GameStop 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

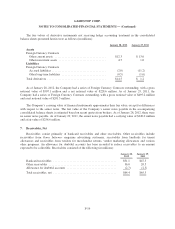

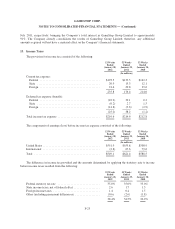

July 2011, respectively, bringing the Company’s total interest in GameStop Group Limited to approximately

91%. The Company already consolidates the results of GameStop Group Limited; therefore, any additional

amounts acquired will not have a material effect on the Company’s financial statements.

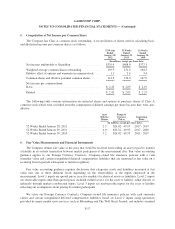

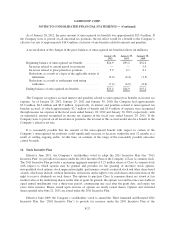

13. Income Taxes

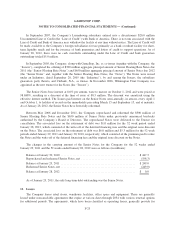

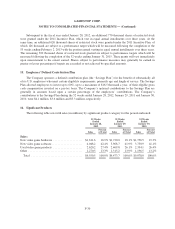

The provision for income tax consisted of the following:

52 Weeks

Ended

January 28,

2012

52 Weeks

Ended

January 29,

2011

52 Weeks

Ended

January 30,

2010

(In millions)

Current tax expense:

Federal ......................................... $193.5 $133.3 $162.3

State ........................................... 20.9 13.3 12.1

Foreign ......................................... 21.4 29.8 39.6

235.8 176.4 214.0

Deferred tax expense (benefit):

Federal ......................................... (10.2) 39.1 0.2

State ........................................... (0.2) 2.7 1.5

Foreign ......................................... (14.8) (3.6) (2.9)

(25.2) 38.2 (1.2)

Total income tax expense ............................. $210.6 $214.6 $212.8

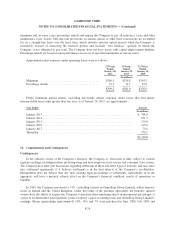

The components of earnings (loss) before income tax expense consisted of the following:

52 Weeks

Ended

January 28,

2012

52 Weeks

Ended

January 29,

2011

52 Weeks

Ended

January 30,

2010

(In millions)

United States ....................................... $551.9 $553.8 $508.9

International ....................................... (2.8) 67.6 79.6

Total ............................................. $549.1 $621.4 $588.5

The difference in income tax provided and the amounts determined by applying the statutory rate to income

before income taxes resulted from the following:

52 Weeks

Ended

January 28,

2012

52 Weeks

Ended

January 29,

2011

52 Weeks

Ended

January 30,

2010

Federal statutory tax rate ............................. 35.0% 35.0% 35.0%

State income taxes, net of federal effect .................. 2.6 1.7 1.5

Foreign income taxes ................................ 1.4 0.4 1.5

Other (including permanent differences) ................. (0.6) (2.6) (1.8)

38.4% 34.5% 36.2%

F-25