Hasbro 2010 Annual Report Download - page 44

Download and view the complete annual report

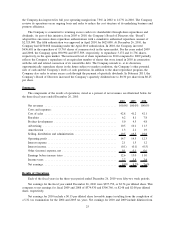

Please find page 44 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.were partially offset by proceeds of $492,528 from the issuance of long-term notes in March 2010. In addition,

cash received from the exercise of employee stock options in 2010 was $93,522.

Net cash provided by financing activities was $236,779 in 2009. Of this amount, $421,309 reflected net

proceeds from the issuance of long-term notes in May 2009. In addition, cash received from the exercise of

employee stock options in 2009 was $9,193. These sources of cash were partially offset by $88,112, which

included transaction costs, used to repurchase shares of the Company’s common stock. During 2009, the

Company repurchased 3,172 shares at an average price per share of $28.67. Dividends paid were $111,458 in

2009 compared to $107,065 in 2008.

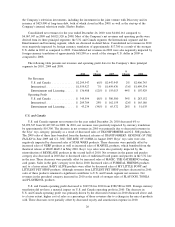

Net cash utilized by financing activities was $457,391 in 2008. Of this amount, $360,244, which includes

transaction costs, was used to repurchase shares of the Company’s common stock. During 2008, the Company

repurchased 11,736 shares at an average price per share of $30.44. Dividends paid were $107,065 in 2008. In

addition, $135,092 was used to repay long-term debt. These uses of cash were partially offset by cash receipts

of $120,895 from the exercise of employee stock options.

At December 27, 2009, the Company had outstanding $249,828 in principal amount of senior convertible

debentures due 2021. If the closing price of the Company’s common stock exceeded $23.76 for at least 20

trading days, within the 30 consecutive trading day period ending on the last trading day of the calendar

quarter, or upon other specified events, the debentures were convertible at an initial conversion price of $21.60

in the next calendar quarter. At December 31, 2009, this conversion feature was met and the debentures were

convertible during the first quarter of 2010. During the first quarter of 2010, holders of these debentures

converted $111,177, in principal amount, of these debentures which resulted in the issuance of 5,147 shares. In

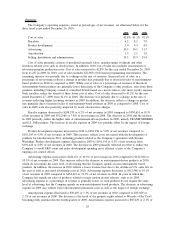

addition, if the closing price of the Company’s common stock exceeded $27.00 for at least 20 trading days in

any 30 day period, the Company had the right to call the debentures by giving notice to the holders of the

debentures. During a prescribed notice period following such a call by the Company, the holders of the

debentures had the right to convert their debentures in accordance with the conversion terms described above.

As of March 28, 2010, the Company had the right to call the debentures. On March 29, 2010, as part of the

Company’s overall debt management strategy and in furtherance of its capital structure goals, the Company

gave notice of its election to redeem in cash all of the outstanding debentures on April 29, 2010 at a

redemption price of $1,011.31 per $1,000 principal amount, which was equal to the par value thereof plus

accrued and unpaid cash interest through April 29, 2010. During the notice period, $138,467, in principal

amount, of the debentures were converted by the holders, resulting in the issuance of 6,410 shares of common

stock. The remaining debentures were redeemed at a total cost of $186, which included accrued interest

through the redemption date.

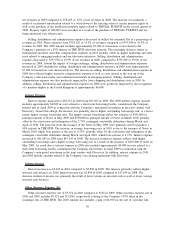

The $350,000 notes due in 2017 bear interest at a rate of 6.30%, which may be adjusted upward in the

event that the Company’s credit rating from Moody’s Investor Services, Inc., Standard & Poor’s Ratings

Services or Fitch Ratings is reduced to Ba1, BB+, or BB+, respectively, or below. At December 26, 2010, the

Company’s ratings from Moody’s Investor Services, Inc., Standard & Poor’s Ratings Services and Fitch

Ratings were Baa2, BBB and BBB+, respectively. The interest rate adjustment is dependent on the degree of

decrease of the Company’s ratings and could range from 0.25% to a maximum of 2.00%. The Company may

redeem the notes at its option at the greater of the principal amount of the notes or the present value of the

remaining scheduled payments discounted using the effective interest rate on applicable U.S. Treasury bills at

the time of repurchase.

The $425,000 notes due in 2014 bear interest at a rate of 6.125%, which may be adjusted upward in the

event that the Company’s credit rating from Moody’s Investor Services, Inc., Standard & Poor’s Ratings

Services or Fitch Ratings is reduced to Ba1, BB+, or BB+, respectively, or below. At December 26, 2010, the

Company’s ratings from Moody’s Investor Services, Inc., Standard & Poor’s Ratings Services and Fitch

Ratings were Baa2, BBB, and BBB+, respectively. The interest rate adjustment is dependent on the degree of

decrease of the Company’s ratings and could range from 0.25% to a maximum of 2.00%. The Company may

redeem the notes at its option at the greater of the principal amount of the notes or the present value of the

remaining scheduled payments discounted using the effective interest rate on applicable U.S. Treasury bills at

the time of repurchase.

34