GameStop 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

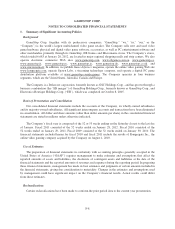

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Measurement and Disclosure Requirements in U.S. GAAP and IFRSs, which amends the current fair value

measurement and disclosure guidance to include increased transparency around valuation inputs and investment

categorization. This guidance will be effective beginning in fiscal 2012. The adoption of ASU 2011-04 is not

expected to have a material impact on the Company’s consolidated net earnings, cash flows or financial position.

In June 2011, the FASB issued ASU 2011-05, Comprehensive Income (Topic 220): Presentation of

Comprehensive Income, which revises the current practice of including other comprehensive income within the

equity section of the statement of financial position and requires disclosure of other comprehensive income either

in a single continuous statement of comprehensive income or in a separate statement. This guidance will be

effective beginning in fiscal 2012. The adoption of ASU 2011-05 is not expected to have an impact on the

Company’s consolidated net earnings, cash flows or financial position, but the adoption will change the current

presentation of other comprehensive income in the Company’s consolidated financial statements.

In September 2011, the FASB issued ASU 2011-08, Intangibles — Goodwill and Other (Topic 350):

Testing Goodwill for Impairment. ASU 2011-08 modifies step one of the goodwill impairment test for reporting

units with zero or negative carrying amounts and offers guidance on when to perform step two of the testing. For

those reporting units, an entity is required to perform step two of the goodwill impairment test if it is more likely

than not that a goodwill impairment exists based upon factors such as unanticipated competition, the loss of key

personnel and adverse regulatory changes. ASU 2011-08 is effective for fiscal years, and interim periods within

those years, beginning after December 15, 2011. The adoption of ASU 2011-08 is not expected to have a material

effect on the Company’s consolidated financial statements.

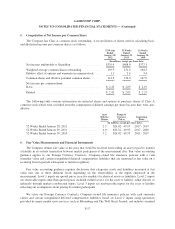

2. Asset Impairments and Restructuring Charges

In the fourth quarter of fiscal 2011, the Company recorded asset impairments and restructuring charges of

$81.2 million, of which $37.8 million was recorded as a result of the Company’s annual impairment test of its

Micromania trade name. In addition, $22.7 million was recorded related to the impairment of investments in

non-core businesses, primarily a small retail movie chain of stores owned by the Company until fiscal 2011. The

Company also incurred restructuring charges in the fourth quarter of fiscal 2011 related to the exit of certain

markets in Europe and the closure of underperforming stores in the international segments, as well as the

consolidation of European home office sites and back-office functions. These restructuring charges are a result of

management’s plan to rationalize the international store base and improve profitability. In addition, the Company

recognized impairment charges related to its annual evaluation of store property, equipment and other assets in

situations where the asset’s carrying value was not expected to be recovered by its future cash flows over its

remaining useful life.

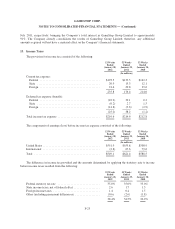

A summary of the Company’s asset impairments and restructuring charges for the 52 weeks ended

January 28, 2012 is as follows:

United States Canada Australia Europe Total

(In millions)

Intangible asset impairment ............................ $ — $— $— $37.8 $37.8

Impairment of investments in non-core businesses .......... 22.7 — — — 22.7

Property, equipment and other asset impairments ........... 3.2 1.1 0.5 6.4 11.2

Termination benefits .................................. 3.0 0.2 — 2.4 5.6

Facility closure and other costs ......................... — — 0.1 3.8 3.9

Total .............................................. $28.9 $1.3 $0.6 $50.4 $81.2

F-15