Hasbro 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

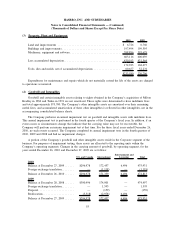

venture for the years ended December 26, 2010 and December 27, 2009 totaled $(9,323) of loss and $3,856 of

earnings, respectively, and is included as a component of other (income) expense in the accompanying

consolidated statements of operations.

The Company has entered into a license agreement with the joint venture that will require the payment of

royalties by the Company to the joint venture based on a percentage of revenue derived from products related

to television shows broadcast by the joint venture. The license agreement includes a minimum royalty

guarantee of $125,000, payable in 5 annual installments of $25,000 per year, commencing in 2009, which can

be earned out over approximately a 10-year period. During 2010 and 2009, the Company paid the first two

annual installments of $25,000 each. The Company and the joint venture are also parties to an agreement

under which the Company will provide the joint venture with an exclusive first look in the U.S. to license

certain types of programming developed by the Company based on its intellectual property. In the event the

joint venture licenses the programming from the Company to air on the network, the joint venture is required

to pay the Company a license fee.

As of December 26, 2010, the Company’s interest in the joint venture totaled $354,612 and is a

component of other assets. The Company enters into certain transactions with the joint venture including the

licensing of television programming and the purchase of advertising. During 2010 and 2009, these transactions

were not material.

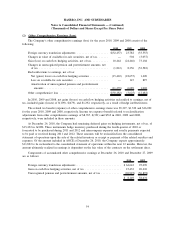

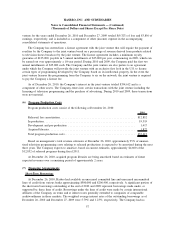

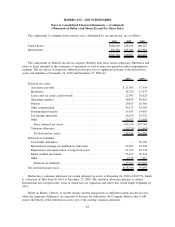

(6) Program Production Costs

Program production costs consist of the following at December 26, 2010:

2010

Released, less amortization ................................................ $12,852

In production .......................................................... 19,319

Development and pre-production ........................................... 1,417

Acquired libraries....................................................... 1,827

Total program production costs ............................................. $35,415

Based on management’s total revenue estimates at December 26, 2010, approximately 95% of unamor-

tized television programming costs relating to released productions is expected to be amortized during the next

three years. The Company expects to amortize, based on current estimates, approximately $4,600 of the

$12,852 of released programs during fiscal 2011.

At December 26, 2010, acquired program libraries are being amortized based on estimates of future

expected revenues over a remaining period of approximately 2 years.

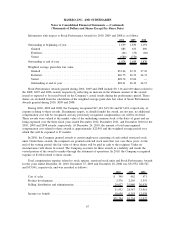

(7) Financing Arrangements

Short-Term Borrowings

At December 26, 2010, Hasbro had available an unsecured committed line and unsecured uncommitted

lines of credit from various banks approximating $500,000 and $206,400, respectively. A significant portion of

the short-term borrowings outstanding at the end of 2010 and 2009 represent borrowings made under, or

supported by, these lines of credit. Borrowings under the lines of credit were made by certain international

affiliates of the Company on terms and at interest rates generally extended to companies of comparable

creditworthiness in those markets. The weighted average interest rates of the outstanding borrowings as of

December 26, 2010 and December 27, 2009 were 5.79% and 1.23%, respectively. The Company had no

57

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)