Hasbro 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

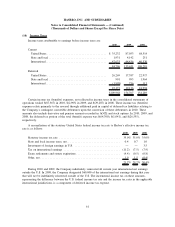

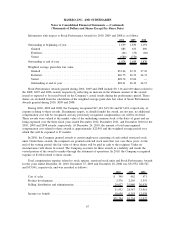

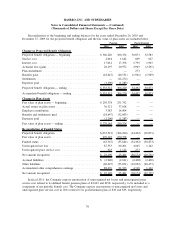

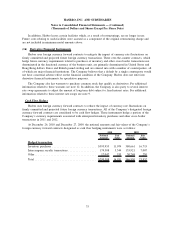

Information with respect to Stock Performance Awards for 2010, 2009 and 2008 is as follows:

2010 2009 2008

Outstanding at beginning of year . . . ............................ 1,639 1,830 1,194

Granted ............................................... 883 631 696

Forfeited ............................................... (64) (52) (60)

Vested ................................................ (580) (770) —

Outstanding at end of year ................................... 1,878 1,639 1,830

Weighted average grant-date fair value:

Granted ............................................... $33.44 22.31 27.10

Forfeited ............................................... $26.75 26.53 24.31

Vested ................................................ $28.74 19.06 —

Outstanding at end of year ................................. $28.61 26.22 24.15

Stock Performance Awards granted during 2010, 2009 and 2008 include 80, 116 and 100 shares related to

the 2008, 2007 and 2006 awards, respectively, reflecting an increase in the ultimate amount of the awards

issued or expected to be issued based on the Company’s actual results during the performance period. These

shares are excluded from the calculation of the weighted average grant-date fair value of Stock Performance

Awards granted during 2010, 2009 and 2008.

During 2010, 2009 and 2008, the Company recognized $17,144, $15,361 and $17,422, respectively, of

expense relating to these awards. If minimum targets, as detailed under the award, are not met, no additional

compensation cost will be recognized and any previously recognized compensation cost will be reversed.

These awards were valued at the market value of the underlying common stock at the dates of grant and are

being expensed over the three fiscal years ended December 2012, December 2011, and December 2010 for the

2010, 2009 and 2008 awards, respectively. At December 26, 2010, the amount of total unrecognized

compensation cost related to these awards is approximately $22,901 and the weighted average period over

which this will be expensed is 27 months.

In 2010, the Company granted awards to certain employees consisting of cash settled restricted stock

units. Under these awards, the recipients are granted restricted stock units that vest over three years. At the

end of the vesting period, the fair value of those shares will be paid in cash to the recipient. Under no

circumstances will shares be issued. The Company accounts for these awards as a liability and marks the

vested portion of the award to market through the statement of operations. In 2010, the Company recognized

expense of $1,004 related to these awards.

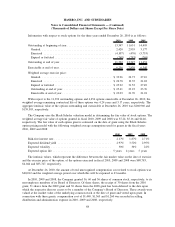

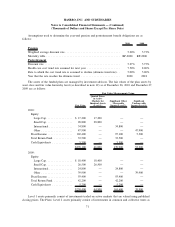

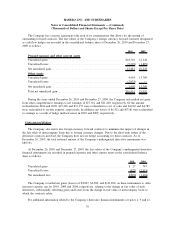

Total compensation expense related to stock options, restricted stock units and Stock Performance Awards

for the years ended December 26, 2010, December 27, 2009 and December 28, 2008 was $31,952, $28,547,

and $33,961, respectively, and was recorded as follows:

2010 2009 2008

Cost of sales ........................................... $ 349 462 471

Product development ..................................... 2,576 2,205 2,551

Selling, distribution and administration ....................... 29,027 25,880 30,939

31,952 28,547 33,961

Income tax benefit ...................................... 10,658 9,293 12,039

$21,294 19,254 21,922

67

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)