GameStop 2011 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.GAMESTOP CORP.

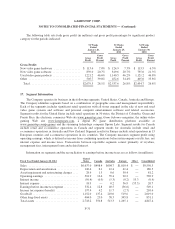

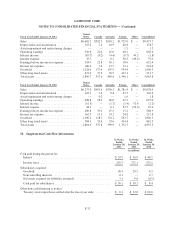

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

Series A Preferred Stock will be entitled to receive one thousand times the amount and type of consideration

received per share of the Company’s common stock. At January 28, 2012, there were no shares of Series A

Preferred Stock outstanding.

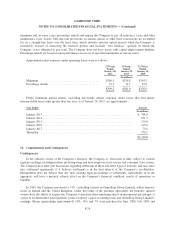

On January 11, 2010, the Board of Directors of the Company approved a $300 million share repurchase

program authorizing the Company to repurchase its common stock. For fiscal 2009, the number of shares

repurchased was 6.1 million for an average price per share of $20.12. In September 2010, the Board of Directors

of the Company approved an additional $300 million share repurchase program authorizing the Company to

repurchase its common stock. For fiscal 2010, the number of shares repurchased was 17.1 million for an average

price per share of $19.84. Approximately $22.0 million of treasury share purchases were not settled at the end of

fiscal 2010 and were reported in accrued liabilities at January 29, 2011. Additionally, approximately

$64.6 million of treasury share purchases were not settled at the end of fiscal 2009 and were reported in accrued

liabilities at January 30, 2010. In February 2011, the Board of Directors of the Company authorized $500 million

to be used for share repurchases of its common stock and/or to retire the Company’s Senior Notes. This plan

replaced the $300 million share repurchase program authorized in September 2010 which had $138.4 million

remaining. In November 2011, the Board of Directors authorized $500 million to be used for share repurchases

and/or retirement of the Company’s Senior Notes, replacing the $180.1 million remaining at the time of the

authorization. For fiscal 2011, the number of shares repurchased was 11.2 million for an average price per share

of $21.38. As of January 28, 2012, the Company had $329.7 million remaining under the November 2011

authorization. As of March 22, 2012, the Company has purchased an additional 3.3 million shares for an average

price per share of $22.97. See Note 21 for additional information on Board authorizations.

On February 8, 2012, the Board of Directors of the Company announced the initiation of a quarterly cash

dividend to its stockholders of $0.15 per Class A common share. The first quarterly dividend was paid on

March 12, 2012 to all stockholders of record as of February 21, 2012. Future dividends will be subject to

approval by the Board of Directors of the Company.

F-34