GameStop 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

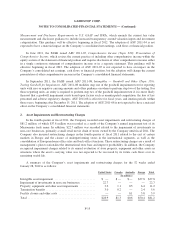

the revolving credit facility. Prior to the retirement of the senior notes in December 2011, deferred financing fees

associated with the senior notes were included in other noncurrent assets in the consolidated balance sheet and

were being amortized over seven years to match the term of the senior notes. As of January 28, 2012, there is no

balance in other noncurrent assets in the consolidated balance sheet relating to deferred financing fees associated

with the senior notes as the senior notes were fully redeemed by that date.

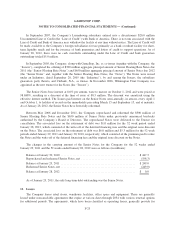

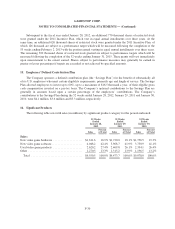

The changes in the carrying amount of deferred financing fees and other intangible assets for the 52 weeks

ended January 29, 2011 and January 28, 2012 were as follows:

Deferred

Financing Fees

Other

Intangible Assets

(In millions)

Balance at January 30, 2010 ................................ $5.7 $259.9

Addition for revolving credit facility amendment .............. 3.8 —

Write-off of deferred financing fees remaining on repurchased

senior notes (see Note 10) .............................. (1.0) —

Addition of acquired intangible assets ...................... — 10.9

Adjustment for foreign currency translation .................. — (3.5)

Amortization for the 52 weeks ended January 29, 2011 ......... (2.3) (12.7)

Balance at January 29, 2011 ................................ 6.2 254.6

Addition for revolving credit facility amendment .............. 0.1 —

Write-off of deferred financing fees remaining on repurchased

senior notes (see Note 10) .............................. (0.4) —

Addition of acquired intangible assets ...................... — 16.0

Impairment of other intangible assets ....................... — (38.0)

Adjustment for foreign currency translation .................. — (5.7)

Amortization for the 52 weeks ended January 28, 2012 ......... (1.7) (17.8)

Balance at January 28, 2012 ................................ $4.2 $209.1

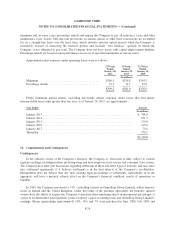

The gross carrying value and accumulated amortization of deferred financing fees as of January 28, 2012

were $10.4 million and $6.2 million, respectively.

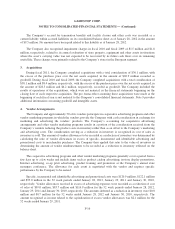

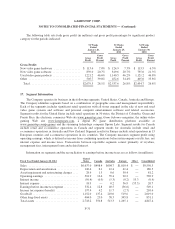

The estimated aggregate amortization expenses for deferred financing fees and other intangible assets for

the next five fiscal years are approximately:

Year Ended

Amortization

of Deferred

Financing Fees

Amortization of

Other

Intangible Assets

(In millions)

January 2013 ............................................ $1.2 $14.1

January 2014 ............................................ 1.2 13.6

January 2015 ............................................ 1.2 13.1

January 2016 ............................................ 0.6 12.6

January 2017 ............................................ — 9.6

$4.2 $63.0

F-21