Hasbro 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

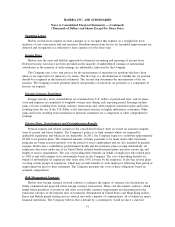

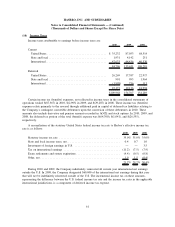

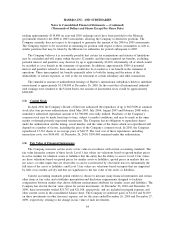

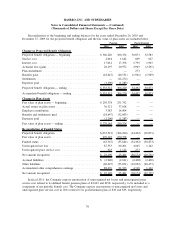

(10) Income Taxes

Income taxes attributable to earnings before income taxes are:

2010 2009 2008

Current

United States ...................................... $ 35,232 87,053 68,514

State and local ..................................... 1,931 4,142 251

International....................................... 47,633 44,436 40,530

84,796 135,631 109,295

Deferred

United States ...................................... 26,269 17,387 22,917

State and local ..................................... 901 993 1,964

International....................................... (1,998) 756 113

25,172 19,136 24,994

$109,968 154,767 134,289

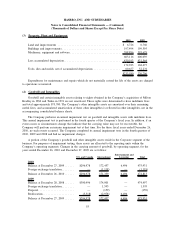

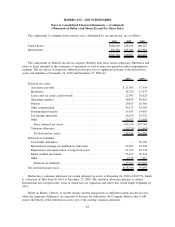

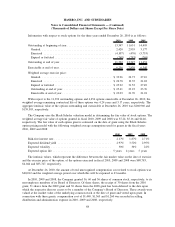

Certain income tax (benefits) expenses, not reflected in income taxes in the consolidated statements of

operations totaled $(87,367) in 2010, $(2,905) in 2009, and $(29,287) in 2008. These income tax (benefits)

expenses relate primarily to the reversal through additional paid in capital of deferred tax liabilities relating to

the Company’s contingent convertible debentures upon the conversion of these debentures in 2010. These

amounts also include derivative and pension amounts recorded in AOCE and stock options. In 2010, 2009, and

2008, the deferred tax portion of the total (benefit) expense was $(64,700), $(1,041), and $(26,555),

respectively.

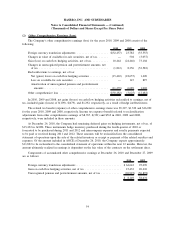

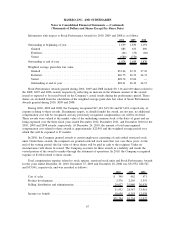

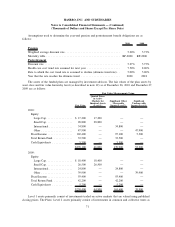

A reconciliation of the statutory United States federal income tax rate to Hasbro’s effective income tax

rate is as follows:

2010 2009 2008

Statutory income tax rate ....................................... 35.0% 35.0% 35.0%

State and local income taxes, net .................................. 0.4 0.7 1.0

Investment of foreign earnings in U.S. . ............................ — — 3.5

Tax on international earnings .................................... (11.2) (7.5) (7.9)

Exam settlements and statute expirations ............................ (4.4) (0.5) (0.8)

Other, net ................................................... 1.9 1.5 (0.4)

21.7% 29.2% 30.4%

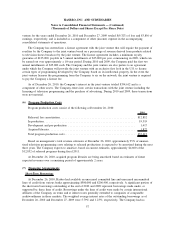

During 2010 and 2009, the Company indefinitely reinvested all current year international net earnings

outside the U.S. In 2008, the Company designated $60,000 of the international net earnings during that year

that will not be indefinitely reinvested outside of the U.S. The incremental income tax on these amounts,

representing the difference between the U.S. federal income tax rate and the income tax rates in the applicable

international jurisdictions, is a component of deferred income tax expense.

61

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)