GameStop 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

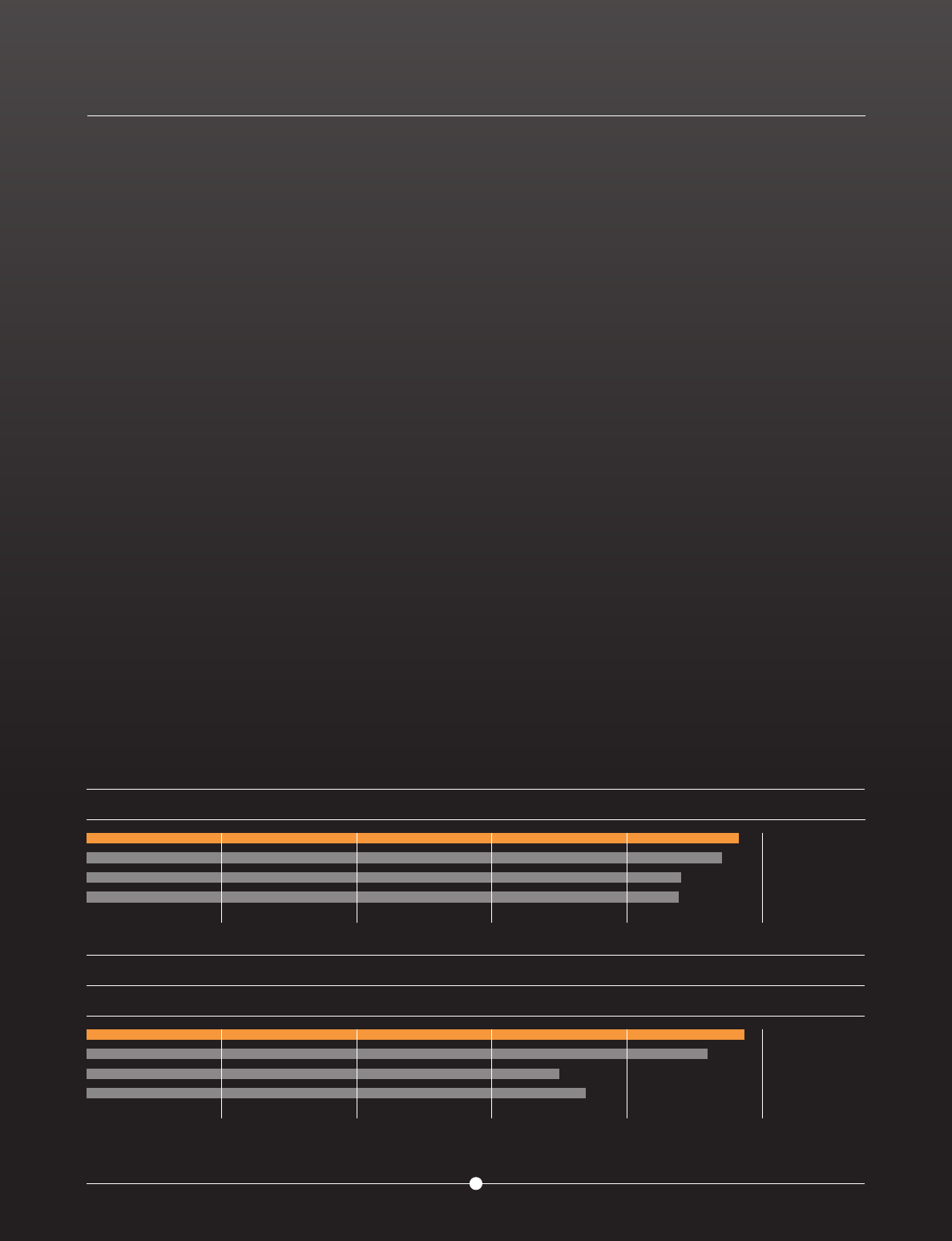

TOTAL REVENUES

EARNINGS PER SHARE

$2,000 $4,000

$1.50$1.00

$6,000

$2.00

$8,000

$2.50

$10,000

$3.00

$9,550

$2.87*

2011

2011

2008

2008

2010

2010

2009

2009

$9,474

$2.65

$9,078

$2.25

$8,806

$2.38

Diluted earnings per share

*Non-GAAP results; excludes restructuring, impairment and debt-retirement expenses

Revenue in millions

SCORECARD FOR GROWTH

Sales and EPS Growth

EPS growth in the future will be achieved through:

• Continued growth of PowerUp Rewards

• Market share gains

• Net square footage decline and transferring sales from closing stores

• Continued progress on multichannel strategies and growth of digital revenue streams

Capital Allocation

Since initiating a disciplined capital allocation plan in Jan. 2010, GameStop’s stock and debt buybacks have totaled more than

one billion dollars and the company now operates debt free. We are committed to returning excess cash to our shareholders

through continued stock buybacks and, beginning in 2012, quarterly dividends.

Digital Growth

In addition to incredible Downloadable Content (DLC) growth of 315 percent, GameStop’s digital business grew in other signifi -

cant areas. Kongregate.com grew considerably in both revenue and site visits. Game Informer launched a digital magazine that

now has more than one million subscribers. We also added cloud gaming and PC download technology with the acquisitions of

Spawn Labs and Impulse.

International Presence

GameStop holds leading market share in most of the 15 countries where we operate. We will continue to rationalize our

international store base, closing stores that are underperforming and opening new stores where fi nancially viable. Our unique

sales transfer method will allow us to retain customers throughout this process.

2011 ANNUAL REPORT

2