Hasbro 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

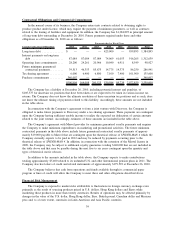

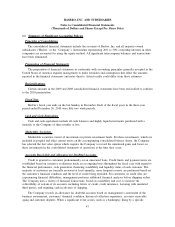

comprehensive earnings related to its defined benefit pension plans compared to $80,201 at December 27,

2009. The increase primarily reflects additional unrecognized actuarial losses in 2010, primarily due to the

reduction of the discount rate used to value the liability at December 26, 2010. The discount rate decreased to

5.20% at December 26, 2010 from 5.73% used at December 27, 2009. Pension plan assets are valued on the

basis of their fair market value on the measurement date. These changes in the fair market value of plan assets

impact the amount of future pension expense due to amortization of the unrecognized actuarial losses or gains.

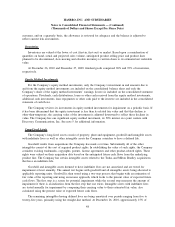

Income Taxes

The Company’s annual income tax rate is based on its income, statutory tax rates, changes in prior tax

positions and tax planning opportunities available in the various jurisdictions in which it operates. Significant

judgment and estimates are required to determine the Company’s annual tax rate and in evaluating its tax

positions. Despite the Company’s belief that its tax return positions are fully supportable, these positions are

subject to challenge and estimated liabilities are established in the event that these positions are challenged

and the Company is not successful in defending these challenges. These estimated liabilities are adjusted, as

well as the related interest, in light of changing facts and circumstances, such as the progress of a tax audit.

An estimated effective income tax rate is applied to the Company’s quarterly operating results. In the

event there is a significant unusual or extraordinary item recognized in the Company’s quarterly operating

results, the tax attributable to that item is separately calculated and recorded at the time. Changes in the

Company’s estimated effective income tax rate during 2010 were primarily due to changes in its estimate of

earnings by tax jurisdiction. In addition, changes in judgment regarding likely outcomes related to tax

positions taken in a prior fiscal year, or tax costs or benefits from a resolution of such positions would be

recorded entirely in the interim period the judgment changes or resolution occurs. During 2010, the Company

recorded a total benefit of approximately $22,300 related to discrete tax events primarily related to the

completion of a U.S. tax examination.

In certain cases, tax law requires items to be included in the Company’s income tax returns at a different

time than when these items are recognized on the financial statements or at a different amount than that which

is recognized on the financial statements. Some of these differences are permanent, such as expenses that are

not deductible on the Company’s tax returns, while other differences are temporary and will reverse over time,

such as depreciation expense. These differences that will reverse over time are recorded as deferred tax assets

and liabilities on the consolidated balance sheet. Deferred tax assets represent credits or deductions that have

been reflected in the financial statements but have not yet been reflected in the Company’s income tax returns.

Valuation allowances are established against deferred tax assets to the extent that it is determined that the

Company will have insufficient future taxable income, including capital gains, to fully realize the future

credits, deductions or capital losses. Deferred tax liabilities represent expenses recognized on the Company’s

income tax return that have not yet been recognized in the Company’s financial statements or income

recognized in the financial statements that has not yet been recognized in the Company’s income tax return. In

2007, the Mexican government instituted a tax structure which results in companies paying the higher of an

income-based tax or an alternative flat tax commencing in 2008. Should the Company be subject to the

alternative flat tax, it would be required to review whether its net deferred tax assets would be realized. As the

Company believes that it will continue to be subject to the income-based tax in 2011, it believes that the net

deferred tax assets related to the Mexican tax jurisdiction will be realizable. Should the facts and

circumstances change, the Company may be required to reevaluate deferred tax assets related to its Mexican

operations, which may result in additional tax expense.

38