GameStop 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

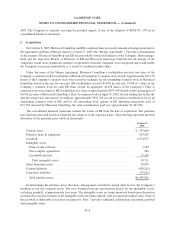

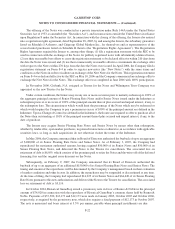

On May 25, 2005, a subsidiary of EB closed on a 10-year, $9,450 mortgage agreement collateralized by a new

315,000 square foot distribution facility located in Sadsbury Township, Pennsylvania. In June 2006, the outstanding

principal balance under the mortgage of approximately $9,200 was paid in full in conjunction with the sale of the

distribution facility.

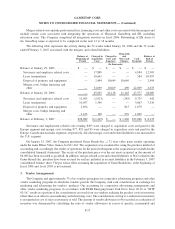

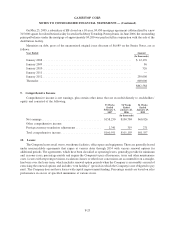

Maturities on debt, gross of the unamortized original issue discount of $6,689 on the Senior Notes, are as

follows:

Year Ended Amount

(In thousands)

January 2008 ....................................................... $ 12,176

January 2009 ....................................................... 86

January 2010 ....................................................... 326

January 2011 ....................................................... —

January 2012 ....................................................... 250,000

Thereafter ......................................................... 600,000

$862,588

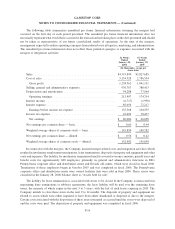

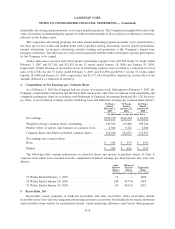

9. Comprehensive Income

Comprehensive income is net earnings, plus certain other items that are recorded directly to stockholders’

equity and consisted of the following:

53 Weeks

Ended

February 3,

2007

52 Weeks

Ended

January 28,

2006

52 Weeks

Ended

January 29,

2005

(In thousands)

Net earnings ..................................... $158,250 $100,784 $60,926

Other comprehensive income:

Foreign currency translation adjustments ................ 2,341 319 271

Total comprehensive income ......................... $160,591 $101,103 $61,197

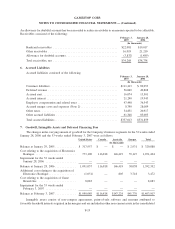

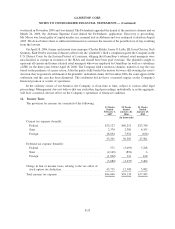

10. Leases

The Company leases retail stores, warehouse facilities, office space and equipment. These are generally leased

under noncancelable agreements that expire at various dates through 2034 with various renewal options for

additional periods. The agreements, which have been classified as operating leases, generally provide for minimum

and, in some cases, percentage rentals and require the Company to pay all insurance, taxes and other maintenance

costs. Leases with step rent provisions, escalation clauses or other lease concessions are accounted for on a straight-

line basis over the lease term, which includes renewal option periods when the Company is reasonably assured of

exercising the renewal options and includes “rent holidays” (periods in which the Company is not obligated to pay

rent). The Company does not have leases with capital improvement funding. Percentage rentals are based on sales

performance in excess of specified minimums at various stores.

F-23

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)