GameStop 2006 Annual Report Download - page 46

Download and view the complete annual report

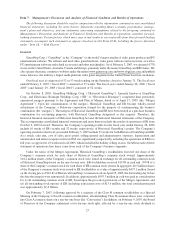

Please find page 46 of the 2006 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.funded by landlord incentives for allowances under operating leases (tenant improvement allowances) to conform

to GAAP, as clarified by the Chief Accountant of the SEC in a February 2005 letter to the American Institute of

Certified Public Accountants. For all stores opened since the beginning of fiscal 2002, the Company had calculated

straight-line rent expense using the initial lease term, but was generally depreciating leasehold improvements over

the shorter of their estimated useful lives or the initial lease term plus the option periods. The Company corrected its

calculation of straight-line rent expense to include the impact of escalating rents for periods in which it is reasonably

assured of exercising lease options and to include in the lease term any period during which the Company is not

obligated to pay rent while the store is being constructed (“rent holiday”). The Company also corrected its

calculation of depreciation expense for leasehold improvements for those leases which do not include an option

period. Because the effects of the correction were not material to any previous years, a non-cash, after-tax

adjustment of $3.3 million was made in the fourth quarter of fiscal 2004 to correct the method of accounting for rent

expense (and related deferred rent liability). Of the $3.3 million after-tax adjustment, $1.8 million pertained to the

accounting for rent holidays, $1.4 million pertained to the calculation of straight-line rent expense to include the

impact of escalating rents for periods in which the Company is reasonably assured of exercising lease options and

$0.1 million pertained to the calculation of depreciation expense for leasehold improvements for the small portion

of leases which do not include an option period. The aggregate effect of these corrections relating to prior years was

$1.9 million. The correction does not affect historical or future cash flows or the timing of payments under related

leases.

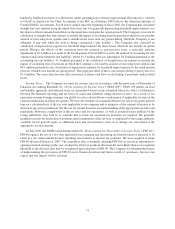

Income Taxes. The Company accounts for income taxes in accordance with the provisions of Statement of

Financial Accounting Standards No. 109 Accounting for Income Taxes (“SFAS 109”). SFAS 109 utilizes an asset

and liability approach, and deferred taxes are determined based on the estimated future tax effect of differences

between the financial reporting and tax bases of assets and liabilities using enacted tax rates. As a result of our

operations in many foreign countries, our global tax rate is derived from a combination of applicable tax rates in the

various jurisdictions in which we operate. We base our estimate of an annual effective tax rate at any given point in

time on a calculated mix of the tax rates applicable to our company and to estimates of the amount of income to be

derived in any given jurisdiction. We file our tax returns based on our understanding of the appropriate tax rules and

regulations. However, complexities in the tax rules and our operations, as well as positions taken publicly by the

taxing authorities, may lead us to conclude that accruals for uncertain tax positions are required. We generally

maintain accruals for uncertain tax positions until examination of the tax year is completed by the taxing authority,

available review periods expire or additional facts and circumstances cause us to change our assessment of the

appropriate accrual amount.

In July 2006, the FASB issued Interpretation No. 48 Accounting for Uncertainty in Income Taxes (“FIN 48”).

FIN 48 requires the use of a two-step approach for recognizing and measuring tax benefits taken or expected to be

taken in a tax return and disclosures regarding uncertainties in income tax positions. We were required to adopt

FIN 48 effective February 4, 2007. The cumulative effect of initially adopting FIN 48 is to record an adjustment to

opening retained earnings in the year of adoption. Only tax positions that meet the more likely than not recognition

threshold at the effective date may be recognized upon adoption of FIN 48. The Company is evaluating the impact

of implementing the provisions of FIN 48 on its financial position and future results of operations, but does not

expect that the impact will be material.

31