Hasbro 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

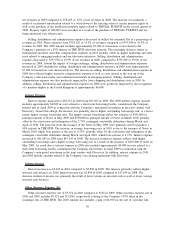

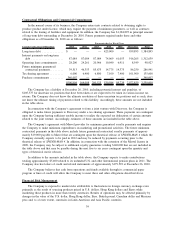

Contractual Obligations and Commercial Commitments

In the normal course of its business, the Company enters into contracts related to obtaining rights to

produce product under license, which may require the payment of minimum guarantees, as well as contracts

related to the leasing of facilities and equipment. In addition, the Company has $1,384,895 in principal amount

of long-term debt outstanding at December 26, 2010. Future payments required under these and other

obligations as of December 26, 2010 are as follows:

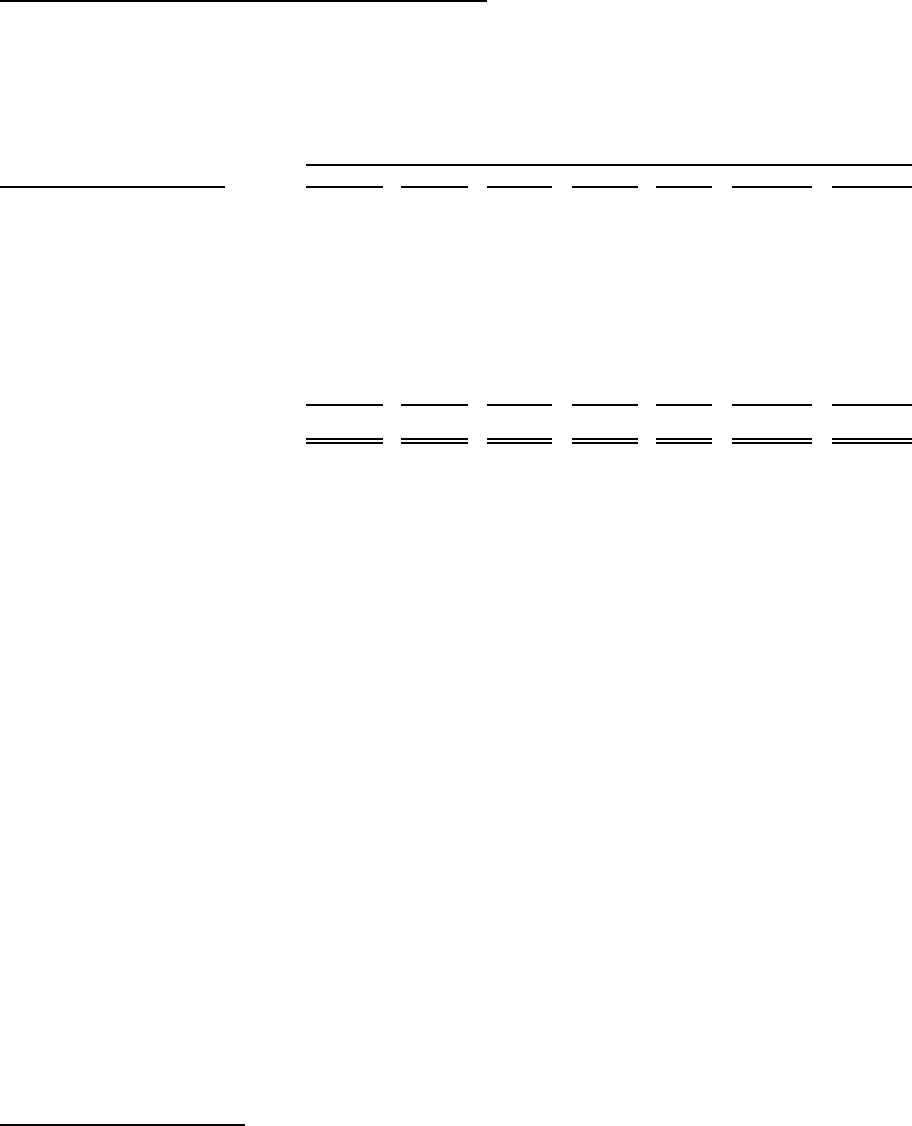

Certain Contractual Obligations 2011 2012 2013 2014 2015 Thereafter Total

Payments due by Fiscal Year

Long-term debt............... $ — — — 425,000 — 959,895 1,384,895

Interest payments on long-term

debt ..................... 87,084 87,084 87,084 74,069 61,053 916,265 1,312,639

Operating lease commitments .... 28,200 24,261 20,966 10,040 6,911 8,549 98,927

Future minimum guaranteed

contractual payments......... 39,513 46,353 85,675 14,775 14,375 86,250 286,941

Tax sharing agreement ......... 6,000 6,400 6,800 7,100 7,400 101,900 135,600

Purchase commitments ......... 340,007 — — — — — 340,007

$500,804 164,098 200,525 530,984 89,739 2,072,859 3,559,009

The Company has a liability at December 26, 2010, including potential interest and penalties, of

$105,575 for uncertain tax positions that have been taken or are expected to be taken in various income tax

returns. The Company does not know the ultimate resolution of these uncertain tax positions and as such, does

not know the ultimate timing of payments related to this liability. Accordingly, these amounts are not included

in the table above.

In connection with the Company’s agreement to form a joint venture with Discovery, the Company is

obligated to make future payments to Discovery under a tax sharing agreement. These payments are contingent

upon the Company having sufficient taxable income to realize the expected tax deductions of certain amounts

related to the joint venture. Accordingly, estimates of these amounts are included in the table above.

The Company’s agreement with Marvel provides for minimum guaranteed royalty payments and requires

the Company to make minimum expenditures on marketing and promotional activities. The future minimum

contractual payments in the table above include future guaranteed contractual royalty payments of approxi-

mately $19,000 payable to Marvel that are contingent upon the theatrical release of SPIDER-MAN 4 which the

Company currently expects to be paid in 2012 and may be reduced by payments occurring prior to the

theatrical release of SPIDER-MAN 4. In addition, in connection with the extension of the Marvel license in

2009, the Company may be subject to additional royalty guarantees totaling $140,000 that are not included in

the table above and that may be payable during the next five to six years contingent upon the quantity and

types of theatrical movie releases.

In addition to the amounts included in the table above, the Company expects to make contributions

totaling approximately $5,400 related to its unfunded U.S. and other International pension plans in 2011. The

Company also has letters of credit and related instruments of approximately $179,592 at December 26, 2010.

The Company believes that cash from operations and funds available through its commercial paper

program or lines of credit will allow the Company to meet these and other obligations described above.

Financial Risk Management

The Company is exposed to market risks attributable to fluctuations in foreign currency exchange rates

primarily as the result of sourcing products priced in U.S. dollars, Hong Kong dollars and Euros while

marketing those products in more than twenty currencies. Results of operations may be affected primarily by

changes in the value of the U.S. dollar, Hong Kong dollar, Euro, British pound, Canadian dollar and Mexican

peso and, to a lesser extent, currencies in Latin American and Asia Pacific countries.

39