

2013.

Based on Hasbro’s history of taxable income and the anticipation of sufficient taxable income in years

when the temporary differences are expected to become tax deductions, the Company believes that it will

realize the benefit of the deferred tax assets, net of the existing valuation allowance.

62

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)