Hasbro 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Hasbro annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

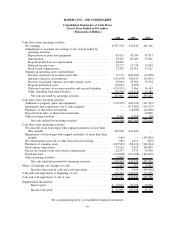

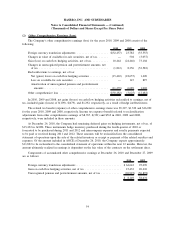

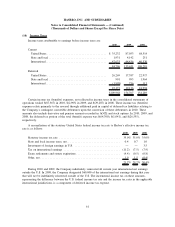

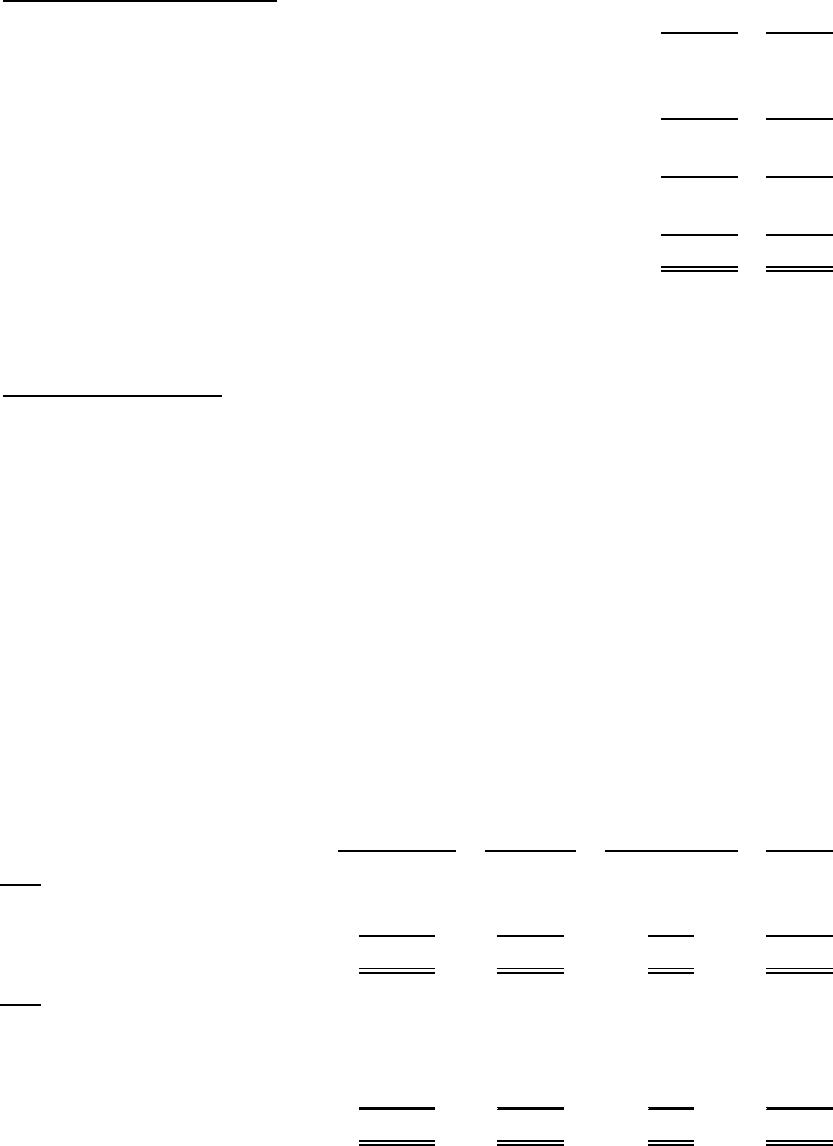

(3) Property, Plant and Equipment

2010 2009

Land and improvements ........................................ $ 6,726 6,766

Buildings and improvements ..................................... 197,494 199,595

Machinery, equipment and software ................................ 398,896 393,678

603,116 600,039

Less accumulated depreciation.................................... 430,193 431,564

172,923 168,475

Tools, dies and molds, net of accumulated depreciation ................. 60,657 52,231

$233,580 220,706

Expenditures for maintenance and repairs which do not materially extend the life of the assets are charged

to operations as incurred.

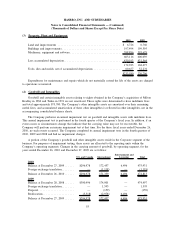

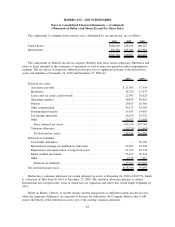

(4) Goodwill and Intangibles

Goodwill and certain intangible assets relating to rights obtained in the Company’s acquisition of Milton

Bradley in 1984 and Tonka in 1991 are not amortized. These rights were determined to have indefinite lives

and total approximately $75,700. The Company’s other intangible assets are amortized over their remaining

useful lives, and accumulated amortization of these other intangibles is reflected in other intangibles, net in the

accompanying consolidated balance sheets.

The Company performs an annual impairment test on goodwill and intangible assets with indefinite lives.

This annual impairment test is performed in the fourth quarter of the Company’s fiscal year. In addition, if an

event occurs or circumstances change that indicate that the carrying value may not be recoverable, the

Company will perform an interim impairment test at that time. For the three fiscal years ended December 26,

2010, no such events occurred. The Company completed its annual impairment tests in the fourth quarters of

2010, 2009 and 2008 and had no impairment charges.

A portion of the Company’s goodwill and other intangible assets reside in the Corporate segment of the

business. For purposes of impairment testing, these assets are allocated to the reporting units within the

Company’s operating segments. Changes in the carrying amount of goodwill, by operating segment, for the

years ended December 26, 2010 and December 27, 2009 are as follows:

U.S. and Canada International

Entertainment and

Licensing Total

2010

Balance at December 27, 2009 ...... $296,978 172,457 6,496 475,931

Foreign exchange translation........ — (1,118) — (1,118)

Balance at December 26, 2010 ...... $296,978 171,339 6,496 474,813

2009

Balance at December 28, 2008 ...... $300,496 174,001 — 474,497

Foreign exchange translation........ — 1,593 — 1,593

Disposal....................... — (159) — (159)

Reallocation .................... (3,518) (2,978) 6,496 —

Balance at December 27, 2009 ...... $296,978 172,457 6,496 475,931

55

HASBRO, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements — (Continued)

(Thousands of Dollars and Shares Except Per Share Data)