GameStop 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

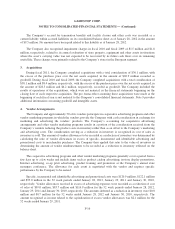

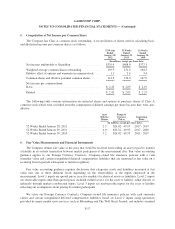

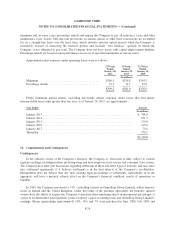

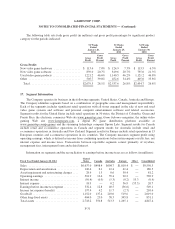

Differences between financial accounting principles and tax laws cause differences between the bases of

certain assets and liabilities for financial reporting purposes and tax purposes. The tax effects of these

differences, to the extent they are temporary, are recorded as deferred tax assets and liabilities and consisted of

the following components (in millions):

January 28,

2012

January 29,

2011

Deferred tax asset:

Inventory obsolescence reserve ................................. $ 18.8 $ 19.7

Deferred rents ............................................... 16.1 16.4

Stock-based compensation ..................................... 24.1 25.8

Net operating losses .......................................... 16.5 15.9

Customer liabilities ........................................... 29.4 9.0

Other ...................................................... 7.5 10.7

Total deferred tax assets ..................................... 112.4 97.5

Valuation allowance ........................................ (3.4) (2.7)

Total deferred tax assets, net .................................. 109.0 94.8

Deferred tax liabilities:

Fixed Assets ................................................ (25.2) (20.3)

Goodwill ................................................... (49.6) (44.5)

Prepaid expenses ............................................. (8.0) (7.5)

Acquired intangible assets ..................................... (41.7) (59.6)

Other ...................................................... (6.9) (9.0)

Total deferred tax liabilities .................................. (131.4) (140.9)

Net...................................................... $ (22.4) $ (46.1)

Financial statements:

Current deferred tax assets ....................................... $ 44.7 $ 28.8

Deferred tax liabilities .......................................... $ (67.1) $ (74.9)

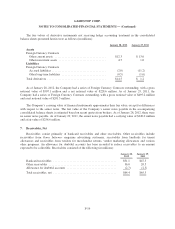

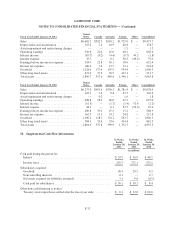

In addition, the valuation allowance for deferred tax assets for the fiscal year ended January 30, 2010 was

$2.0 million.

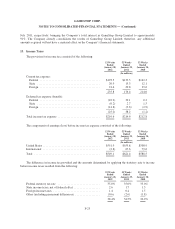

The Company and its subsidiaries file income tax returns in the U.S. federal jurisdiction and various states

and foreign jurisdictions. The Internal Revenue Service (“IRS”) is currently examining the Company’s

U.S. income tax returns for the fiscal years ended on January 30, 2010, January 31, 2009, February 2, 2008 and

February 3, 2007. The Company does not anticipate any adjustments that would result in a material impact on its

consolidated financial statements as a result of these audits. The Company is no longer subject to U.S. federal

income tax examination for years before and including the fiscal year ended January 28, 2006.

With respect to state and local jurisdictions and countries outside of the United States, the Company and its

subsidiaries are typically subject to examination for three to six years after the income tax returns have been

filed. Although the outcome of tax audits is always uncertain, the Company believes that adequate amounts of

tax, interest and penalties have been provided for in the accompanying financial statements for any adjustments

that might be incurred due to state, local or foreign audits.

F-26