GameStop 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GAMESTOP CORP.

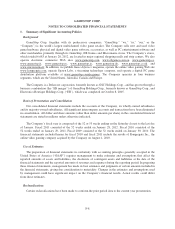

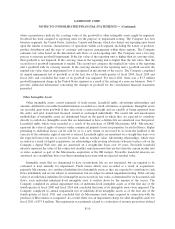

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

in the discounted cash flows. The impairment charge is recorded in asset impairments and restructuring charges

in the accompanying consolidated statements of operations and is recorded in the Europe segment. Note 9

provides additional information related to the Company’s intangible assets.

Revenue Recognition

Revenue from the sales of the Company’s products is recognized at the time of sale, net of sales discounts,

reduced by a provision for sales returns. The sales return reserve, which represents the gross profit effect of sales

returns, is estimated based on historical return levels. The sales of used video game products are recorded at the

retail price charged to the customer. Advertising revenues for Game Informer are recorded upon release of

magazines for sale to consumers. Subscription revenues for the Company’s PowerUp Rewards loyalty program

and magazines are recognized on a straight-line basis over the subscription period. Revenue from the sales of

product replacement plans is recognized on a straight-line basis over the coverage period. The deferred revenues

for magazine subscriptions and deferred financing plans are included in accrued liabilities (see Note 8). Gift

cards sold to customers are recognized as a liability on the balance sheet until redeemed.

The Company sells a variety of digital products which generally allow consumers to download software or

play games on the internet. Certain of these products do not require the Company to purchase inventory or take

physical possession of, or take title to, inventory. When purchasing these products from the Company, consumers

pay a retail price and the Company earns a commission based on a percentage of the retail sale as negotiated with

the product publisher. The Company recognizes this commission as revenue on the sale of these digital products.

Revenues do not include sales taxes or other taxes collected from customers.

Cost of Sales and Selling, General and Administrative Expenses Classification

The classification of cost of sales and selling, general and administrative expenses varies across the retail

industry. The Company includes purchasing, receiving and distribution costs in selling, general and

administrative expenses, rather than cost of goods sold, in the statement of operations. For the 52 weeks ended

January 28, 2012, January 29, 2011 and January 30, 2010, these purchasing, receiving and distribution costs

amounted to $61.7 million, $64.7 million and $63.6 million, respectively.

The Company includes processing fees associated with purchases made by check and credit cards in cost of

sales, rather than selling, general and administrative expenses, in the statement of operations. For the 52 weeks

ended January 28, 2012, January 29, 2011 and January 30, 2010, these processing fees amounted to

$65.1 million, $69.7 million and $63.1 million, respectively.

Customer Liabilities

The Company establishes a liability upon the issuance of merchandise credits and the sale of gift cards.

Revenue is subsequently recognized when the credits and gift cards are redeemed. In addition, income

(“breakage”) is recognized quarterly on unused customer liabilities older than three years to the extent that the

Company believes the likelihood of redemption by the customer is remote, based on historical redemption

patterns. Breakage has historically been immaterial. To the extent that future redemption patterns differ from

those historically experienced, there will be variations in the recorded breakage.

F-11