GameStop 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

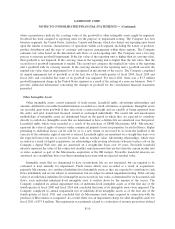

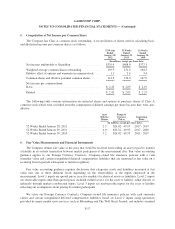

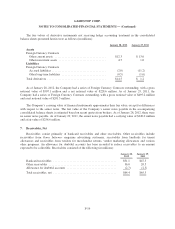

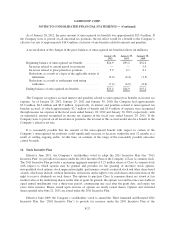

8. Accrued Liabilities

Accrued liabilities consisted of the following (in millions):

January 28,

2012

January 29,

2011

Customer liabilities ............................................. $323.2 $242.7

Deferred revenue ............................................... 84.6 74.9

Accrued rent .................................................. 7.4 10.4

Employee benefits, compensation and related taxes ................... 135.4 124.3

Other taxes ................................................... 60.4 60.9

Settlement of treasury share purchases .............................. 0.1 22.0

Other accrued liabilities ......................................... 138.7 121.8

Total accrued liabilities .......................................... $749.8 $657.0

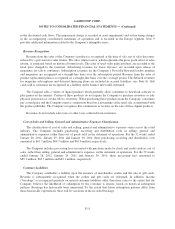

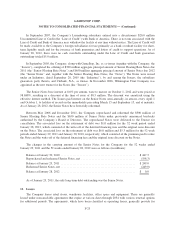

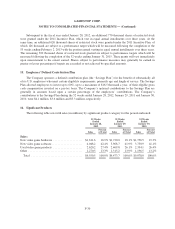

9. Goodwill, Intangible Assets and Deferred Financing Fees

The changes in the carrying amount of goodwill for the Company’s business segments for the 52 weeks

ended January 29, 2011 and the 52 weeks ended January 28, 2012 were as follows:

United States Canada Australia Europe Total

(In millions)

Balance at January 30, 2010 ......................... $1,100.2 $128.5 $174.1 $543.7 $1,946.5

Goodwill acquired, net ............................. 28.5 — — — 28.5

Foreign currency translation adjustment ............... (0.1) 8.9 21.8 (9.3) 21.3

Balance at January 29, 2011 ......................... 1,128.6 137.4 195.9 534.4 1,996.3

Goodwill acquired, net ............................. 26.9 — — — 26.9

Impairment loss .................................. (3.3) — — — (3.3)

Foreign currency translation adjustment ............... (0.2) — 14.1 (14.8) (0.9)

Balance at January 28, 2012 ......................... $1,152.0 $137.4 $210.0 $519.6 $2,019.0

There were no impairments to goodwill during the 52 weeks ended January 29, 2011. During the 52 weeks

ended January 28, 2012, $3.3 million of goodwill was expensed in the United States segment as a result of the

exiting of an immaterial non-core business.

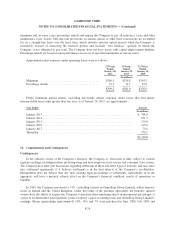

Intangible assets, primarily from the EB merger and Micromania acquisition, consist of internally developed

software, amounts attributed to favorable leasehold interests and advertiser relationships which are included in

other intangible assets in the consolidated balance sheet. The trade names acquired, primarily Micromania, have

been determined to be indefinite-lived intangible assets and are therefore not subject to amortization. The total

weighted-average amortization period for the remaining intangible assets, excluding goodwill, is approximately

ten years. The intangible assets are being amortized based upon the pattern in which the economic benefits of the

intangible assets are being utilized, with no expected residual value. For fiscal 2011, the Company recorded a

$37.8 million charge as a result of the Company’s annual impairment test of its Micromania trade name.

The deferred financing fees associated with the Company’s revolving credit facility are included in other

noncurrent assets in the consolidated balance sheet and are being amortized over five years to match the term of

F-20