GameStop 2006 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

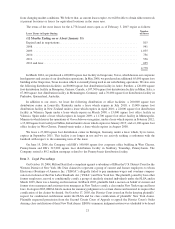

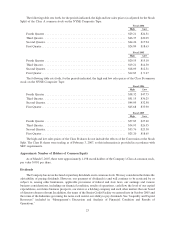

The following table sets forth, for the periods indicated, the high and low sales prices (as adjusted for the Stock

Split) of the Class A common stock on the NYSE Composite Tape:

High Low

Fiscal 2006

Fourth Quarter .................................................. $29.21 $24.51

Third Quarter ................................................... $26.37 $20.05

Second Quarter .................................................. $24.26 $17.94

First Quarter .................................................... $24.84 $18.63

High Low

Fiscal 2005

Fourth Quarter .................................................. $20.55 $15.10

Third Quarter ................................................... $19.21 $14.30

Second Quarter .................................................. $18.09 $12.31

First Quarter .................................................... $12.85 $ 9.27

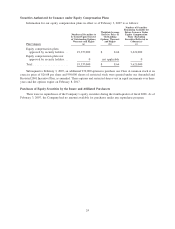

The following table sets forth, for the periods indicated, the high and low sales prices of the Class B common

stock on the NYSE Composite Tape:

High Low

Fiscal 2006

Fourth Quarter .................................................. $58.32 $47.73

Third Quarter ................................................... $51.15 $36.25

Second Quarter .................................................. $44.09 $32.58

First Quarter .................................................... $45.68 $33.90

High Low

Fiscal 2005

Fourth Quarter .................................................. $37.85 $27.20

Third Quarter ................................................... $34.93 $26.55

Second Quarter .................................................. $33.76 $23.30

First Quarter .................................................... $25.20 $18.65

The high and low sales prices of the Class B shares do not include the effects of the Conversion or the Stock

Split. The Class B shares were trading as of February 3, 2007, so this information is provided in accordance with

SEC requirements.

Approximate Number of Holders of Common Equity

As of March 5, 2007, there were approximately 1,198 record holders of the Company’s Class A common stock,

par value $.001 per share.

Dividends

The Company has never declared or paid any dividends on its common stock. We may consider in the future the

advisability of paying dividends. However, our payment of dividends is and will continue to be restricted by or

subject to, among other limitations, applicable provisions of federal and state laws, our earnings and various

business considerations, including our financial condition, results of operations, cash flow, the level of our capital

expenditures, our future business prospects, our status as a holding company and such other matters that our board

of directors deems relevant. In addition, the terms of the Senior Credit Facility we entered into in October 2005 and

the terms of the Indenture governing the notes each restrict our ability to pay dividends. See “Liquidity and Capital

Resources” included in “Management’s Discussion and Analysis of Financial Condition and Results of

Operations.”

23