GameStop 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the store credit given to the customer. In valuing inventory, management is required to make assumptions regarding

the necessity of reserves required to value potentially obsolete or over-valued items at the lower of cost or market.

Management considers quantities on hand, recent sales, potential price protections and returns to vendors, among

other factors, when making these assumptions.

Property and Equipment. Property and equipment are carried at cost less accumulated depreciation and

amortization. Depreciation on furniture, fixtures and equipment is computed using the straight-line method over

estimated useful lives (ranging from two to eight years). Maintenance and repairs are expensed as incurred, while

betterments and major remodeling costs are capitalized. Leasehold improvements are capitalized and amortized

over the shorter of their estimated useful lives or the terms of the respective leases, including renewal options in

which the exercise of the option is reasonably assured (generally ranging from three to ten years). Costs incurred to

third parties in purchasing management information systems are capitalized and included in property and

equipment. These costs are amortized over their estimated useful lives from the date the systems become

operational. The Company periodically reviews its property and equipment whenever events or changes in

circumstances indicate that their carrying amounts may not be recoverable or their depreciation or amortization

periods should be accelerated. The Company assesses recoverability based on several factors, including manage-

ment’s intention with respect to its stores and those stores’ projected undiscounted cash flows. An impairment loss

is recognized for the amount by which the carrying amount of the assets exceeds their fair value, as approximated by

the present value of their projected cash flows. As a result of the mergers and an analysis of assets to be abandoned,

the Company impaired assets totaling $9.0 million in fiscal 2005 and $1.9 million in fiscal 2006 prior to October 8,

2006, the anniversary of the mergers. These impairment costs are included in merger-related expenses in the

consolidated statements of operations. Write-downs incurred by the Company through February 3, 2007 which

were not related to the mergers have not been material.

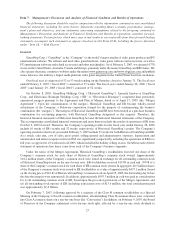

Merger-Related Costs. In connection with the mergers, management incurred merger-related costs and

integration activities which have resulted in involuntary employment terminations, lease terminations, disposals of

property and equipment and other costs and expenses. Approximately $64.3 million of these costs were charged to

acquisition costs, representing a portion of the recorded goodwill, and approximately $21.1 million were charged to

costs in the accompanying consolidated statement of operations. The remaining liability for involuntary termination

benefits covers severance amounts, payroll taxes and benefit costs for former EB employees, primarily in general

and administrative functions in EB’s Pennsylvania corporate office and distribution center and Nevada call center

which have been closed. Termination of these employees began in October 2005 and is now complete. The

Pennsylvania corporate office and distribution center were owned facilities that were sold in July 2006. These assets

were classified in the January 28, 2006 consolidated balance sheet as “Assets held for sale”.

The liability for lease terminations is associated with stores to be closed. If the Company is unsuccessful in

negotiating lease terminations or sublease agreements, the lease liability will be paid over the remaining lease

terms, the majority of which expire in the next 3 to 5 years, with the last of such leases expiring in 2015. The

Company intends to close these stores in the next 9 to 12 months. The disposals of property and equipment are

related to assets which were either impaired or have been either abandoned or disposed of due to the mergers.

Certain costs associated with the disposition of these assets remained accrued until the assets were disposed of and

the costs were paid. The disposition of property and equipment is now complete.

Merger-related costs include professional fees, financing costs and other costs associated with the mergers and

include certain costs associated with integrating the operations of Historical GameStop and EB, including

relocation costs. The Company finalized integration plans and related liabilities and all integration activities in

fiscal 2006. Rebranding of EB stores to the GameStop name is expected to be completed in the next 12 to 18 months.

Note 2 of “Notes to Consolidated Financial Statements” provides additional information on the merger costs and

related liabilities.

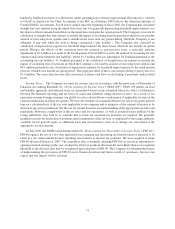

Goodwill. Goodwill, aggregating $340.0 million was recorded in the acquisition of Funco in 2000 and

through the application of “push-down” accounting in accordance with Securities and Exchange Commission Staff

Accounting Bulletin No. 54 (“SAB 54”) in connection with the acquisition of Babbage’s in 1999 by a subsidiary of

Barnes & Noble, Inc. (“Barnes & Noble”). Goodwill in the amount of $2.9 million was recorded in connection with

the acquisition of Gamesworld Group Limited in 2003. Goodwill in the amount of $1,074.9 million was recorded in

29