GameStop 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In September 2005, the Company, along with GameStop, Inc. as co-issuer (together with the Company, the

“Issuers”), completed the offering of $300 million aggregate principal amount of Senior Floating Rate Notes due

2011 (the “Senior Floating Rate Notes”) and $650 million aggregate principal amount of Senior Notes due 2012

(the “Senior Notes” and, together with the Senior Floating Rate Notes, the “Notes”). The Notes were issued

under an Indenture, dated September 28, 2005 (the “Indenture”), by and among the Issuers, the subsidiary

guarantors party thereto, and Citibank, N.A., as trustee. In November 2006, Wilmington Trust Company was

appointed as the new trustee for the Notes (the “Trustee”).

The Senior Notes bore interest at 8.0% per annum, were to mature on October 1, 2012 and were priced at

98.688%, resulting in a discount at the time of issue of $8.5 million. The discount was amortized using the

effective interest method. The Issuers paid interest on the Senior Notes semi-annually, in arrears, every April 1

and October 1, to holders of record on the immediately preceding March 15 and September 15, and at maturity.

As of January 28, 2012, the Senior Notes have been fully redeemed.

As of January 29, 2011, the only long-term debt outstanding was the Senior Notes.

Uses of Capital

Our future capital requirements will depend on the number of new stores we open and the timing of those

openings within a given fiscal year. We opened 285 stores in fiscal 2011. We expect to open approximately 150

stores in fiscal 2012. Capital expenditures for fiscal 2012 are projected to be approximately $140 million, to be

used primarily to fund continued digital initiatives, new store openings, store remodels and invest in distribution

and information systems in support of operations.

Between May 2006 and December 2011, the Company repurchased and redeemed the $300 million of

Senior Floating Rate Notes and the $650 million of Senior Notes under previously announced buybacks

authorized by the Company’s Board of Directors. The repurchased Notes were delivered to the Trustee for

cancellation. The associated loss on the retirement of debt was $1.0 million for the 52 week period ended

January 28, 2012, which consisted of the write-off of the deferred financing fees and the original issue discount

on the Notes. The associated loss on the retirement of debt was $6.0 million and $5.3 million for the 52 week

periods ended January 29, 2011 and January 30, 2010, respectively, which consisted of the premium paid to retire

the Notes and the write-off of the deferred financing fees and the original issue discount on the Notes.

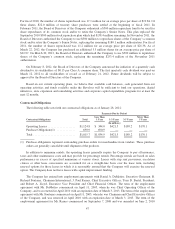

The changes in the carrying amount of the Senior Notes for the Company for the 52 weeks ended

January 29, 2011 and the 52 weeks ended January 28, 2012 were as follows (in millions):

Balance at January 30, 2010 ................................................... $447.3

Repurchased and redeemed Senior Notes, net ..................................... (198.3)

Balance at January 29, 2011 ................................................... $249.0

Redeemed Senior Notes, net ................................................... (249.0)

Balance at January 28, 2012 ................................................... $ 0.0

We used cash to expand the Company through acquisitions. During fiscal 2011, fiscal 2010 and fiscal 2009,

the Company used $30.1 million, $38.1 million and $8.4 million, respectively, for acquisitions which were

primarily for the Company’s overall digital growth strategy.

In January 2010, the Board of Directors of the Company approved a $300 million share repurchase program

authorizing the Company to repurchase its common stock. For fiscal 2009, the number of shares repurchased was

6.1 million for an average price per share of $20.12. Of these shares, $64.6 million of treasury share purchases

were settled at the beginning of fiscal 2010. In September 2010, the Board of Directors of the Company approved

an additional $300 million share repurchase program authorizing the Company to repurchase its common stock.

46