GameStop 2011 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

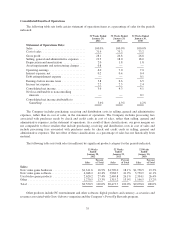

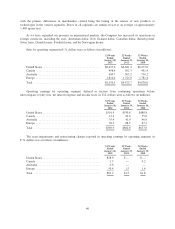

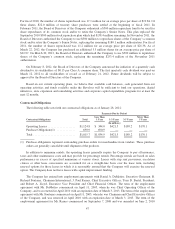

Total assets by operating segment in U.S. dollars were as follows (in millions):

January 28,

2012

January 29,

2011

January 30,

2010

United States ....................................... $2,718.2 $2,896.7 $2,864.9

Canada ........................................... 350.8 357.6 337.8

Australia .......................................... 513.3 469.4 399.9

Europe ............................................ 1,265.1 1,340.1 1,352.7

Total ............................................. $4,847.4 $5,063.8 $4,955.3

Fiscal 2011 Compared to Fiscal 2010

United States

Segment results for the United States include retail operations in 50 states, the District of Columbia, Puerto

Rico and Guam, the electronic commerce Web site www.gamestop.com, Game Informer magazine,

www.kongregate.com, a digital PC game distribution platform available at www.gamestop.com/pcgames and

Spawn Labs. As of January 28, 2012, the United States segment included 4,503 GameStop stores, compared to

4,536 stores on January 29, 2011. Sales for fiscal 2011 decreased 0.7% compared to fiscal 2010 and comparable

store sales decreased 1.2%. Comparable store sales decreased primarily due to decreases in new video game

hardware sales and other product sales offset partially by an increase in used video game product sales. Despite

the sales decrease, gross margin dollars increased by $88.1 million when compared to fiscal 2010 due to the

higher mix of used video game product sales and higher other product margin primarily related to our digital

initiatives. Asset impairments and restructuring charges of $28.9 million were recognized in fiscal 2011 primarily

related to asset impairments, severance and disposal costs associated with the exit of non-core businesses. No

asset impairments or restructuring charges were recognized in fiscal 2010. Segment operating income for fiscal

2011 decreased by $28.9 million, or 5.4%, compared to fiscal 2010, an amount equal to the asset impairments

and restructuring charges recognized in fiscal 2011.

Canada

Segment results for Canada include retail operations and an e-commerce site in Canada. Sales in the

Canadian segment in the 52 weeks ended January 28, 2012 decreased 0.8% compared to the 52 weeks ended

January 29, 2011. The decrease in sales was primarily attributable to a decrease in sales at existing stores

partially offset by the impact of changes in exchange rates in fiscal 2011 when compared to fiscal 2010, which

had the effect of increasing sales by $11.8 million. Excluding the impact of changes in exchange rates, sales in

the Canadian segment decreased 3.1%. The decrease in sales at existing stores was primarily due to weak

consumer traffic and a slow-down in hardware unit sell-through and lower price points when compared to fiscal

2010. As of January 28, 2012, the Canadian segment had 346 stores compared to 345 stores as of January 29,

2011. Segment operating income for fiscal 2011 decreased $10.2 million to $12.4 million compared to

$22.6 million for fiscal 2010. The decrease in operating income when compared to the prior year was primarily

due to the decrease in sales at existing stores. The unfavorable impact of changes in exchange rates had the effect

of decreasing operating earnings by $0.3 million when compared to fiscal 2010.

Australia

Segment results for Australia include retail operations and e-commerce sites in Australia and New Zealand.

As of January 28, 2012, the Australian segment included 411 stores, compared to 405 stores as of January 29,

2011. Sales for the 52 weeks ended January 28, 2012 increased 7.0% compared to the 52 weeks ended

January 29, 2011. The increase in sales was primarily attributable to the favorable impact of changes in exchange

rates in fiscal 2011 when compared to fiscal 2010, which had the effect of increasing sales by $54.5 million.

41