Hasbro 2010 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

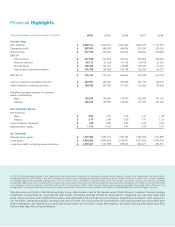

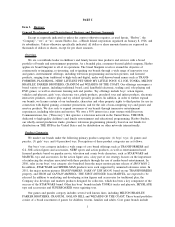

Financial Highlights

(Thousands of Dollars and Shares Except Per Share Data) 2010 2009 2008 2007 2006

For the Year

Net revenues $4,002,161 4,067,947 4,021,520 3,837,557 3,151,481

Operating profi t $587,859 588,598 494,296 519,350 376,363

Net earnings $397,752 374,930 306,766 333,003 230,055

EBITDA

Net earnings $397,752 374,930 306,766 333,003 230,055

Interest expense $82,112 61,603 47,143 34,618 27,521

Income taxes $109,968 154,767 134,289 129,379 111,419

Depreciation and amortization $146,330 180,963 166,138 156,520 146,707

EBITDA (1) $736,162 772,263 654,336 653,520 515,702

Cash provided by operating activites $367,981 265,623 593,185 601,794 320,647

Cash utilized by investing activities $104,188 497,509 271,920 112,465 83,604

Weighted average number of common

shares outstanding

Basic 139,079 139,487 140,877 156,054 167,100

Diluted 145,670 152,780 155,230 171,205 181,043

Per Common Share

Net Earnings

Basic $2.86 2.69 2.18 2.13 1.38

Diluted $2.74 2.48 2.00 1.97 1.29

Cash dividends declared $1.00 0.80 0.80 0.64 0.48

Shareholders’ equity $11.76 11.63 9.99 9.54 9.57

At Year-End

Shareholders’ equity $1,615,420 1,594,772 1,390,786 1,385,092 1,537,890

Total assets $4,093,226 3,896,892 3,168,797 3,237,063 3,096,905

Long-term debt, including current portions $1,397,681 1,131,998 709,723 845,071 494,917

(1) EBITDA (earnings before interest, taxes, depreciation and amortization) represents net earnings, excluding interest expense, income taxes, depreciation and amortization.

Management believes that EBITDA is one of the appropriate measures for evaluating the operating performance of the Company because it refl ects the resources available

for strategic opportunities including, among others, to invest in the business, strengthen the balance sheet, and make strategic acquisitions. However, this measure should be

considered in addition to, not as a substitute for, or superior to, net earnings or other measures of fi nancial performance prepared in accordance with GAAP as more fully discussed

in the Company’s fi nancial statements and fi lings with the SEC. As used herein, “GAAP” refers to accounting principles generally accepted in the United States of America. See

Management’s Discussion and Analysis of Financial Condition and Results of Operations in the enclosed annual report for a detailed discussion of the Company’s business.

The discussion set forth in the following letter to our shareholders, and in the annual report that follows it, contains forward-looking

statements concerning our expectations and beliefs, including, without limitation, expectations regarding our business plans and

goals, future product and entertainment plans, and anticipated future fi nancial performance, including expectations with respect to

our revenues, operating margins, earnings and uses of funds. For a discussion of uncertainties, risks and assumptions associated with

these statements, see Item 1A of our enclosed annual report on Form 10-K, under the heading, “Forward-Looking Information and Risk

Factors that May A ect Future Results.”