GameStop 2006 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Reclassifications

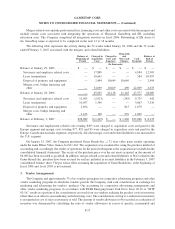

Certain reclassifications have been made to conform the prior period data to the current year presentation.

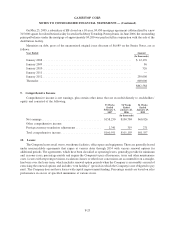

Stock Conversion and Stock Split

On February 7, 2007, following approval by a majority of the Class B common stockholders in a Special

Meeting of the Company’s Class B common stockholders, all outstanding Class B common shares were converted

into Class A common shares on a one-for-one basis (the “Conversion”). In addition, on February 9, 2007, the Board

of Directors of the Company authorized a two-for-one stock split, effected by a one-for-one stock dividend to

stockholders of record at the close of business on February 20, 2007, paid on March 16, 2007 (the “Stock Split”).

The effect of the Conversion and the Stock Split has been retroactively applied to all periods presented in the

consolidated financial statements and notes thereto.

New Accounting Pronouncements

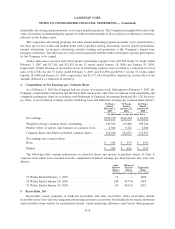

In July 2006, the FASB issued Interpretation No. 48 Accounting for Uncertainty in Income Taxes (“FIN 48”).

FIN 48 requires the use of a two-step approach for recognizing and measuring tax benefits taken or expected to be

taken in a tax return and disclosures regarding uncertainties in income tax positions. We were required to adopt

FIN 48 effective February 4, 2007. The cumulative effect of initially adopting FIN 48 is to record an adjustment to

opening retained earnings in the year of adoption. Only tax positions that meet the more likely than not recognition

threshold at the effective date may be recognized upon adoption of FIN 48. The Company is evaluating the impact

of implementing the provisions of FIN 48 on its financial position and future results of operations, but does not

expect that the impact will be material.

In September 2006, the FASB issued Statement of Financial Accounting Standard No. 157, Fair Value

Measurements (“SFAS No. 157”). This statement defines fair value, establishes a framework for measuring fair

value in generally accepted accounting principles, and expands disclosures about fair value measurements. This

statement applies under other accounting pronouncements that require or permit fair value measurements.

SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. The Company is currently assessing

the impact that the adoption of SFAS No. 157 will have on its consolidated financial statements.

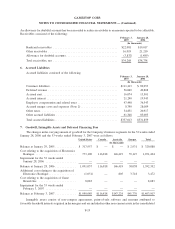

In September 2006, the SEC issued Securities and Exchange Commission Staff Accounting Bulletin No. 108

(“SAB No. 108”) in order to eliminate the diversity of practice surrounding how public companies quantify

financial statement misstatements. In SAB No. 108, the SEC staff established an approach that requires quan-

tification of financial statement misstatements based on the effects of the misstatements on each of the Company’s

financial statements and the related financial statement disclosures. SAB No. 108 is effective for fiscal years ending

after November 15, 2006. The Company adopted SAB No. 108 in fiscal 2006, which did not have a material impact

on its consolidated financial statements.

In June 2006, the Emerging Issues Task Force (“EITF”) ratified its conclusion on EITF No. 06-03, How Taxes

Collected From Customers and Remitted to Governmental Authorities Should Be Presented in the Income Statement

(That Is, Gross Versus Net Presentation)(“EITF 06-03”). The EITF concluded that the presentation of taxes assessed

by a governmental authority that is directly imposed on a revenue-producing transaction between a seller and a

customer such as sales, use, value added and certain excise taxes, is an accounting policy decision that should be

disclosed in a company’s financial statements. Additionally, companies that record such taxes on a gross basis

should disclose the amounts of those taxes in interim and annual financial statements for each period for which an

income statement is presented if those amounts are significant. EITF 06-03 is effective for fiscal years beginning

after December 15, 2006. The Company presents such taxes on a net basis for all periods presented.

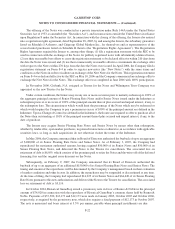

In February 2007, the FASB issued Statement of Financial Accounting Standard No. 159, The Fair Value

Option for Financial Assets and Financial Liabilities (“SFAS No. 159”). This statement permits entities to choose

to measure many financial instruments and certain other items at fair value. Companies should report unrealized

gains and losses on items for which the fair value option has been elected in earnings at each subsequent reporting

date. This statement is effective as of the beginning of an entity’s first fiscal year that begins after November 15,

F-14

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)