GameStop 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.are typically also driven by manufacturer-funded retail price reductions, further driving sales of related software

and accessories. New hardware systems are typically introduced every four to six years. The current generation

of hardware is now between five and six years old and consumer demand is waning. We expect to see declines in

hardware sales in fiscal 2012 and related declines in software sales.

We expect that future growth in the video game industry will also be driven by the sale of video games

delivered in digital form and the expansion of other forms of gaming. We currently sell various types of products

that relate to the digital category, including digitally downloaded software, Xbox LIVE, PlayStation and

Nintendo network point cards, as well as prepaid digital and online timecards. We expect our sales of digital

products to increase in fiscal 2012. We have made significant investments in e-commerce, online game

development, digital kiosks and in-store and Web site functionality to enable our customers to access digital

content and eliminate friction in the digital sales and delivery process. We plan to continue to invest in these

types of processes and channels to grow our digital sales base and enhance our market leadership position in the

video game industry and in the digital aggregation and distribution category. We also intend to continue to invest

in customer loyalty programs designed to attract and retain customers.

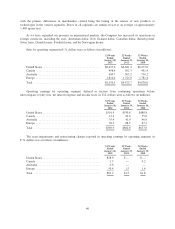

Critical Accounting Policies

The Company believes that the following are its most significant accounting policies which are important in

determining the reporting of transactions and events:

Use of Estimates. The preparation of financial statements in conformity with accounting principles

generally accepted in the United States of America (“GAAP”) requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and

liabilities at the date of the financial statements and the reported amounts of revenues and expenses during

the reporting period. In preparing these financial statements, management has made its best estimates and

judgments of certain amounts included in the financial statements, giving due consideration to materiality.

Changes in the estimates and assumptions used by management could have significant impact on the

Company’s financial results. Actual results could differ from those estimates.

Revenue Recognition. Revenue from the sales of the Company’s products is recognized at the time of

sale, net of sales discounts, reduced by a provision for sales returns. Our sales return reserve, which

represents the gross profit effect of sales returns, is estimated based on historical return levels. The sales of

used video game products are recorded at the retail price charged to the customer. Advertising revenues for

Game Informer are recorded upon release of magazines for sale to consumers. Subscription revenues for the

Company’s PowerUp Rewards loyalty program and magazines are recognized on a straight-line basis over

the subscription period. Revenue from the sales of product replacement plans is recognized on a straight-line

basis over the coverage period. Gift cards sold to customers are recognized as a liability on the balance sheet

until redeemed.

The Company sells a variety of digital products which generally allow consumers to download

software or play games on the internet. Certain of these products do not require the Company to purchase

inventory or take physical possession of, or take title to, inventory. When purchasing these products from

the Company, consumers pay a retail price and the Company earns a commission based on a percentage of

the retail sale as negotiated with the product publisher. The Company recognizes this commission as

revenue on the sale of these digital products.

Stock-Based Compensation. The Company records share-based compensation expense in earnings

based on the grant-date fair value of options or restricted stock granted. As of January 28, 2012, the

unrecognized compensation expense related to the unvested portion of our stock options and restricted stock

was $2.8 million and $10.9 million, respectively, which is expected to be recognized over a weighted

average period of 1.1 and 1.7 years, respectively. Note 1 and Note 14 of “Notes to Consolidated Financial

Statements” provide additional information on stock-based compensation.

30