GameStop 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

was heard in November 2005 and was denied. The Defendants appealed the denial of the motion to dismiss and on

March 24, 2006, the Alabama Supreme Court denied the Defendants’ application. Discovery is proceeding.

Mr. Moore was found guilty of capital murder in a criminal trial in Alabama and was sentenced to death in August

2005. We do not believe there is sufficient information to estimate the amount of the possible loss, if any, resulting

from the lawsuit.

On April 18, 2006, former and current store managers Charles Kohler, James O. Little, III, Jason Clayton, Nick

Quintois, Kirk Overby and Amy Johnson (collectively the “plaintiffs”) filed a complaint against the Company in the

U.S. District Court for the Eastern District of Louisiana, alleging that GameStop’s salaried retail managers were

misclassified as exempt in violation of the FLSA and should have been paid overtime. The plaintiffs sought to

represent all current and former salaried retail managers who were employed by GameStop (as well as a subsidiary

of EB) for the three years before April 18, 2006. The Company filed a motion to dismiss, transfer or stay the case

based on the pendency of a prior action. After the parties fully briefed the motion but were still awaiting the court’s

decision, they negotiated a settlement of the plaintiffs’ individual claims. In November 2006, the court approved the

settlement and the case has been dismissed. The settlement did not have a material impact on the Company’s

financial position or results of operations.

In the ordinary course of our business, the Company is, from time to time, subject to various other legal

proceedings. Management does not believe that any such other legal proceedings, individually or in the aggregate,

will have a material adverse effect on the Company’s operations or financial condition.

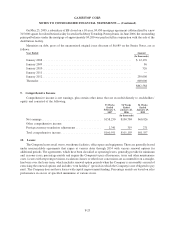

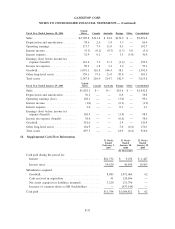

12. Income Taxes

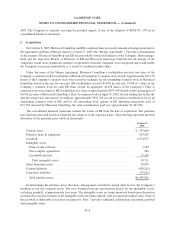

The provision for income tax consisted of the following:

53 Weeks

Ended

February 3,

2007

52 Weeks

Ended

January 28,

2006

52 Weeks

Ended

January 29,

2005

(In thousands)

Current tax expense (benefit):

Federal ....................................... $32,127 $40,251 $23,780

State......................................... 2,370 2,300 4,355

Foreign....................................... 18,894 7,954 (634)

53,391 50,505 27,501

Deferred tax expense (benefit):

Federal ....................................... 571 (3,093) 5,228

State......................................... (2,149) (894) 6

Foreign....................................... (1,502) 312 168

(3,080) (3,675) 5,402

Charge in lieu of income taxes, relating to the tax effect of

stock option tax deduction......................... 45,735 12,308 5,082

Total income tax expense ........................... $96,046 $59,138 $37,985

F-25

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)