GameStop 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

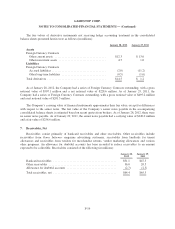

minimum and, in some cases, percentage rentals and require the Company to pay all insurance, taxes and other

maintenance costs. Leases with step rent provisions, escalation clauses or other lease concessions are accounted

for on a straight-line basis over the lease term, which includes renewal option periods when the Company is

reasonably assured of exercising the renewal options and includes “rent holidays” (periods in which the

Company is not obligated to pay rent). The Company does not have leases with capital improvement funding.

Percentage rentals are based on sales performance in excess of specified minimums at various stores.

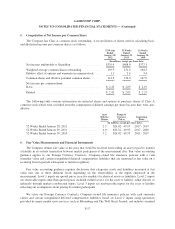

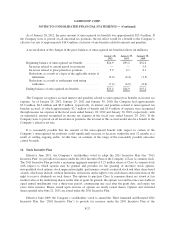

Approximate rental expenses under operating leases were as follows:

52 Weeks

Ended

January 28,

2012

52 Weeks

Ended

January 29,

2011

52 Weeks

Ended

January 30,

2010

(In millions)

Minimum ......................................... $386.9 $370.8 $354.3

Percentage rentals ................................... 12.3 11.1 22.6

$399.2 $381.9 $376.9

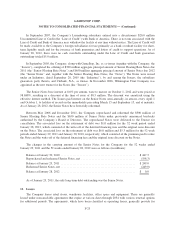

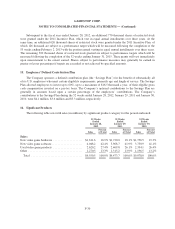

Future minimum annual rentals, excluding percentage rentals, required under leases that had initial,

noncancelable lease terms greater than one year, as of January 28, 2012, are approximately:

Year Ended Amount

(In millions)

January 2013 ............................................................. $ 344.0

January 2014 ............................................................. 251.5

January 2015 ............................................................. 170.0

January 2016 ............................................................. 115.6

January 2017 ............................................................. 73.6

Thereafter ............................................................... 170.1

$1,124.8

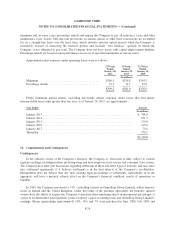

12. Commitments and Contingencies

Contingencies

In the ordinary course of the Company’s business, the Company is, from time to time, subject to various

legal proceedings, including matters involving wage and hour employee class actions and consumer class actions.

The Company may enter into discussions regarding settlement of these and other types of lawsuits, and may enter

into settlement agreements, if it believes settlement is in the best interest of the Company’s stockholders.

Management does not believe that any such existing legal proceedings or settlements, individually or in the

aggregate, will have a material adverse effect on the Company’s financial condition, results of operations or

liquidity.

In 2003, the Company purchased a 51% controlling interest in GameStop Group Limited, which operates

stores in Ireland and the United Kingdom. Under the terms of the purchase agreement, the minority interest

owners have the ability to require the Company to purchase their remaining shares in incremental percentages at

a price to be determined based partially on the Company’s price to earnings ratio and GameStop Group Limited’s

earnings. Shares representing approximately 16%, 16% and 7% were purchased in June 2008, July 2009 and

F-24