GameStop 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

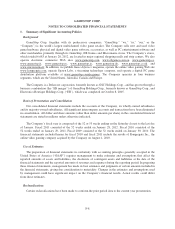

1. Summary of Significant Accounting Policies

Background

GameStop Corp. (together with its predecessor companies, “GameStop,” “we,” “us,” “our,” or the

“Company”) is the world’s largest multichannel video game retailer. The Company sells new and used video

game hardware, physical and digital video game software, accessories, as well as PC entertainment software and

other merchandise primarily through its GameStop, EB Games and Micromania stores. The Company’s stores,

which totaled 6,683 at January 28, 2012, are located in major regional shopping malls and strip centers. We also

operate electronic commerce Web sites www.gamestop.com, www.ebgames.com.au, www.gamestop.ca,

www.gamestop.it, www.gamestop.es, www.gamestop.ie, www.gamestop.de, www.gamestop.co.uk and

www.micromania.fr. In addition, we publish Game Informer magazine, operate the online video gaming Web site

www.kongregate.com, operate Spawn Labs, a streaming technology company, and operate a digital PC game

distribution platform available at www.gamestop.com/pcgames. The Company operates in four business

segments, which are the United States, Australia, Canada and Europe.

The Company is a Delaware corporation, formerly known as GSC Holdings Corp., and has grown through a

business combination (the “EB merger”) of GameStop Holdings Corp., formerly known as GameStop Corp., and

Electronics Boutique Holdings Corp. (“EB”), which was completed on October 8, 2005.

Basis of Presentation and Consolidation

Our consolidated financial statements include the accounts of the Company, its wholly-owned subsidiaries

and its majority-owned subsidiaries. All significant intercompany accounts and transactions have been eliminated

in consolidation. All dollar and share amounts (other than dollar amounts per share) in the consolidated financial

statements are stated in millions unless otherwise indicated.

The Company’s fiscal year is composed of the 52 or 53 weeks ending on the Saturday closest to the last day

of January. Fiscal 2011 consisted of the 52 weeks ended on January 28, 2012. Fiscal 2010 consisted of the

52 weeks ended on January 29, 2011. Fiscal 2009 consisted of the 52 weeks ended on January 30, 2010. The

financial statements included herein for fiscal 2010 and fiscal 2011 include the results of Kongregate Inc., the

online video gaming company acquired by the Company on August 1, 2010.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America (“GAAP”) requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses during the reporting period. In preparing

these financial statements, management has made its best estimates and judgments of certain amounts included in

the financial statements, giving due consideration to materiality. Changes in the estimates and assumptions used

by management could have significant impact on the Company’s financial results. Actual results could differ

from those estimates.

Reclassifications

Certain reclassifications have been made to conform the prior period data to the current year presentation.

F-8