GameStop 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The offering of the Notes was conducted in a private transaction under Rule 144A under the United States

Securities Act of 1933, as amended (the “Securities Act”), and in transactions outside the United States in reliance

upon Regulation S under the Securities Act. In connection with the closing of the offering, the Issuers also entered

into a registration rights agreement, dated September 28, 2005, by and among the Issuers, the subsidiary guarantors

listed on Schedule I-A thereto, and Citigroup Global Markets Inc., for themselves and as representatives of the

several initial purchasers listed on Schedule II thereto (the “Registration Rights Agreement”). The Registration

Rights Agreement required the Issuers to, among other things, (1) file a registration statement with the SEC to be

used in connection with the exchange of the Notes for publicly registered notes with substantially identical terms,

(2) use their reasonable best efforts to cause the registration statement to be declared effective within 210 days from

the date the Notes were issued, and (3) use their commercially reasonable efforts to consummate the exchange offer

with respect to the Notes within 270 days from the date the Notes were issued. In April 2006, the Company filed a

registration statement on Form S-4 in order to register new notes (the “New Notes”) with the same terms and

conditions as the Notes in order to facilitate an exchange of the New Notes for the Notes. This registration statement

on Form S-4 was declared effective by the SEC on May 10, 2006 and the Company commenced an exchange offer to

exchange the New Notes for the Notes. This exchange offer was completed in June 2006 with 100% participation.

In November 2006, Citibank, N.A. resigned as Trustee for the Notes and Wilmington Trust Company was

appointed as the new Trustee for the Notes.

Under certain conditions, the Issuers may on any one or more occasions prior to maturity redeem up to 100% of

the aggregate principal amount of Senior Floating Rate Notes and/or Senior Notes issued under the Indenture at

redemption prices at or in excess of 100% of the principal amount thereof plus accrued and unpaid interest, if any, to

the redemption date. The circumstances which would limit the percentage of the Notes which may be redeemed or

which would require the Company to pay a premium in excess of 100% of the principal amount are defined in the

Indenture. Upon a Change of Control (as defined in the Indenture), the Issuers are required to offer to purchase all of

the Notes then outstanding at 101% of the principal amount thereof plus accrued and unpaid interest, if any, to the

date of purchase.

The Issuers may acquire Senior Floating Rate Notes and Senior Notes by means other than redemption,

whether by tender offer, open market purchases, negotiated transactions or otherwise, in accordance with applicable

securities laws, so long as such acquisitions do not otherwise violate the terms of the Indenture.

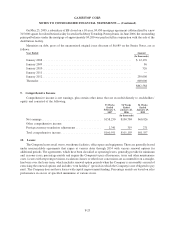

In May 2006, the Company announced that its Board of Directors authorized the buyback of up to an aggregate

of $100,000 of its Senior Floating Rate Notes and Senior Notes. As of February 3, 2007, the Company had

repurchased the maximum authorized amount, having acquired $50,000 of its Senior Notes and $50,000 of its

Senior Floating Rate Notes, and delivered the Notes to the Trustee for cancellation. The associated loss on

retirement of debt is $6,059, which consists of the premium paid to retire the Notes and the write-off of the deferred

financing fees and the original issue discount on the Notes.

Subsequently, on February 9, 2007, the Company announced that its Board of Directors authorized the

buyback of up to an aggregate of an additional $150,000 of its Senior Floating Rate Notes and Senior Notes. The

timing and amount of the repurchases will be determined by the Company’s management based on their evaluation

of market conditions and other factors. In addition, the repurchases may be suspended or discontinued at any time.

At the time of filing, the Company had repurchased $14,925 of its Senior Notes and $64,620 of its Senior Floating

Rate Notes pursuant to this new authorization and delivered the Notes to the Trustee for cancellation. The associated

loss on retirement of debt is $5,114.

In October 2004, Historical GameStop issued a promissory note in favor of Barnes & Noble in the principal

amount of $74,020 in connection with the repurchase of Historical GameStop’s common shares held by Barnes &

Noble. Payments of $37,500, $12,173 and $12,173 were made in January 2005, October 2005 and October 2006,

respectively, as required by the promissory note, which also requires a final payment of $12,173 in October 2007.

The note is unsecured and bears interest at 5.5% per annum, payable when principal installments are due.

F-22

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)